As announced in the 2023-24 Budget, the Victorian Government proposes to introduce payroll tax related changes.

The following payroll tax changes have been annouced:

- As part of its COVID Debt Repayment Plan, from 1 July 2023, a levy on payroll will apply to businesses with annual Australia-wide taxable wages above $10m

- From 1 July 2024, the payroll tax-free threshold will increase from $700 000 to $900 000, and subsequently increase to $1m from 1 July 2025

- From 1 July 2024, the payroll tax exemption for high-fee non-government schools will be removed

COVID Debt Levy – Payroll tax

The COVID Debt Levy relating to payroll tax has been introduced as a temporary measure as part of the COVID Debt Repayment Plan. The levy will apply from 1 July 2023 as a surcharge on Victorian wages (in addition to the Mental Health and Wellbeing Levy) paid by businesses with annual Australia-wide wages over $10m.

Those businesses with annual Australia-wide taxable wages over $10m will pay a surcharge of 0.5% on their Victorian wages, to the extent they exceed the relevant threshold. For example, a business with an annual payroll of $12m, that employs wholly in Victoria, will be subject to a surcharge of $10,000. Those businesses with annual Australia-wide taxable wages above $100m will be subject to a further surcharge of 0.5% on their Victorian wages to the extent they exceed this higher threshold. Thus, a business with a payroll of $120m, that employs wholly in Victoria, should expect a total surcharge of $650,000.

Whilst the Government has said that it is targeting businesses that thrived during the pandemic, the levy will not discriminate and will create an additional payroll tax burden on all medium and large businesses. As this measure will increase the operating costs for many businesses in Victoria, it remains to be seen whether the impact will be felt by customers through increased service/product rates or reduced service offerings, by employees through wage pressures, or in business profit margins (or a combination of these).

The COVID Debt Levy will apply until 30 June 2033. Existing payroll tax exemptions such as those for hospitals, charities, local councils, and wages paid for parental and volunteer leave will generally continue. The Victorian Government estimates that revenue from the COVID Debt Levy will be $836m for the year ended 30 June 2024.

Increase in the Payroll Tax Threshold

To ease the payroll tax on smaller businesses, the tax-free threshold will increase from $700,000 to $900,000 from 1 July 2024. The threshold will be increased further to $1m from 1 July 2025.

This is a welcome change for eligible businesses but it will only benefit businesses with relatively small payrolls. The Victorian Government estimates that around 6,000 businesses, who otherwise would have paid payroll tax, will no longer be subject to the tax when the threshold reaches $1m. Furthermore, it is expected that more than 26,000 small businesses will benefit from the increase of the tax-free threshold to $1m.

This change will provide a payroll tax saving of up to $9,700 for the financial year ending 30 June 2025 and a saving of up to $14,550 for eligible businesses for the financial year ending 30 June 2026 and onwards. These estimates are calculated on the expected savings for those businesses that are not based in regional Victoria.

Phase out of Tax-free Threshold

The Government will also ‘phase out’ the tax-free threshold for businesses with taxable Australia-wide wages over $3m. The threshold will be reduced proportionally such that businesses with taxable wages over $5m will no longer be entitled to any tax-free threshold.

This measure will result in an additional payroll tax liability for affected businesses. For a business with taxable wages above $5m, the introduction of the phase out threshold will result in an additional payroll tax liability of $43,650 for the year ending 30 June 2025 (and $48,500 for the year ending 30 June 2026). These estimates are calculated on the assumption that the businesses are not based in regional Victoria.

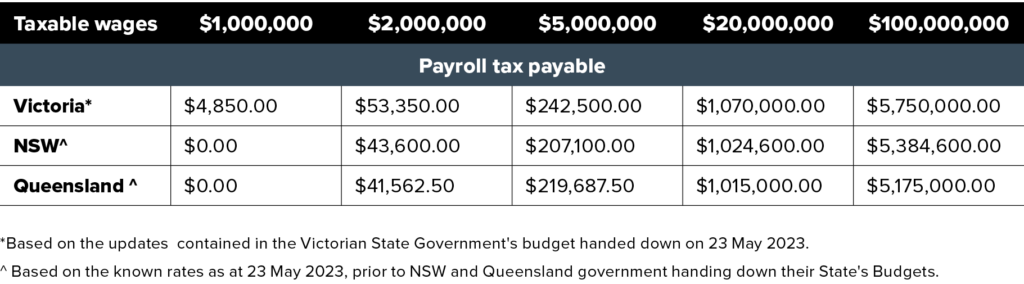

The table below shows a comparison of payroll tax liabilities in Victoria, NSW and Queensland for the financial year ending 30 June 2025, based on different levels of taxable wages. It is evident from the table that the payroll tax costs will be higher in Victoria as compared to NSW and Queensland.

Mental Health and wellbeing levy

The Mental Health and Wellbeing Levy will continue to apply as a payroll tax surcharge on wages paid in Victoria for those businesses with annual Australia-wide wages over $10m. Revenue from the Levy is forecast to be $912m for the year ending 30 June 2024.

The Government has legislated that 100% of revenue from the Levy must be spent on mental health services. The revenue mechanism provides dedicated funding that supports investment in Victoria’s mental health system.

Removal of payroll tax exemption for high-fee non-government schools

From 1 July 2024, the Government will remove the payroll tax exemption for high-fee non-government schools. The Government estimates that approximately 110 schools, or around the top 15% by fee level, will lose their exemption. The Minister for Education will determine, with the consent of the Treasurer, the non-government schools that will continue to be exempt from payroll tax. The change will bring affected non-government schools in line with government schools (which are not exempt).

The payroll tax liability for the affected schools will depend on their taxable wages above the applicable payroll tax-free threshold. Payroll tax is applied at the rate of 4.85% for non-regional schools and 1.2125% for schools in regional Victoria. As with the other measures, it remains to be seen whether the tax increase will be passed onto families, or whether services (costs) will be adjusted.

What are the next steps?

Clients should anticipate whether the additional labour costs will impact on their business and their pricing mechanisms. Clients should contact their Pitcher Partners representative to review their existing arrangements and determine what action is required in light of the changes.