In some workplaces it is common practice to provide employees a company car as a tool of trade, as part of their compensation, or to give the possibility to finance a novated lease. However, as workplaces and companies move their fleets to a greener alternative, an unintended consequence of this can be the increased employee’s tax liability.

In case you have missed our previous article, here are the key takeaways on how the FBT exemption works – Full article can be found here

Which cars will the exemption apply to?

To be eligible for the FBT exemption three requirements must be satisfied:

- First, it must be a vehicle (other than a motorcycle or similar vehicle) designed to carry a load of less than 1 tonne and fewer than 9 passengers.

- Second, the value of the car at the time of its first retail sale must not exceed the luxury car tax threshold for fuel efficient vehicles (currently $84,916).

- Third, the car must be a “zero or low emission car”. That term is defined to include a battery electric vehicle, a hydrogen fuel cell electric vehicle or plug-in hybrid electric vehicle.

Is the FBT exemption available for salary packaging arrangements?

Yes, the FBT exemption will be available for eligible electric cars provided to employees under salary packaging arrangements, as long as all the relevant conditions for the FBT exemption are satisfied.

Is the provision of an eligible car a reportable fringe benefit?

Yes, the car benefit will be a Reportable Fringe Benefit and thus considered in determining eligibility for certain tax offsets and means tested benefits and liability for certain Government charges.

FBT exemptions for low emissions vehicles

Typically, the FBT car benefit is valued based on the statutory formula method. This statutory method is applied by allocating 20% of the car’s base value to determine the car benefit.

However, from 1 July 2023 employers do not pay FBT on eligible electric cars and associated car expenses for novated leases on EVs and PHEVs which are under the luxury car threshold of $84,916. The new regulation makes the EVs novated leasing (or company cars) an enticing offer.

Whilst the new tax ruling is beneficial for the employer, (as they typically pay the FBT) aiding their transition to a green fleet and saving on vehicle FBT. The employee is left to wear the impact as a result of higher EV prices, meaning that the employee will be relatively worse off at the end of the financial year.

An individual repayment income is composed of taxable income plus any total net investment loss, total reportable fringe benefits amount (RFBA), reportable super contributions and exempt foreign employment income.

Reportable FBT impact on HELP repayments

To illustrate the impact on the reportable tax fringe benefit, we have provided two examples:

Example 1 – Higher Education Loan Program (HELP) repayment by an individual

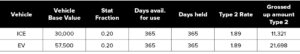

The calculation below was performed using the Grossed-up amount Type 2 (as the individual will not be entitled to a GST).

We researched 20 EVs which are under the threshold of $84,196, and the average price of these EVs was $57,500. We picked a comparable ICE vehicle that represents the same segment and market position with a driveaway price of $30,000.

In both cases we kept vehicles held throughout the year, and always available for use to the taxpayer.

Source: ATO.gov.au, Pitcher Partners calculations

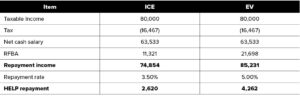

We then analysed how the price disparity would impact a salary of an individual making $80,000 per annum who is repaying HELP, as this amount is representative of an average HELP re-payer.

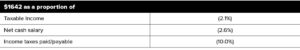

HELP is repaid based on the repayment income and the associated rate given by the ATO. This results in the difference between the ICE vehicle and the EV of $1,642.

That means that an individual with an EV instead of an ICE vehicle would have an impact of $1,642 per annum reduction in take home pay at tax time.

Example 2 – a family with childcare benefit

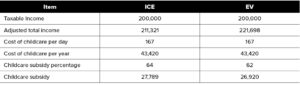

A family, with a combined income of $200,000, living in Sydney Metro, and that sends their child 5 days a week to childcare, would expect to pay in excess of $43,000 per annum.

The family would be $868 better off with the ICE vehicle than with the EV vehicle.

This isn’t an article bashing the price of EV’s. In fact, the quicker the price disparity disappears, the better this will be for individual family taxpayers. However, with the rising interest rates, the current high inflation, and the discontinued tax offsets for low to middle income earners, this new tax ruling would primarily benefit the employer, leaving the employee in a worse position than they might expect. Employers transitioning to green fleets need to be aware of this and be open to finding ways to make sure employees are no worse off.

The bottom line is that the introduction of this ruling benefits the employer by having a greener fleet, but the average middle-income earner will find it even harder to meet their monthly expenses.