International economy

The information in this article is current as of 1 January 2024.

United States

In the US, growth has been resilient in the face of material interest rate hikes. The Federal Reserve has hiked interest rates by 1% in 2023 following 4.25% of hikes in 2022. This has raised financing costs substantially but has seen limited impact outside of certain interest-rate sectors, such as commercial real estate. The bulk of American households have been insulated due to taking on fixed rate mortgages when interest rates were materially lower.

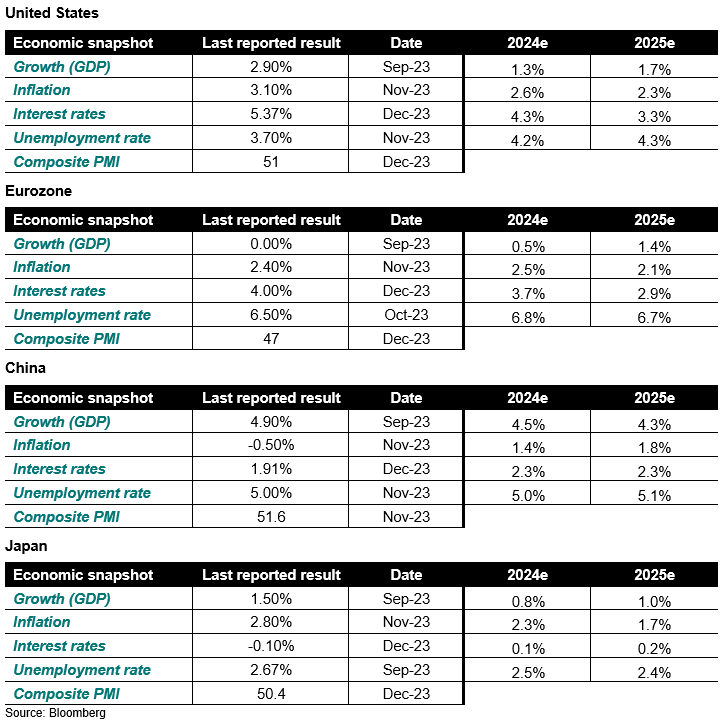

In addition, the US government was extremely proactive in its fiscal support programs during the coronavirus pandemic. This has seen US households retain strong levels of excess savings across all income groups, which remain about 20% above the pre-pandemic levels[1]. The median US worker continues to see reasonably high levels of wage growth with the Atlanta Fed wage tracker showing growth of 5.2% for the year to November.

Median household savings by income category (Jan-19 to Nov-23)

Source: Bank of America

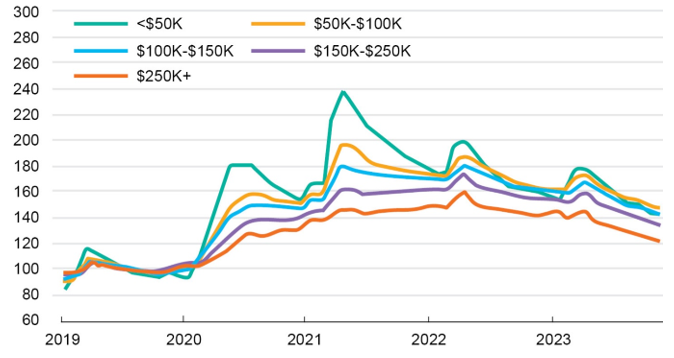

A strong household sector has supported consumer spending and overall economic growth as a result with some level of excess savings offering a buffer in the year ahead. In addition, the business sector has weathered higher financing costs surprisingly well. Partly, this has been thanks to prudent capital management when rates were at lower levels by locking in fixed rate debt. Another important factor has been ongoing demand from consumers, as well as support from the US government. Initiatives such as the Inflation Reduction Act have been a powerful “carrot” to incentivise business investment. Construction activity for US manufacturing is up 71.6% for the year to October or some US $86bn[2], a material surge that dwarfs typical “late cycle” behaviour by the private sector.

Annual growth in US construction spending (Oct-03 to Oct-23)

After a decade of underinvestment in housing, we are seeing emerging signs of a recovery that should provide a tailwind over the medium term as well.

Leading indicators, such as the Conference Board Leading Economic Index (LEI), appear to have failed as a recession barometer. Typically, when the LEI has remained at strongly negative levels for over a year, we see recessionary conditions ensue. This has not happened. One major contributor is the over-indexing on manufacturing sector performance. Usually this sector is the “canary in the coal mine” with performance peaking just as a recession is commencing. However, the pandemic brought forward a surge in demand with locked down households focused on goods consumption. As restrictions eased, we saw household spending shifted to services and “experiences” (e.g. going out) and retailers pulled back on new orders when expected demand for goods was ultimately unsustainable. As a result, “this time” may indeed be different from past late-cycle periods and a recession will not be forthcoming. This is increasingly our view on the US.

The labour market has shown a similar dynamic of over-ordering more expensive temporary labour before subsequently correcting to pre-pandemic levels. Ultimately though it is also showing a marked resilience and any weakness is more consistent with a growth slowdown than a major recession.

Finally on the inflation front, it would appear the Federal Reserve considers its job largely complete. The latest headline inflation print of 3.1% for the year to November is a marked deceleration from the 9.1% peak inflation seen in June 2022. The Fed is now forecasting three rate cuts in 2024 and a further four in 2025.

Taken together the extreme risk of a major recession now appears off the table. The worst case may still be a mild recession but this would be materially less disruptive from a global context. While there is scope for the US to see growth slowdown in 2024 as household excess savings are finally exhausted, we believe the offset of a supportive Fed will be an important tailwind. Overall, we are firming up in our support for the US and see it continuing to be a growth leader amongst developed economies.

Eurozone

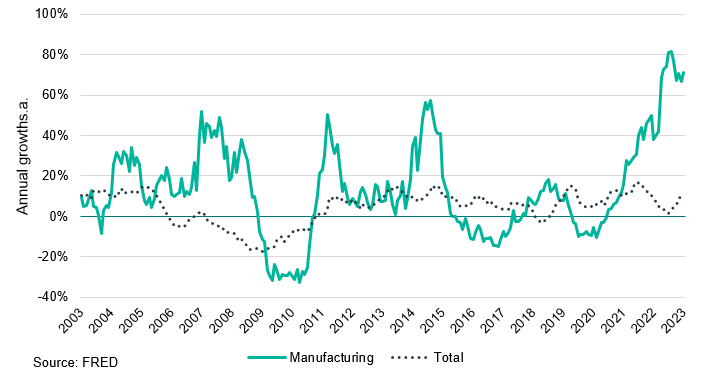

The situation in Europe has showed limited signs of improvement. Growth in the September quarter was slightly negative (down 0.1%) and flat for the year to September. Elevated energy costs and high interest rates have had a larger impact on the Eurozone with its households more subject to variable rates that makes rate hikes more effective than is the case in the US where 30-year fixed rate mortgages are the norm. Subdued global demand for manufactured goods has impacted the region hard, particularly its largest economy, Germany. The HCOB Manufacturing PMI from S&P Global has languished in contractionary territory (readings below 0) for over a year now in a testament to the region’s malaise. Even the services sector has been impacted with the HCOB Services PMI shifting to a contractionary phase in the past four months.

Eurozone PMI surveys (Dec-20 to Dec-23)

There are signs that the worst on the inflation front might be over with consensus forecasts anticipating a deceleration of inflation to sub-3% levels going forward. This may offer scope for near-term relief by the European Central Bank on the interest rate front.

A more potent source of support would be sustained fiscal spending on the part of Eurozone governments, However outside of certain, regional solidarity efforts such as the Green Deal[3], more targeted support for both businesses and households appear less than forthcoming in sharp contrast to the UK, for example, where its own unique challenges, as well as weaker regional demand, has seen a more forceful government response than its peers in mainland Europe.

Taken together we would expect current subdued economic conditions to persist for the Eurozone in the near term. Eventually as conditions rebase, we would expect to see an uptick in growth with consensus arguably anticipating this already as the current recessionary conditions are not expected to deepen.

China

China has seen a mixed year in 2023. On the one hand there has been a notable bounce back in household spending with retail sales up 10.1% for the year to November as activity normalises from a lockdown-afflicted 2022. The industrial sector has also held up reasonably well with 6.6% growth to November, well ahead of developed markets with a 0.4% decline in the US by contrast, as well as negative growth in the Eurozone.

While growth is certainly more subdued than prior years, it has still shown marked resilience with 4.9% growth for the year to September. This was admittedly flattered by comparisons to a pandemic-challenged 2022 but is still a strong result in a global context.

On an underlying level however, China’s economy faces some notable challenges.

The property sector, a material contributor to growth in recent decades, has struggled markedly with residential property sales for the year to November declining 4.3% and property investment spending down 9.4% over the same period.

Further, official price data shows that with both consumer inflation and producer inflation declined 0.5% and 3% for the year to November respectively. This is not the backdrop of a “healthy economy” per se. It is suggestive of subdued underlying demand amongst consumers and an inability for companies to pass through costs to preserve profitability. On that last note, industrial profits for the year to October declined 7.8% suggesting limited pricing power in the current environment.

Business survey data also offered a level of confirmation with the manufacturing sectors flirting between expansionary and contractionary states for the bulk of 2023. Meanwhile the services sector has seen a protracted slowdown since it initially surged on the lifting of pandemic restrictions in the March quarter.

The inability to meaningfully break out with stronger underlying growth is perhaps unsurprising. China was unwilling to exercise the same degree of household or business support as was the case in Western countries. This meant one lever of excess savings has not been evident as a support for economic growth. Signs have begun emerging that authorities are acknowledging the potential scale of underlying weakness. There is heightened expectation that the central government will enlarge its deficit target to at least 3.8% of GDP, mirroring its efforts in 2023 where the deficit target was lifted from 3% to 3.8% in order to support increased investment spending and provide a measure of natural disaster relief.

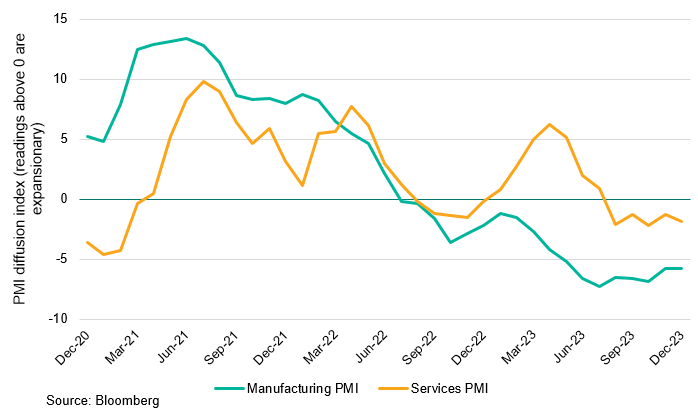

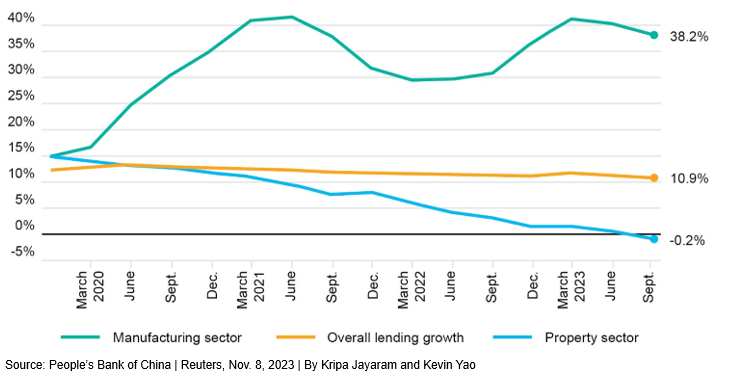

China lending growth by sector (Mar-20 to Oct-23)

Finally, the credit environment has become more supportive particularly as authorities look to divert credit creation towards sectors more aligned to the CCP’s long term goals, predominantly in manufacturing as the aim is to create a stronger technology sector in areas, including semiconductors and electric vehicle production. We can see this illustrated below by the sizeable acceleration in manufacturing lending growth relative to overall lending and the anaemic conditions for the property sector.

On balance, we do not expect further deterioration in the Chinese economy. The diversion of resources including credit to other sectors will be a net support to economic activity while the potential enlargement of the national fiscal deficit should act similarly. In net terms, we would still anticipate China being a major source of resource demand in the near term to fund its expansionary manufacturing sector notwithstanding underlying weakness in domestic consumption.

Conclusion

Our outlook for global growth suggests rebasing at current levels before gradually accelerating towards the end of 2024. The key driver of a shift in our view has been the resilience of the US private sector, spurred on by strong government support beyond the pandemic emergency spending. A more proactive fiscal response out of China is also giving us scope for optimism. While we acknowledge the malaise higher interest rates are having on the European economy, we believe there is sufficient positive evidence to suggest an inflection point in global growth into 2024 with central banks increasingly likely to shift to a more supportive stance as the supply shock of the pandemic fades into memory with inflation, it appears, being brought to heel successfully.

Part 2: Key economic indicators