Australia – Supporting the EV revolution

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 01 October 2023

The Australian mining industry has become a key enabler in the energy transition through its abundant supply of low cost and easily accessible lithium, a key input in batteries that power Electric Vehicles (EV) and support Energy Storage Systems (ESS).

As the value of Australia’s thermal coal exports wind down over time, the growing demand for lithium production will likely become an important export earnings substitute.

Lithium industry overview

Within the battery storage industry, there exists several important dynamics to appreciate how the intricate global lithium supply chain supports the Australian hard rock spodumene (lithium) producers.

Battery technology continues to evolve but currently, lithium is the core ingredient in main-stream battery solutions for both EV and commercial energy storage in support of intermittent renewable power. Batteries for EV are now the biggest driver of global lithium demand as governments around the world incentivise consumers to transition from the traditional internal combustion engines motor vehicles and auto-makers build out their diverse range of replacement EV models. Based on the level of expected EV penetration and roll-out of ESS, many forecasters don’t expect the current level of global lithium production by 2030 to meet this forward battery demand.

As with all commodity-based investment opportunities, it’s important to appreciate the global supply and demand dynamics as a key input into the underlying price that a company will receive for its mined production. Lithium globally can essentially be found in three geological forms:

- Hard rock spodumene

- Brines

- Clay-based or sedimentary deposits

Currently the hard rock deposits, primarily located in Western Australia, offer some of the lowest cost production globally. Importantly, it is well supported by recently built mine infrastructure and transport networks to end markets.

Source: UBS and Delta Lithium (ASX: DLI) estimates 17 May 2023

In its simplest form, there is an abundance of lithium deposits globally but what are the risks of increased supply challenging Australia’s position:

- It takes time (4–10 years to bring new mineral production online – excluding China.)

- Producing lithium from new brine facilities (primarily located in South America) takes 2–3 years longer than hard rock sites (as located in Australia) because recovering lithium from brines currently relies on evaporation ponds. This does not factor in timelines for environmental permits, which in industrialised countries like the US can take a decade or more.

- Extracting brines lithium requires increased processing given the wide range of other minerals present which, when combined with relatively low lithium concentrations, results in a higher unit cost of production.

- Geo-political risks in developing lithium deposits in emerging markets.

Australia is one of four countries that currently dominates the world’s lithium reserves, with Chile, Argentina and China making up the quartet. For Australian hard rock miners, the ore is typically processed into spodumene, which can then be refined into either lithium hydroxide or lithium carbonate (lithium hydroxide is the preferred route because refining from spodumene is less complex and cheaper than refining lithium carbonate from spodumene). For the South American-based lithium producers which are brine-based, there is a heavy reliance on water-dependent evaporation ponds to extract the end product. This raw material is then predominantly converted into lithium carbonate (given the greater level of chemical processing complexity and therefore cost in converting to lithium hydroxide).

Australia’s rapidly evolving position

The pricing of lithium comes in a few different forms, given the multiple levels of concentration as a result of the raw mined ore being processed to various degrees of purity (i.e. spodumene, spodumene concentrate, lithium carbonate and lithium hydroxide). For the large Australian lithium miners, their strategy over time will likely be to move more ‘down-stream’ (i.e. building refining capacity to earn a higher profit margin on the tonnes they mine). As the demand within the intricate supply chain for each of these products shifts, it has the potential to cause additional price swings and changes to the processing requirements. Hence the observation that lithium miners who chose to refine their product are more akin to a complex chemical company as opposed to a less sophisticated ore extracting miner.

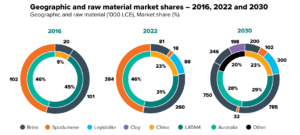

While Australia accounted for 46% of global lithium extraction in 2022 (almost all exported to China), it has only just started processing spodumene into the more valuable lithium hydroxide. China, by contrast, accounts for less than 25% of global lithium extraction, but over 70% of the global refined lithium hydroxide.

Given the strong trading relationship between Australia, the United States and Europe, an opportunity exists for it to increase supply to these growing markets with both semi-processed and the purer lithium hydroxide. Several key attributes in this rapidly evolving marketplace positions Australia well to capitalise on this opportunity including:

i) the economics of its low cost mined / processed production

ii) access to cheap renewable energy

iii) in the US, an ability to leverage off the recently legislated US Inflation Reduction Act (IRA). This importantly offers tax credits to the end consumer of the manufactured product subject to meeting minimum input requirements from free trade agreement countries.

With the rapid development of the EV industry and the opportunity available to the global scaled players, it’s perhaps not surprising that the leading participants have key joint venture relationships with Australian lithium miners.

Source: PPIS at 29 Sept. 2023

The world’s largest lithium producer, Albemarle Corporation, operates a Chilean lithium mine in partnership with the second biggest producer, Sociedad Química y Minera de Chile (SQM). In turn, SQM is a joint venture partner of Wesfarmers Ltd (ASX: WES) in the development of the $1.9bn Mt Holland lithium project in WA. Albemarle also has assets in the US and Australia via its 50/50 partnership with Mineral Resources (ASX: MIN) Wodgina lithium mine. Albemarle has only recently bid A$6.6bn for another lithium player in WA – Liontown Resources (ASX: LTR). As part of the country’s efforts to dominate the clean energy metals supply chain, three Chinese companies are also among the top lithium companies. The biggest, Tianqi Lithium, has a significant stake in the Greenbushes mine in WA along with its partner Albemarle and IGO Ltd (ASX: IGO), which is currently the world’s largest and highest-grade source of hard-rock lithium.

WA is also home to Australia’s three lithium hydroxide processing plants, which Tianqi Lithium currently operates one (the largest outside of China and in a joint venture with IGO) while Albemarle and WES also have facilities that are currently under construction. To further highlight the entangled web of the global lithium industry, Gangfeng Lithium Group is the largest lithium chemicals producer in China and a 50/50 joint venture partner of MIN’s Mt Marion lithium mine just outside Kalgoorlie.

Conclusion

The Australian lithium industry continues to experience buoyant conditions but as the world makes the energy transition, there will naturally be winners and losers in supplying the key commodity inputs to this rapidly growing industry segment. While Australia is again in the fortunate position of having large lithium ore deposits, the industry’s long-term success will be reliant on having key global partnerships, increasing scale to drive lower unit costs and moving down the supply chain to generate more sustainable returns for shareholders.