As touched on before, the supply of new vehicles to the Australian market is constricted.

The constricted supply and recent surges in demand have pushed prices and gross margins to the highest on record, not only in new vehicles but also in the used car market. Speaking with our dealer clients, stock is limited, new orders face large wait times and average days inventory is down significantly from pre-pandemic levels.

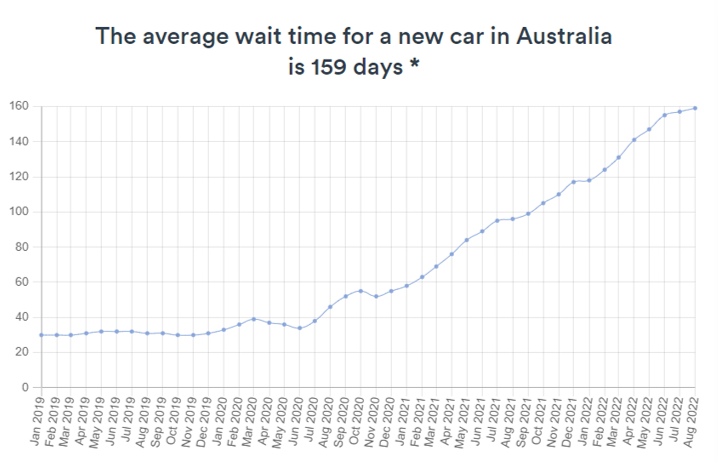

Benefits of reduced stock include reduced floorplan expenses, especially in an economy where interest rates are rising. However, the wait times have blown out considerably with data from Price My Car suggesting that average day wait time has increased from 30 days in January 2019 to 159 in August 2022. That is a 530% increase in order wait times!

Source: New Car Delivery Date Estimator, https://pricemycar.com.au/delivery-dates

Pitcher Partners have undertaken an analysis of the car parc and notes previously the quantum of the hole created by the lower sales on new cars since 2019 will be as much as 500,000 vehicles which dealers will not have the opportunity to buy or sell or service1.

Source: VFACTs, ABS and Pitcher Partners Analysis

The most important takeaway from the analysis is understanding how long it will take for the automotive industry to plug the gap in the market. This will require supply returning to normal levels and for some time exceeding long term sales volumes. The assumptions used in the analysis were:

- Demand volumes: 2017 volumes would continue to increase at 1% (below the long term 2% average)

- 2022 volume would be c. 1m units

- From 2023 supply would be 10% greater than historical run rate demand volumes

The results of the analysis are that at the end of 2022 the total number of units ‘missing from the Australian car parc is approximately 615,000. If supply was to outstrip demand from 2023 onwards by 10% (this is a very conservative measure both in volume and timeline given the supply chain difficulties already discussed) it would take until the first quarter of calendar year 2028 for the lost units to be made up. This illustrates the magnitude of the restricted supply into Australia over the last 4 years, which is half that of the global average. However, underpinning the analysis is the assumption that the macroeconomic factors would continue to support the level of consumer demand.

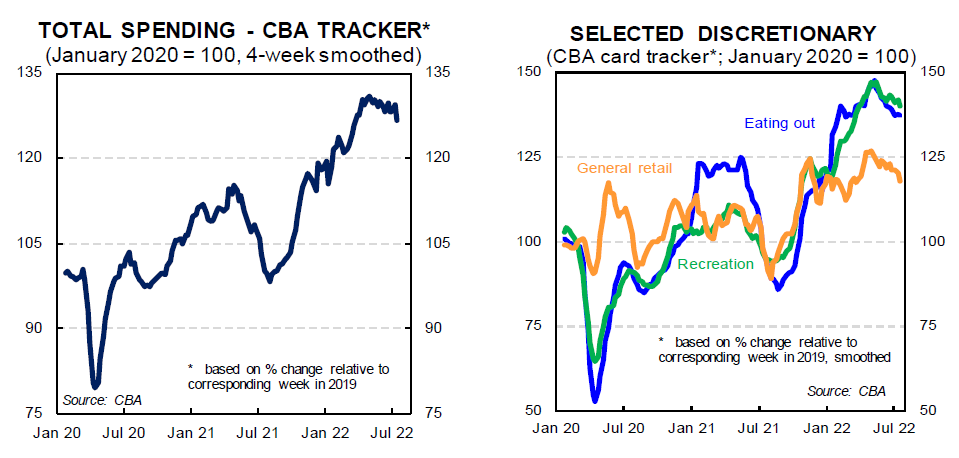

The Australian Government and Reserve Bank of Australia (RBA) is actively trying to rein in inflation to its long-term target for under current monetary policy of 2-3%2. Despite the last 6 consecutive rate increases, totalling an increase of 2.5% to 2.6%, consumer spending has not slowed down significantly, a sign that the full effects of the interest rate increases have not hit the household budget & savings as consumers still have cash reserves and fixed rate loans.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

The big question therefore is what will occur first – supply levels return to a point where the pent-up demand from the last four years can be satisfied, or will the Government and RBA be able to rein in spending and inflation in the economy and dampen consumer discretionary spending (new car sales).

1 J. Mellor, ‘Used car ‘black holes’ loom’, GoAuto, 2022, https://premium.goauto.com.au/used-car-black-holes-loom/ (accessed 13 October 2022).

2 ‘’Inflation Target’, Reserve Bank of Australia, 2022, https://www.rba.gov.au/inflation/inflation-target.html (accessed 13 October 2022).

Return to Australian retail automotive industry hub