DealmakersMid-market M&A in Australia 2023

Despite a challenging start to 2023, Australia remains a compelling market for global dealmakers searching for growth and security.

In our annual Dealmakers report published in February 2023, more than half of respondents (56%) said mergers and acquisitions (M&A) conditions and sentiment would improve through 2023. 60% said they would be increasing their investing and M&A activities. At the half-year point, these intentions are taking shape, albeit in different ways.

Total M&A value showed a 13% improvement in 1H23 (AU$64.8bn) from 1H22 (AU$57.1bn). That value was influenced heavily by one deal in particular – the AU$30bn Newmont Mining purchase of Newcrest Mining – but nonetheless reflects both the attractiveness of Australian assets and dealmaker willingness to find and complete M&A. It also bucks global trends, where worldwide M&A value has dropped for the third half-year in a row.

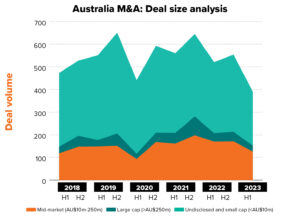

Deal totals, however, were more subdued. M&A in 1H23 (390 deals) dropped 26% from the same timeframe in 2022 (524 deals). The volume of transactions appears to have been stalled by cautious dealmakers, many hesitant given persistent macroeconomic and geopolitical uncertainties. Equally, deals appear to be taking longer than usual given extended negotiations and due diligence processes – once overcome, though, deals completed in the second half of 2023 should show an uptick.

While sentiment and action may temporarily be at odds, Australia’s solid fundamentals remain unchanged. Buoyed by its stable economy, robust regulatory frameworks and abundant natural resources, the country’s resilience and ability to weather global economic, social and political shocks have cemented its reputation as a safe haven for dealmakers seeking diversification and long-term growth prospects.

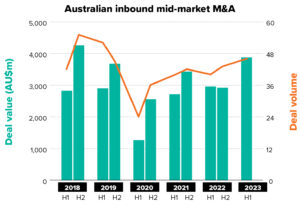

This is being seen prominently in renewed interest from offshore dealmakers, many of whom are staging a comeback with overall inbound M&A hitting new highs. Foreign-buyer led deals into the mid-market, specifically, have posted a strong uptrend in recent years as international acquirers seek exposure to Australia’s resilient economy in the post-COVID world.

Indeed, the mid-market (deals valued between AU$10m and AU$250m) is once again proving itself as a safe and stable source of activity. While deal totals dipped in the first half of 2023, ultimately, historical trends show consistent interest and optimism for this deal segment.

A promising and busy outlook lies ahead. The current lull could quickly give way to a new surge in M&A from both international buyers searching outside their home markets and domestic dealmakers ready to jump off the sidelines and into the action. Moving quickly will be key to succeeding in 2023 and beyond – and dealmakers with the knowledge, determination and market expertise to act now will yield the positive returns needed to advance their business objectives and position themselves to withstand future uncertainties and global market challenges.

Definitions

Mid-market AU$10m-250m |

Large cap >AU$250m |

Undisclosed and small cap <AU$10m |

Australian mid-market M&A: Down but not out

Global & inbound M&A

Sector watch

Our experts