NSW Labor government announces significant duty and land tax changes in its first budget in 12 years

The NSW government handed down its 2023-2024 budget on 19 September 2023. The budget includes many adverse tax amendments.

In this article, we explain the key duty and land tax changes proposed in the NSW budget which are set out in the Treasury and Revenue Legislation Amendment Bill (‘the Bill’) and discuss what taxpayers can do to prepare for the changes.

The Bill is currently before the NSW Parliament and therefore the details contained in this article are subject to changes to the Bill as it progresses through Parliament.

What is changing?

Reduction of Corporate Restructure Duty Relief

Currently, certain restructures of assets such as land in NSW or securities in companies or unit trusts that hold land in NSW within a corporate group (including unit trusts) may be fully exempt from duty under certain duty exemption provisions. These exemptions are generally referred to as the corporate reconstruction relief and corporate consolidation relief.

The relief, currently in the form of 100 per cent duty exemptions, will be replaced with 90 per cent concessions. Therefore, the duty payable on relevant restructures will be 10 per cent of the duty that would otherwise be payable. Accordingly, moving forward, the NSW duty cost needs to be considered in making decisions in relation to corporate group restructures.

Unlike Victoria, the NSW Bill contains no carve-outs where the underlying assets are restructured several times within 30 days of the first event that triggers a duty liability. This means that restructures that involve multiple steps can be liable to 10 per cent of the duty otherwise payable at every step, and therefore multi-step restructures should be carefully considered in light of the new rules.

For example, consider the following structure:

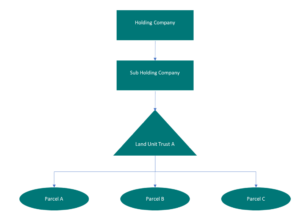

Diagram 1

Three parcels of land are held by a single unit trust (Land Unit Trust A). The unit trust is 100 per cent owned by a company (Sub Holding Company), which is in turn 100 per cent owned by another company (Holding Company).

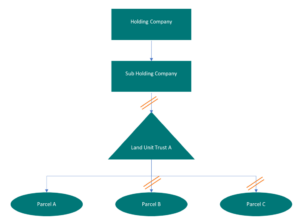

Diagram 2

The stakeholders of the group decided that the three land parcels are to be developed and used separately, such that the ownership of land parcels needs to be split up. They also decided that the Sub Holding Company is no longer required in the ownership structure.

As a result, the stakeholders decided to:

- set up new Land Unit Trust B under the Holding Company to acquire Parcel B from Land Unit Trust A;

- set up new Land Unit Trust C under the Holding Company to acquire Parcel C from Land Unit Trust A; and

- remove Sub Holding Company from the group by transferring the units in Land Unit Trust A to the Holding Company.

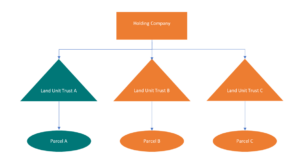

Diagram 3

The new ownership structure is as follows:

Under the current exemption rules, all the steps above are likely to qualify for full duty relief.

Under the new proposed 90% concession rules, duty is expected to be payable on:

- 10% of the duty otherwise payable on the transfers of Parcel B and Parcel C; and

- 10% of the duty otherwise payable on the transfer of units in Land Unit Trust A by reference to the land held by Land Unit Trust A.

Accordingly, it would be important to carefully consider the potential impact of the new rules in planning restructures, including any restructures similar to the one in the example above.

The current exemptions regime will continue to be applicable to transactions occurring before 1 February 2024. The current regime will also continue to be applicable to transactions occurring after 1 February 2024, if:

(a) the transaction arose from an agreement or arrangement entered into before 19 September 2023; and

(b) the application for exemption is made on or before 1 February 2024.

Significant Interest Threshold

The ‘significant interest’ threshold that triggers landholder duty in NSW is currently 50 per cent for acquisitions or investments in private companies and private unit trusts that are NSW landholders. Under the Bill, the threshold will decrease to 20 per cent for private unit trusts.

The reduction in the threshold for the application of landholder duty with respect to private unit trusts means that any proposed changes to unit holdings in private unit trusts with landholdings in NSW should be carefully considered to ensure there are no unexpected adverse consequences.

It also means that structural decisions on appropriate landholding and investment vehicles (e.g. company vs unit trust) need to take into account the new rules.

Linked Entity

The threshold for the tracing of property through linked entities of a landholder will decrease from 50 per cent to 20 per cent. The linked entity rules are effectively tracing rules governing when lands owned by linked entities are counted as land holdings of a company or a unit trust scheme.

This change will mean that the net cast will be bigger and can capture more land as landholdings on which a landholder duty liability will be determined.

Introduction of Wholesale Unit Trust Scheme Regime

The Bill introduces a new scheme for registration of wholesale unit trust schemes, similar to that which operates in Victoria. A registered wholesale unit trust scheme will be subject to a higher, more favourable landholder duty ‘significant interest’ threshold of 50 per cent, rather than the 20 per cent announced for private unit trusts.

Principal Place of Residence

The Bill also introduces a minimum ownership threshold for the principal place of residence exemption for land tax. Under the new rules, the principal place of residence exemption in relation to land will be limited to persons who use or occupy the land as a principal place of residence and own at least a 25 per cent interest in the land.

When will the new rules apply?

Subject to some transitional rules, the majority of the changes above are intended to apply from 1 February 2024.

What are the next steps?

It is critical that clients consider their position and are aware of the impact of the proposed changes.

With the changes to the NSW restructure duty relief provisions and with the next annual taxing date for land tax of 31 December fast approaching in NSW (as well as Victoria), we recommend clients begin to review their land holdings now (if they have not already done so) to ensure there is adequate opportunity to consider plans to restructure asset holdings within a group of entities (for example, to streamline the ownership structure and potentially optimise operating and holding costs).

Once the new restructure duty relief rules apply, not only will there be a duty cost associated with many intra-group restructures, but we also expect the process of applying for the 90% concessional treatment to become more onerous, including with respect to obtaining valuations for duty purposes which are likely to be closely scrutinised by Revenue NSW.

Please contact your Pitcher Partners expert as soon as possible regarding the implications of the announced measures for your existing and proposed arrangements to determine what actions are required.