On Friday 12 January 2024, Treasury released its draft legislation Climate-related financial disclosure: Exposure draft legislation for mandatory climate reporting (and assurance requirements) for certain types of entities.

This is a significant (and costly) reform to implement the Government’s commitment to provide Australians and investors with greater transparency and more comparable information about an entity’s exposure to climate-related financial risks and opportunities, plans and strategies. It is still subject to the passage of the final legislation through Parliament, which will need to occur before the commencement date of reporting for Group 1 entities, being 1 July 2024.

Who will be impacted?

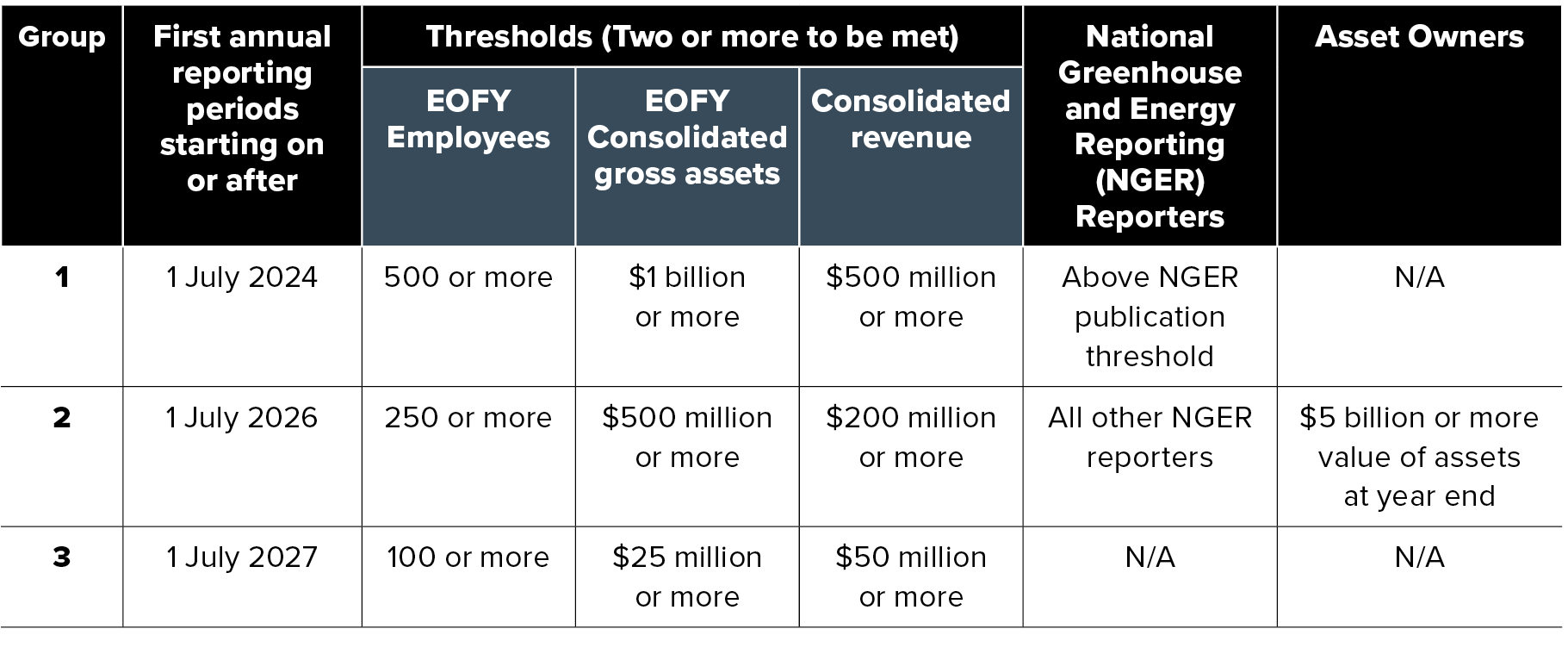

The majority of entities reporting under Chapter 2M of the Corporations Act 2001 (the Act) will be subject to mandatory climate reporting. The timing of when reporting is first required is subject to the threshold requirements as outlined in the table below. This includes privately held entities, public companies, registered schemes, registrable superannuation entities and companies limited by guarantee with revenue of $1 million or more and that meet the requirements below and are not exempted from lodgement of an annual financial report in accordance with the Act (therefore excludes companies reporting under the Australian Charities and Not-for-Profits Commission Act 2012).

What is required to be lodged?

A sustainability report is required to be lodged in the annual report which complies with Australian Sustainability Reporting Standards (ASRS). The Australian Accounting Standards Board (AASB) published its Exposure Draft ED SR1 Australian Sustainability Reporting Standards – Disclosure of Climate-related Financial Information (ED SR1) in October 2023 and they are currently open for comment, with the comment period closing 1 March 2024.

A sustainability report will consist of:

- the climate statement for the year;

- notes to the climate statement;

- any statements prescribed by the regulations for the year; and

- the directors’ declaration about the compliance of the statements with the relevant sustainability standards.

The timing for lodgement of the sustainability report is the same as current annual reporting requirements in section 319 of the Act:

- Within three months after the end of the financial year for disclosing entities and registered managed investment schemes; and

- Within four months after the end of the financial year for all other companies.

Who provides the sustainability assurance?

The sustainability disclosure report would be audited by the auditor of the financial report supported by technical climate and sustainability experts where appropriate.

A phased approach will be introduced for assurance commencing with limited assurance of Scope 1 and 2 emission disclosures from years beginning 1 July 2024 onwards and ending with assurance of all climate-related financial disclosures made from years beginning 1 July 2030 onwards.

The Australian Auditing and Assurance Standards Board (AUASB) will develop the extent and level of assurance required for climate-related financial disclosures and set the pathway for phasing in requirements over time.

Are there any exemptions?

Group 3 entities (i.e., they do not meet the Group 1 or Group 2 thresholds) would only be required to make climate-related financial disclosures in line with the ASRS if they face material climate-related risks or opportunities for the financial reporting period. Where they assess that they do not have material risks or opportunities, they would only be required to disclose a statement to that effect. Materiality is assessed in accordance with the sustainability standards.

What about the liability framework?

For sustainability reports issued between 1 July 2025 and 30 June 2028, the application of misleading and deceptive conduct provisions to Scope 3 emissions and forward-looking statements would be limited to regulator-only actions for a fixed period of three years. Beyond this period, the existing liability arrangements will apply.

What type of information needs to be disclosed in the climate statement?

The reporting requirements as outlined in ED SR1 are standardised and internationally-aligned for businesses to make disclosures regarding governance, strategy, risk management, targets and metrics – including greenhouse gasses. Specific requirements include disclosures of:

- Governance of climate risks and opportunities

- Identification of climate risks and opportunities, impact on business model, value chain, strategy, cash flows and capital, financial position and performance

- Assessment of likelihood and impacts and disclosure of assumptions

- Scope 1, Scope 2 emissions for the first reporting year onwards and Scope 3 emissions for the second reporting year onwards.

- Remuneration arrangements linkage to climate

- Scenario analysis and climate resilience of strategy

- Transition plans and climate targets or revisions to targets.

What about organisations not subject to mandatory reporting?

- As highlighted in our earlier article dated 30 June 2023 even organisations not subject to mandatory reporting are likely to feel the impact of the need to report climate-related financial information. This is because entities that are subject to mandatory reporting requirements will need to estimate scope 3 emissions that are produced upstream or downstream of product or service value chains. Therefore, they will be reviewing their supply chains and will seek input from material suppliers and/or clients to determine relevant emissions information.

Action to take now

Consistent with our earlier article mentioned above, if you feel you are likely to be impacted, we recommend educating board and executives on sustainability, emissions reporting and climate-related disclosures and consider setting up trial assessments or pilot reporting exercises.

There is an opportunity to provide feedback on the Draft legislation by 9 February 2024 and the AASB Exposure Draft ED SR1 by 1 March 2024.

There are three steps your business can take now to prepare for climate reporting and these are outlined in an earlier article dated 28 April 2023.