If you want to succeed in M&A, don’t do a deal in a downturn.

For the past decade or so, that’s been the conventional wisdom from the global financial crisis, which saw a collapse in deal volumes and write-downs on value on many acquisitions. In fact, to hear some researchers tell it, almost every M&A deal done in a downturn goes sour.

But whether it’s good luck, good timing, or good strategy, we have found that dealmakers in the past year are bucking that belief.

Instead, 85% say they have come out on the winning side of the ledger, even if their deals were made before the economic recovery seemed assured.

Defying the gloom

Each year we work with Mergermarket, an Acuris company, to survey 60 leading dealmakers about the drivers and trends in Australian M&A.

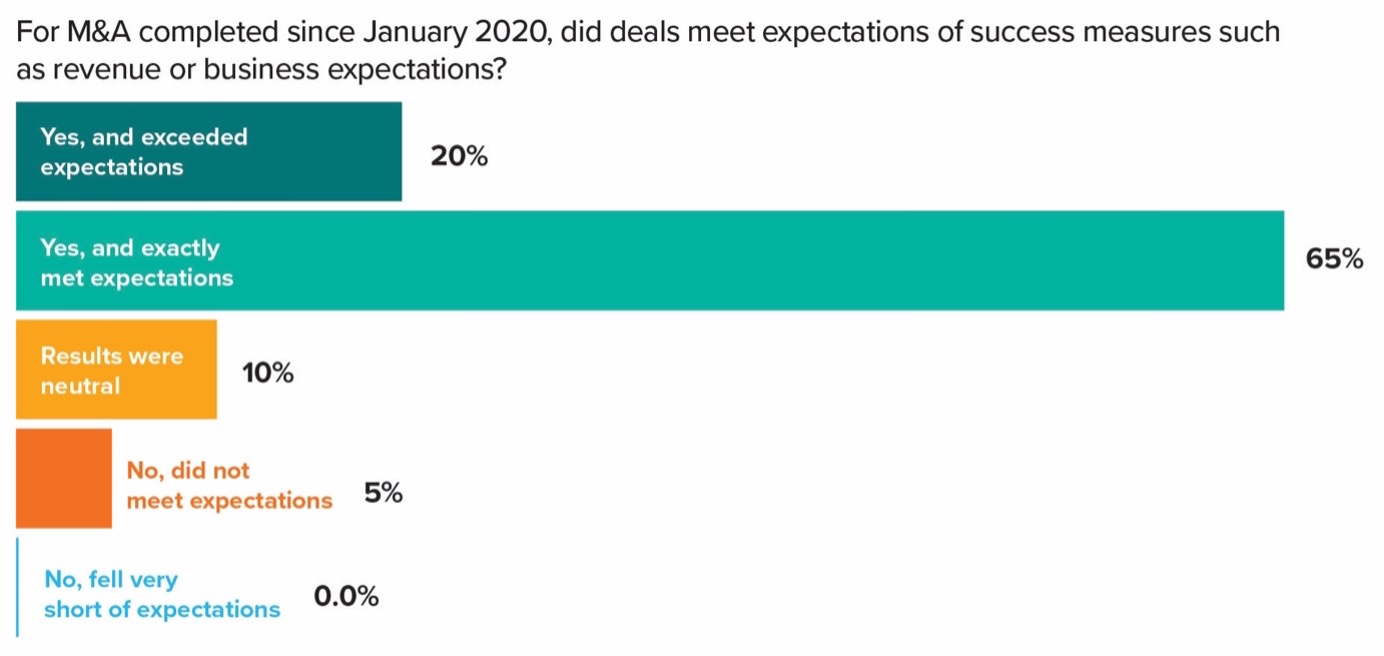

For our most recent report, we asked whether M&A deals completed since January 2020 had met the dealmaker’s expectations of success, whether that was in measures such as revenue or return on investment, the integration of assets or other business metrics.

Nearly two-thirds (65%) said their deals had met expectations and another 20% said they had exceeded them.

One in 10 said the results were neutral and only 5% overall said the deals had not met their expected measures of success.

But these are deals that have been conducted in the most challenging business period for a decade, in which every sector in every country has been impacted in some way.

To put it in context, the Australian economy has shown negative growth in three of the last seven quarters, down 1.9% in the September quarter. Although unemployment has finally fallen, for much of the past two years it has been at decade-record highs.

And uncertainty — surely the biggest sapper of business confidence — has never been greater.

Yet despite these economic headwinds, M&A in the COVID-19 era has been a resounding success — so what can we take from this finding?

For a start, it says we should draw a line under some of the lessons learned in the GFC, which have less resonance today.

Although that economic shock was substantial, it also played out very differently in the Australian business context, lingering on for years.

The pandemic — so far at least — has prompted a V-shaped recovery, with almost all measures bouncing back by the end of 2021.

It was also a different kind of crisis.

The GFC saw demand vanish, while supply was largely untouched. COVID-19 hit supply first, as workers were forced into lockdown, and while demand was constrained, we saw it surge back whenever restrictions were lifted and confidence returned.

A second message is the role government support has played in keeping the economy stable, which in turn has given dealmakers confidence in buying assets.

Investment during the GFC was targeted at the public sector and individuals, rather than business, and business insolvencies in the wake of that crisis were nearly three times as high as we have seen in the past year.

With fewer business insolvencies on the back of JobKeeper and lockdown support measures, we have seen fewer distressed sales, although dealmakers believe that is likely to change.

Our survey found 82% of dealmakers believe the opportunity for distressed M&A will either grow in 2022 or at least keep pace with 2021, as some of that support retreats.

A third argument for the success of M&A in the past two years lies in the way dealmakers have approached the market.

Our survey finds 88% of dealmakers turned to external advisors and consultants to help source deals for M&A in the last 12 months — and 100% say they will engage this expertise in the year ahead.

That’s a big change from pre-pandemic deals, where just 58% of dealmakers engaged a strategy or management consultant, and only two-thirds sought advice on critical issues like finance or tax.

Now, they are turning to advisors to help identify the right targets, but also to structure the sale appropriately to mitigate risk, understand exposure to ESG sleeper issues, and support the change management process on deal completion.

It’s a finding that underscores the value of bringing more perspectives to the table, to assist with due diligence and context setting, and in navigating some of the complexity that remains with limited travel.

This year looks set to be another bonanza for M&A, and many dealmakers are optimistic that the peak will be hit not in 2022 but 2023 or beyond.

But looking ahead, we believe the newfound reliance on expertise rather than optimism may be the greatest determinant of successful M&A.

As dealmakers get the right information early on to set their expectations, it becomes more likely those expectations can be met.

Looking for more? Our Dealmakers hub gives you access to key M&A trends for 2022 plus you can download the full Dealmakers report – it’s here.