Beyond Borders: Navigating Emerging Markets Through Developed Markets

Pitcher Partners Wealth Management Pty Ltd (Brisbane) | The information in this article is current as at 01 October 2023

In the evolving landscape of global investments, investors seeking double-digit growth outside of the surging MANGMA (Microsoft, Amazon, Nvidia, Google, Meta, Apple) stocks this year, may find themselves turning to emerging markets.

These fast-growing economies promise lucrative opportunities, but they often come with complex challenges involving governance and geopolitical risks. As investors seek to diversify their portfolios and tap into these markets, one strategy to consider is investing based on the revenue exposure of global companies rather than where they are listed or domiciled.

Challenges investing in emerging markets

Investing in emerging markets can be a lucrative prospect, but not without its issues. These markets often exhibit heightened volatility due to political instability, currency fluctuations and unpredictable regulatory changes. Despite these challenges, the allure of high growth potential continues to attract investors willing to navigate the intricacies of emerging markets in pursuit of rewarding opportunities.

As an opportunity set, emerging market countries exhibit features of growth, such as rising populations, a burgeoning middle class, increased consumer spending, increased manufacturing capability and increased government spending on long-term assets, such as infrastructure. One only need to have witnessed the growth of China as an economic powerhouse.

Source: https://meet.nyu.edu/academics/us-education-unique-location-shanghai-has-it-all/

Information asymmetry and limited transparency can obscure investment opportunities in the developing world, making thorough due diligence difficult, yet essential. For global fund managers to gain a competitive edge, they either have staff on the ground in the region, conduct frequent research trips if based outside of the country, or rely on local experts providing insights.

In addition, cultural and language barriers can complicate communication and understanding. Inadequate legal frameworks and weak property rights further hinder investment security. Less than democratic governments add additional uncertainty for investors as the tide can turn very quickly against them.

Those that have read Red Notice by Bill Browder may recall reading about the dangers of investing in emerging markets (like Russia). As an early advocate of investing in the Russian market following the dissolution of the Soviet Union, Browder’s Hermitage Capital Management fund became one of the largest foreign investors in Russia during the 1990s. That is until his activist investing strategy was no longer seen favourably by the Russian government.

There can also be a stark difference of opinion even among emerging market managers on the best approach to invest in emerging markets. Not to mention the difference in discourse between buying a company in the domiciled country or a cross listing in a developed market such as an American Depositary Receipt (ADR) listing in the US.

Pitcher Partners Investment Services (PPIS) has spoken to some fund managers that advocate investing in state-aligned companies, such as China SOEs (State Owned Enterprises). They believe government ownership provides a level of certainty and support. However, we have spoken to other global managers which are of the opposite viewpoint, preferring to invest in companies not in the sphere of government influence or more specifically, in their regulatory crosshairs. These managers tend to stay away from the newsworthy names- so investing not in your Alibaba, Tencent or Evergrande, but more traditional industries and lower profile businesses.

Economic exposure investing

To introduce the concept of economic versus domiciled exposure, let’s first review the exposures of the MSCI Index.

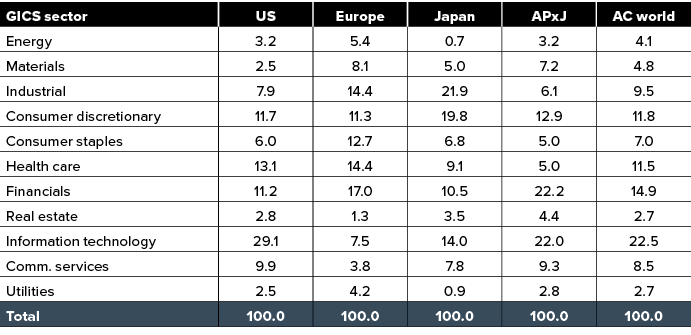

The Global Industry Classification Standard (GICS) is a widely recognised framework that categorises industries into sectors, each representing a distinct segment of the economy. One caveat of GICS is that different regions and countries will exhibit varying exposure to sectors. One perspective of classification does not provide a full picture of a portfolio.

For example: the US has nearly 30% exposure to Information Technology while the MSCI ACWI Index has a 22% exposure to IT across regions. Whereas Japan has the most exposure (22%) to Industrials while the global index has only a 10% exposure to Industrials. Evidently, there is a stark difference in exposure depending on the perspective taken.

Source: MSCI, Factset, Goldman Sachs GIR

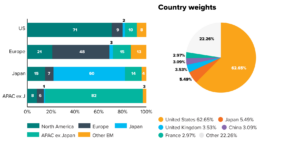

Turning our attention to the economic exposure of countries, the below sales data shows where the economic activity originates. As we can see, 71% of sales in the US originate from North America. When we compare this to the regional weights of the MSCI index, 62% of the index is exposed to the US. Conversely Europe has a more diverse mix of economic exposure as only 50% of the sales in Europe originate from Europe.

Source: MSCI, Factset, Goldman Sachs GIR

Using the above concept, we can also assess the economic exposure of companies as compared to their domiciled listing.

The decision of investing based on economic or domiciled exposure is a matter of philosophy and risk management. Establishing a foundational view in which all decisions originate informs the investment process and the level of risk appropriate for the strategy.

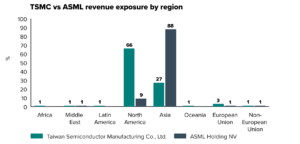

Consider an individual stock selection scenario. We seek to construct a portfolio with exposure to the Semiconductor industry in Asia. What would be the most appropriate stock to include in the portfolio? The most well-known companies in the sector are Taiwan Semiconductor Manufacturing Co., Ltd (TSMC), and ASML Holding NV (ASML).

If we frame our portfolio construction on the domiciled location and country of listing, TSMC is the obvious choice as it is listed and located in Taiwan. ASML by comparison is listed on the Amsterdam Stock Exchange (via EuroNext) and therefore is not appropriate.

From a domiciled perspective, TSMC is the most appropriate choice. However, does TSMC accurate reflect the economic activity of the region? Moreover, as investors, are we comfortable with the associated risks of investing in Taiwan, particularly the geopolitical risks?

Source: Company Interim 2Q23 Reports

When framing the portfolio construction on economic exposure, measured by revenue, the results differ. According to the interim annual report, a significant portion of TSMC’s revenue originates from North America, while a comparatively smaller proportion is derived from Asia (66% and 19% respectively).

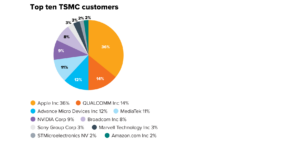

One could argue that TSMC does not provide the adequate exposure for the level of risk as the end consumer of its products are predominantly situated in the US. Below are TSMC’s top 10 customers to illustrate the point.

Source: Bloomberg

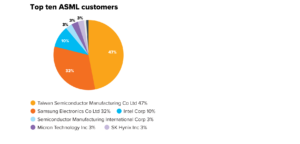

In contrast, ASML generates 87.6% of revenue from Asia, notably driven by Taiwan (47%), South Korea (27%), and China (15%). Interestingly, TSMC is in fact ASML’s most prominent customer. When measuring semiconductor exposure in Asia from an economic activity perspective, ASML provides a greater connection to both the sector and region than TSMC. For context, below is a breakdown of ASML’s top 10 customers based on percentage revenue.

Source: Bloomberg

Fund manager philosophy matters

This analytical framework is applicable to global fund managers, serving as a valuable tool to ensure alignment with expected exposures in a portfolio. The philosophy adopted by a manager holds significant weight, influencing their investment decisions and the resulting portfolio.

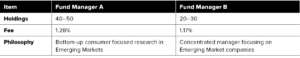

Below, we present two global equity fund managers specialising in emerging markets. While these managers share similarities in pricing, their investment philosophies and portfolio compositions diverge.

Source: Fund Manager Website

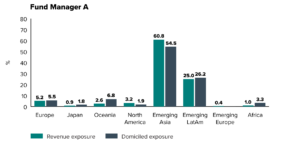

Fund Manager A’s focus is researching the end consumer within emerging market countries, encompassing an analysis of consumer habits and spending patterns. This leads the manager to invest in companies with most of their economic exposure in emerging markets. As a result, the difference between the domiciled exposure and economic exposure is notably smaller than Fund Manager B.

Source: Fund Manager websites

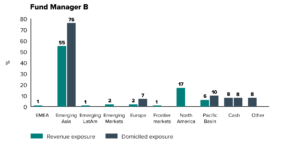

In contrast, Fund Manager B, through its philosophy, directs investments towards companies domiciled in emerging markets that exhibit growth factors. Analogous to the TSMC scenario, these firms often find a customer base in North America, leading to a discrepancy between domiciled and economic exposure.

Source: Fund Manager B Holdings Data

Pros and cons of economic-based investing

Pros:

- Alternative perspective: Investing on the basis of economic exposure can be enough of a differentiated strategy to add value in an investment portfolio if most participants do not consider it.

- Diversification: Construction of the portfolio by economic exposure can generate a differently diversified portfolio while still providing the sought-after exposures.

- Differentiated Risk Profile: Investing via economic exposure can present a different array of risks to an investor. In the single stock example, investing in ASML removes the liquidity and geopolitical risks of investing in Taiwan while leaving the exposure to semiconductors as ASML has other customers in other countries in Asia.

Cons:

- Time: It will be time consuming to perform a revenue analysis on each stock, particularly for a fund’s underlying holdings, and establish a diversified portfolio with appropriate exposures.

- Data Availability: Individual companies may not disclose all their economic activity, and third-party data providers have their own methodology for measuring it. In addition, much of the available data is on a domiciled listing basis, especially in the way indices categorise companies.

- Overlooked Fundamentals: Relying solely on economic exposure may cause investors to overlook factors relating to the country of domicile. Issues such as regulation and currency still apply, regardless of where company revenue originates.

Conclusion

Overall, investing via economic exposure represents an alternative perspective on constructing a global portfolio, whether that be stock specific or via a fund manager. By leveraging developed market domiciled companies with a global footprint, this method offers an approach to capitalise on emerging market exposures while benefiting from the stability that developed markets provide.

We encourage you to contact your Pitcher Partners adviser if you wish to gain a deeper understanding of the types of underlying global equity exposures in your portfolio.