Under pressure to provide cost-of-living relief to middle Australia, Prime Minister Albanese announced a proposed redesign of the stage 3 tax cuts legislated to apply from 1 July 2024.

Treasury advice estimates that the proposed changes will offer some cost-of-living relief, in the form of a lower income tax liability in 2024-25 compared to 2023-24, to 2.8 million more taxpayers than the current legislated tax changes.

How do the legislated and proposed stage 3 cuts compare?

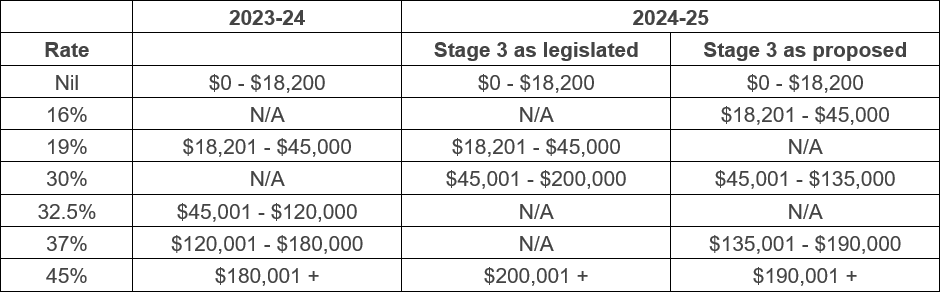

The following table summarises the current rates (i.e. 2023-24), the stage 3 rates as legislated and those proposed by the government for 2024-25.

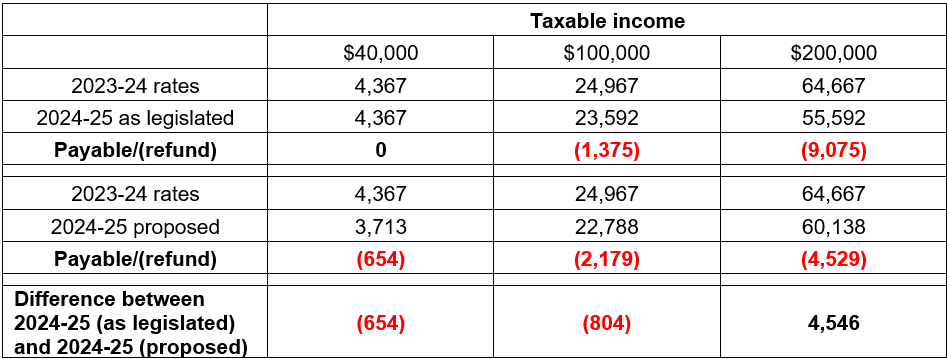

The following table summarises the impact of the redesigned tax rates using the taxable incomes quoted by the Prime Minister. The numbers include Medicare Levy and, where available, the Low-Income Tax Offset.

What do the proposed changes mean for dividend planning this 30 June?

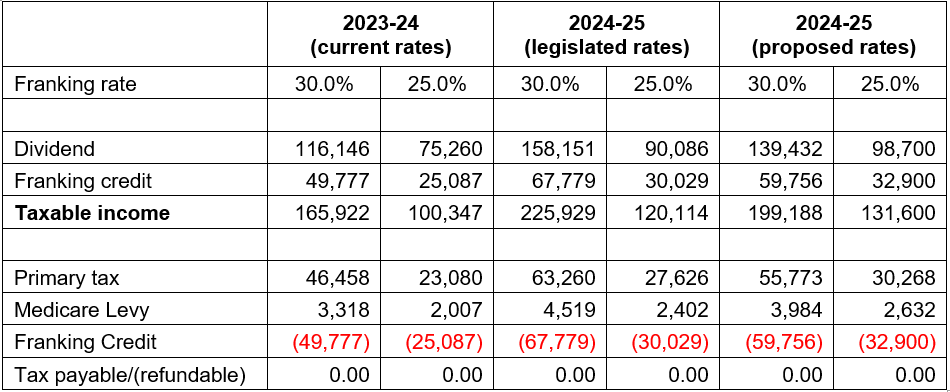

Two preliminary matters to note before looking at the impact for an individual receiving a franked dividend. First, does the company have sufficient profits to be able to pay a franked dividend? Second, whether the maximum franking credit will be set having regard to the 25% or the 30% company tax rate.

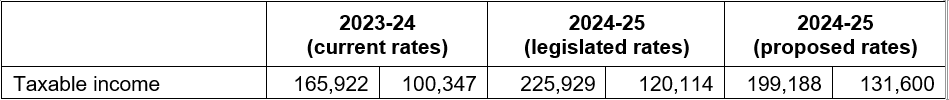

The following table illustrates, for an individual resident taxpayer, the taxable income at which the average tax rate (including Medicare levy) for an individual resident taxpayer equates to the company tax rate.

This table shows the amount of a dividend, fully franked at 30% and 25%, that equates to that level of taxable income.

What are the next steps?

Clients should contact their Pitcher Partners representative to discuss their year-end dividend plans and determine what action is required in light of the proposed changes.