Federal Budget 2024-25

Cost of living Budget leaves businesses to fend for themselves

A Federal Budget focused on tackling the political poison that is the cost-of-living crisis — while not reawakening inflation — was never going to be a blockbuster and last night’s Budget contained few surprises.

Everything from the headline promises in the form of HELP debt indexation changes and energy relief, to the bottom line of a $9.3b surplus, was socialised well before Treasurer Jim Chalmers rose to his feet

For business it was a case of another year, another set of missed opportunities for business investment or visionary Government policy to transition the Australian economy.

The small business instant asset write-off will be extended for another year and is capped at a very modest $20,000, for businesses with turnover of less than $10m.

As the legislation for a similarly modest amount last year remains stalled in Parliament, with just six weeks to go to the end of the financial year, it is unlikely to get business investment engines revving.

A million smaller businesses can expect an energy rebate of $325 on their electricity bills throughout the year, but that is roughly half the payment of last year.

In contrast, the average annual electricity bills for business increased nationally by $540 between October 2022 and October 2023, according to Energy Consumers Australia.

Apart from some minor other measures, that’s the extent of any largesse for business. GDP is expected to bounce between 1.75 and 2.75 for the next five years, and this Budget will do little to fuel investment or growth. Confidence is also not going to be helped by the forecast that wage increases are to exceed CPI across the forward estimates.

Unemployment is predicted to remain flat — the only positive for business lies in the forecast reduction of inflation, which is expected to settle at 3.5% this financial year before falling into the 2-3% band sought by the RBA from 2024-25.

One sleeper issue for business will be access to labour – a challenge that is not unfamiliar to business, but which has not attracted huge attention in the lead-up to the Budget. The Budget forecasts indicate that overseas migration will reduce by 110,000 people over the forward estimates from 1 July 2024. While almost 80% of the permanent migration program will be allocated to skilled visa categories, the number of inbound workers will be significantly restrained.

On the other hand, the tax cuts are forecast to be a net positive for labour supply, with the Government anticipating 930,000 extra hours worked a week, equivalent to 25,000 full-time jobs, as women and individuals on low-to-middle incomes increase their participation.

While productivity has grown in the last two quarters and is expected to continue to as economic conditions improve, it remains a key concern for middle market business leaders, as revealed in our latest Business Radar survey in February 2024. 52% of business leaders are extremely or very concerned about the levels of productivity in their business. It remains to be seen whether the Federal Budget will deliver changes to sustain this trend. Ultimately delivering policy to support productivity improvement is a better way to repay debt and balance the books than introducing new taxes.

Fast facts

Tax relief

We will see personal tax cuts for 13.6m people, with an average tax saving of $1,888Energy savings

$3.5b in energy rebates to ease the cost of living pressures for households and businessMade in Australia

$22.7b to be invested in Future Made in Australia to develop clean energy and economic resilienceHousing

$4.3b support for social housing programs to build 40,000 homesInfrastructure

An additional $9.5b for infrastructure projects over the coming 5 yearsDefence

An additional $50b earmarked for defence programs over the coming 10 yearsTax deferral

$290m tax deferral for small business through the instant asset write offGovernment spending

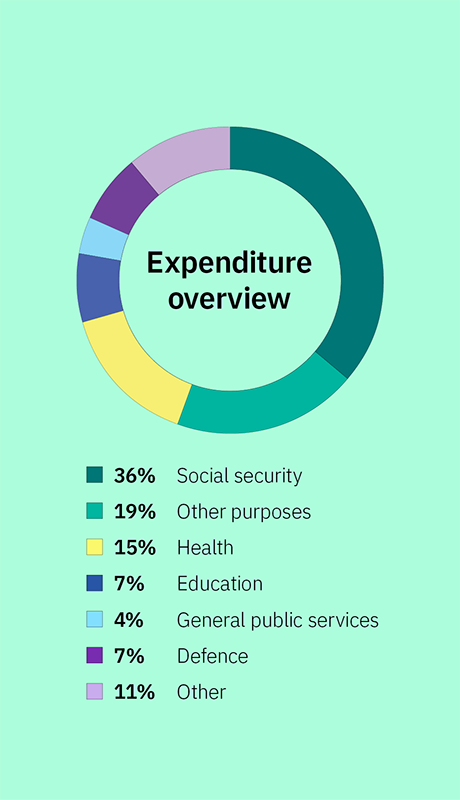

Forecasting a rise of 6% in Government spending and 1% in Government receiptsThe Government expects to collect $19.8b in superannuation fund taxes, down 14.5% from the Mid-Year Economic and Fiscal Outlook (MYEFO). Superannuation fund taxes have been revised down by $3.4b in 2024–25, with fewer contributions to super funds than expected translating into weaker tax receipts.

The Budget papers suggest that the weakness in tax from fund earnings was due to revised forecasts around foreign income, capital gains and foreign exchange gains and losses.

Manufacturing and industry get a boost but only through the lens of new energy and innovation. Some $1.5b is allocated over seven years to the Australian Renewable Energy Agency’s industry-building investments on top of the recently announced $1.7b Future Made in Australia Innovation Fund.

The fund will support innovation, commercialisation, pilot and demonstration projects and early-stage development in priority sectors, including renewable hydrogen, green metals, low carbon liquid fuels and clean energy technology manufacturing such as batteries. The Budget also invests $44.4m in an Energy Industry Jobs Plan and $134.2m for skills and employment support in key regions impacted by the net zero transition.

Tax incentives announced last year at a cost $34.3m over five years are expected to incentivise Build to Rent (BTR) developments to increase the supply of rental housing in Australia. Analysis commissioned by the Property Council of Australia suggests this could unlock 150,000 apartments over the next decade.

The Government has lowered foreign investment application fees for new BTR developments and will also allow foreign investors to purchase established BTR developments while paying lower fees for those applications.

BTR projects will now attract Foreign Investment Review Board filing fees at commercial land rates, regardless of how the project land is classified.

Company tax receipts are forecast to be $5.5b higher in 2024–25 than was predicted in the MYEFO, up 1.4%, to $139.1b, reflecting strong corporate performance. The Petroleum Resource Rent Tax will climb 17.8% delivering an additional $400m to the bottom line, on the back of stronger commodity prices. Over the forward estimates, though, it is assumed oil prices will act as a dampener on growth.

While not the structural reforms many business owners were hoping for, some red tape concerns will be addressed with the removal of 457 nuisance tariffs from 1 July in the largest unilateral tariff reform in two decades. This is designed to simplify Australia’s trade system and cut compliance costs for businesses, including small businesses which are particularly burdened by complexity of the tariff system. The Government is also investing $25.3m to improve payment times, via an expanded reporting function for the new Payment Times Reporting Regulator first funded in the MYEFO. The regulator can name and shame slow–paying businesses, to put pressure on bigger firms to do more to enable small business cashflow.

Pitcher Partners insights

Get the latest Pitcher Partners updates direct to your inbox