On Monday 26 June 2023, the International Sustainability Standards Board (ISSB) released its inaugural sustainability standards, designed to provide a global baseline of sustainability- and climate- related disclosures for the capital markets.

Further, on Tuesday 27 June 2023, the Australian Treasury released its second consultation on climate-related financial disclosures.

Both internationally and in Australia the matters of climate change and more broadly sustainability are moving at a rapid pace due to stakeholder expectations of transparency in this area. New Zealand are already into their first year of mandatory climate related disclosure reporting.

Who is likely to be impacted in Australia?

Legislative change will be required in Australia before any reporting of climate change risks and opportunities is mandated.

Whilst we will need to wait for the outcome of the Treasury second consultation for confirmation, the stated intent is to mandate climate-related financial disclosure reporting for the majority of entities reporting under Chapter 2M of the Corporations Act 2001 (including privately held entities).

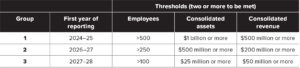

The proposed implementation date for these requirements will be phased in over a four-year period from 2024-25 to 2027-28. The following timeline has been proposed, and reporting will be mandated for entities that meet at least two of the following criteria for the year shown:

Regardless of the size thresholds, the requirements will also apply from the 2024-25 financial year to all entities meeting the National Greenhouse and Energy Reporting (NGER) publication threshold reporting.

Assurance requirements for climate-related financial disclosures is also intended to be subject to a phased approach, with scope increases and level of assurance expanded over time.

Even organisations not subject to mandatory reporting are likely to feel the impact of the need to report climate related financial information. This is because entities that are subject to the mandatory reporting requirements will need to report scope 2 emissions, and (from the second reporting year) estimate scope 3 emissions upstream or downstream of product or service value chains. Therefore, they will be reviewing their supply chains and will seek input from their suppliers and/or clients to determine relevant emissions information.

The Treasury consultation refers to Australian standards equivalent to the International Sustainability Standards Board.

What are the new international sustainability standards?

The newly released international sustainability standards, issued by the ISSB, are:

- IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information; and

- IFRS S2 Climate-related Disclosures

IFRS S1 requires companies to report the broader sustainability risks and opportunities they face over the short, medium and long term, for access to resources for example.

IFRS S2 is more specifically about climate, setting out specific climate-related disclosures based on recommendations of the Task Force on Climate-related Financial Disclosures (TCFD).

The ISSB Standards are designed to ensure that companies provide sustainability-related information alongside financial statements – in the same reporting package. The Standards have been developed to be used in conjunction with any accounting requirements, built on concepts underpinning the IFRS Accounting Standards. IFRS S1 also contains general requirements as well as the conceptual foundations on which the standards are based, which includes the concept of materiality.

The core content of the requirements of the ISSB Standards are set out under the same four categories used by the TCFD framework:

- Governance

- Strategy

- Risk Management

- Metrics and Targets

What’s next?

We anticipate the following steps will likely need to occur before any Australian equivalent ISSB standards are applicable in Australia:

- Legislation is amended to give power to the Australian Accounting Standards Board (AASB) to issue such standards (currently in Parliament);

- The ISSB Standards along with any Australian modifications are subject to due process in Australia (i.e. through an exposure draft(s));

- The Corporations Act 2001 is amended (after being passed by Parliament) to require reporting for certain types of entities – this is the subject of the current Treasury consultation; and

- The Australian equivalents to the ISSB Standards are issued as legislation with future application dates.

It is important to note that Federal and State Governments are also issuing internal TCFD-style reporting guidelines for departments and agencies, which will also trickle down to bidders and suppliers.

Given the Government’s position to manage and deliver polices and programs to help Australia respond to climate change we would anticipate the above steps will progress rapidly.

Action to take now

If you feel that you are likely to be impacted, we recommend educating board and executives on sustainability, emissions reporting and climate-related disclosures, and considering setting up trial assessments or pilot reporting exercises.

For those better prepared, there will be sufficient time to implement these changes when they finally arrive and incorporate them into your existing annual reporting requirements.

For additional practical guidance on actions you might take refer to this previous article https://www.pitcher.com.au/insights/mandatory-climate-reporting/