2024 outlook

DealmakersMid-market M&A in Australia

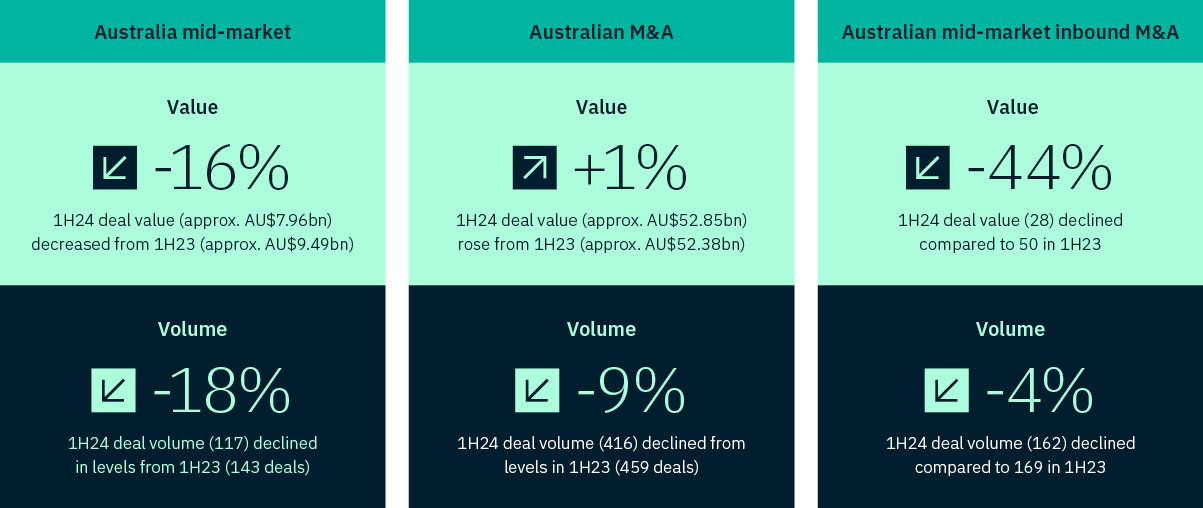

Australian M&A in 1H24 remains cautiously strategic, as dealmakers focus on long-term value creation.

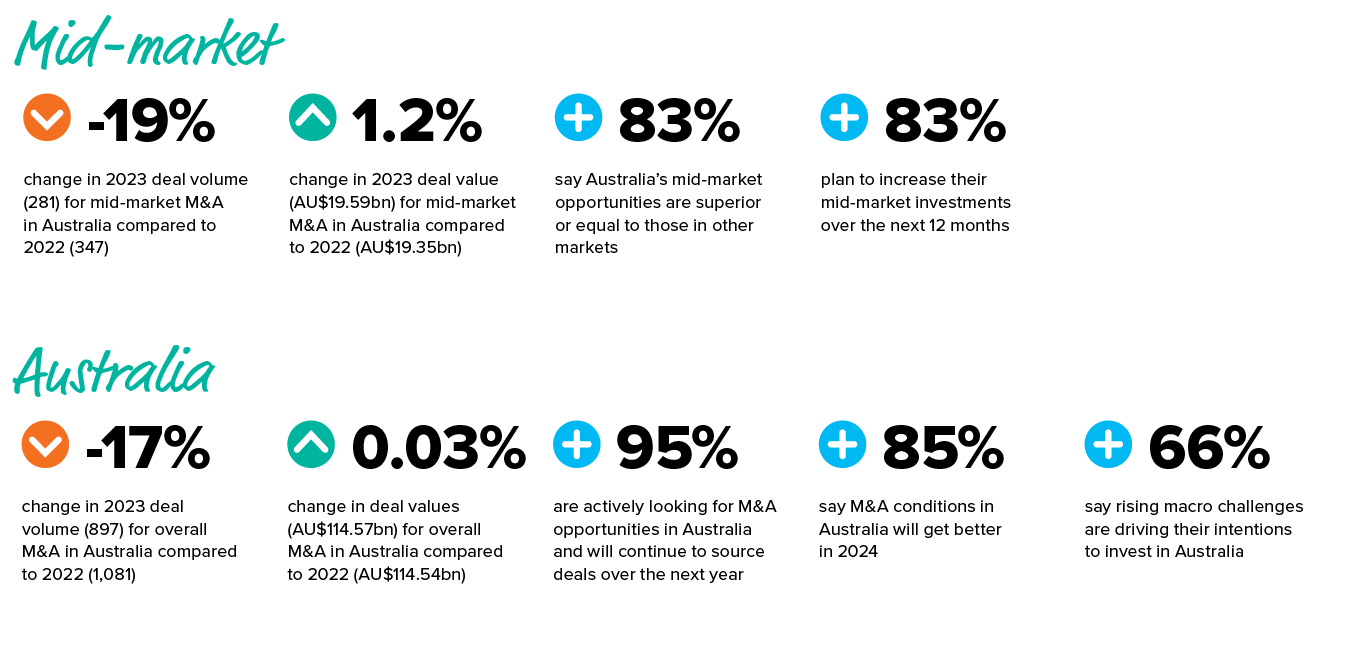

Earlier this year, our annual Dealmakers report found that 70% of respondents were planning to increase their M&A activities in Australia in 2024. Another 85% said that M&A conditions would improve, paving the way for greater deal volumes.

But sentiment and action are at odds, with dealmakers ultimately taking a cautious approach to M&A activity – however some bright spots, such as offshore buyer interest and steadying deal values and valuations, leave cautious optimism for the second half of the year.

Dealmaking in Australia: 1H24 in numbers

So what does the rest of the year look like for Australian dealmakers? Dive into our 2024 reports to understand:

- Factors influencing future dealmaking, and how the mid-market can appeal to risk-averse dealmakers

- Inbound M&A trends and their impact on the Australian dealmaking landscape

- What’s driving activity in the top sectors – in the mid-market and Australia more broadly

Foreword

Australian M&A in 2024

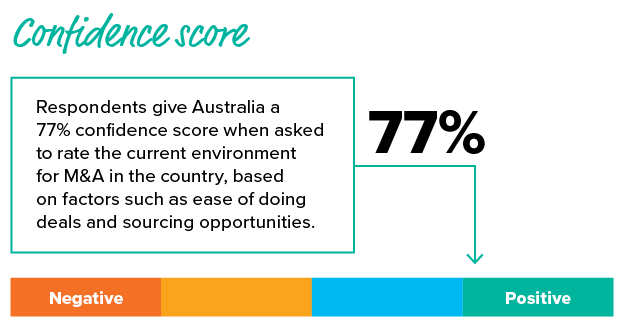

Dealmaker sentiment toward the Australian Mergers & Acquisitions (M&A) market remains strong and the outlook looks very positive for 2024 as economic uncertainty declines

Section 1

Australian M&A 2024

Global dealmakers look ahead with confidence as the market once again proves its resilience

Section 2

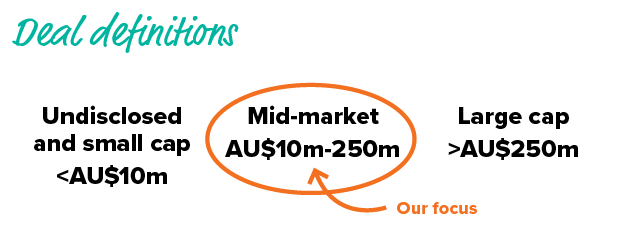

Mid-market deals

Superior opportunities and resilient businesses

Sector 3

Deal drivers

Rising competition: and what to expect from valuations in 2024

Section 4

Risk outlook

Financing challenges lead concerns, inflation and interest rates fears persist

Section 5

Spotlight on sectors

Respondents reflect on which sectors will be hotspots for mid-market M&A, and which may experience distress in 2024

Section 6

Focus: ESG

The weight that Environmental, Social and Governance (ESG) factors hold in the M&A process has increased compared to a year ago – but mandatory reporting of emissions will raise the bar further

Read our full 2024 Dealmakers report here

Read our mid-year 2024 Dealmakers report here

Our experts

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa

asdfafsdfa