While there is a risk that inflation continues climbing in the short-term, there are also early signs that inflation pressures may be peaking. If recession risks transpire, they may aid the battle against inflation.

How are your nerves? There has been a fair bit for investors to digest – and to test their patience — in the first half of the year.

Issues are compounding in a manner rarely seen in Australia – the highest inflation in decades, soaring energy costs and rising interest rates are just the start.

Factor in supply chain bottlenecks, workforce pressure from record low unemployment and the never-ending pandemic, and you can almost hear the strain on the economic machine.

The highs and lows can be maddening, like watching a favourite sports team struggling for consistency – world beaters one minute, easy-beats the next.

With so many factors feeding in at present, it can cloud our judgement. But if we can push aside the emotional and sentimental elements impacting the market right now, it allows us to look objectively and uncover pockets where opportunities lie.

What’s the problem?

Rising interest rates and inflation have not been major concerns in Australia for some time.

The most obvious consequence is that investment markets sold off heavily in the first of the year, both fixed income and equity markets, in part due to changing expectations of future interest rates.

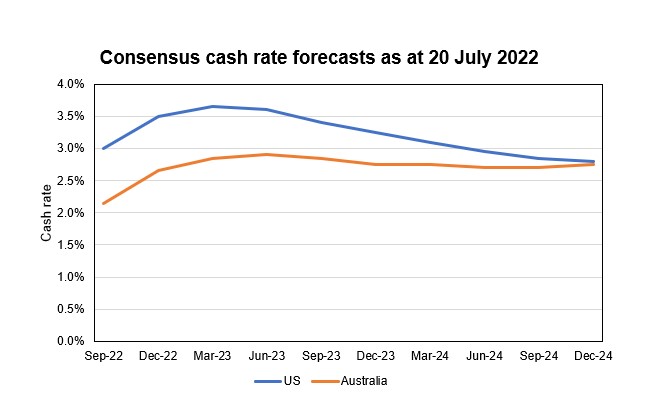

However, we anticipate rate hikes will peak in 2023 and cuts may then potentially begin in response to a materially weaker growth outlook.

While there is a risk that inflation continues climbing in the short-term, there are also early signs that inflation pressures may be peaking. If recession risks transpire, they may aide the battle against inflation.

Higher interest rates lead to higher discount rates in the models used for pricing investment assets. All else being equal, a higher discount rate equates to a lower present value of the asset. This puts downward pressure on investment prices as market participants re-evaluate an asset’s worth.

Government bonds

This can present attractive investment opportunities. Australian government bond yields briefly exceeded 4 per cent, a level not seen for close to a decade. Although they have since come back to between 3 and 3.5 per cent.

Yields of between 3 and 3.5 per cent might not seem an overly eye-catching rate of return. But investors should consider that if economic conditions become overly tight, we may fall into recession. If that happens, government bonds can be a safe haven, with buying pressure pushing bond prices up.

Investors may see monetary policy decision-makers turn their focus to stimulating economic activity, via lower interest rates. This has a reverse effect – lower interest rate expectations mean higher government bond prices. Now may be a prudent time to add bonds as an insurance policy against what could unfold in the future.

Keep an eye on A-REITs

Another area we are closely analysing are the Australian real estate investment trusts (A-REITs).

Everything has been sold of late, but the disposal of A-REITs has been particularly heavy in recent months, as the Reserve Bank began its hiking cycle. The market harboured concerns for commercial property valuations and the flow-on impact to their funds management businesses.

That has left some A-REITs trading at or below the value of their net tangible assets (the value of physical assets less any debts). This can be an attractive buying price, though consideration should be given to the future value of the underlying assets and potential for markdowns.

A-REITs may also represent viable inflation hedges through property value (replacement costs rise with inflation) and inflation-linked rents.

What lies beyond Australian shores?

The third asset class we are adding to is international equities, specifically high-quality businesses. Quality businesses not only survive weaker economic conditions but they can come out stronger via reduced competition.

We are looking at companies that have a franchise, or a really strong brand or patent over a product, the elements that give it an enduring competitive advantage, and we are looking overseas because international markets have sold off more heavily than the domestic market.

Our guiding principles for identifying quality companies to invest in is threefold:

- The competitive advantage, which might include brands, patents, intellectual property, cost advantages and the like;

- a strong balance sheet. Though some businesses naturally have more debt (infrastructure is an example); and

- a history of being well-managed with sound capital management.

The bottom line

Patience is easy to say but can be difficult to execute in investments, and it is not easy to sit by and watch portfolios and assets shrink in value. Allowing emotions, or psychological factors, to influence your investment decisions can lead to irrational decisions.

If you are committed to the investment game plan, don’t ride the highs and lows like a football team. Take a leaf out of the coach’s book and stick to the process.

Selling on bad news and buying on good news is a near certain way to permanently lose your savings. It is near impossible to pick the bottom or the top.

Factors that influence share prices in the short term, like interest rate and inflation speculation, are not predictable. Long-term returns are driven by factors like valuation, profitability, earnings growth, balance sheet strength and competitive advantages.

Stay practical and objective when it comes to investments and look for opportunities. Talk to experts, do extensive research and review your thought patterns before making any investment decision.