The Budget proposed no changes to the personal income tax rates, however, the Government has announced exemptions from the Medicare Levy for lump sum payments in arrears.

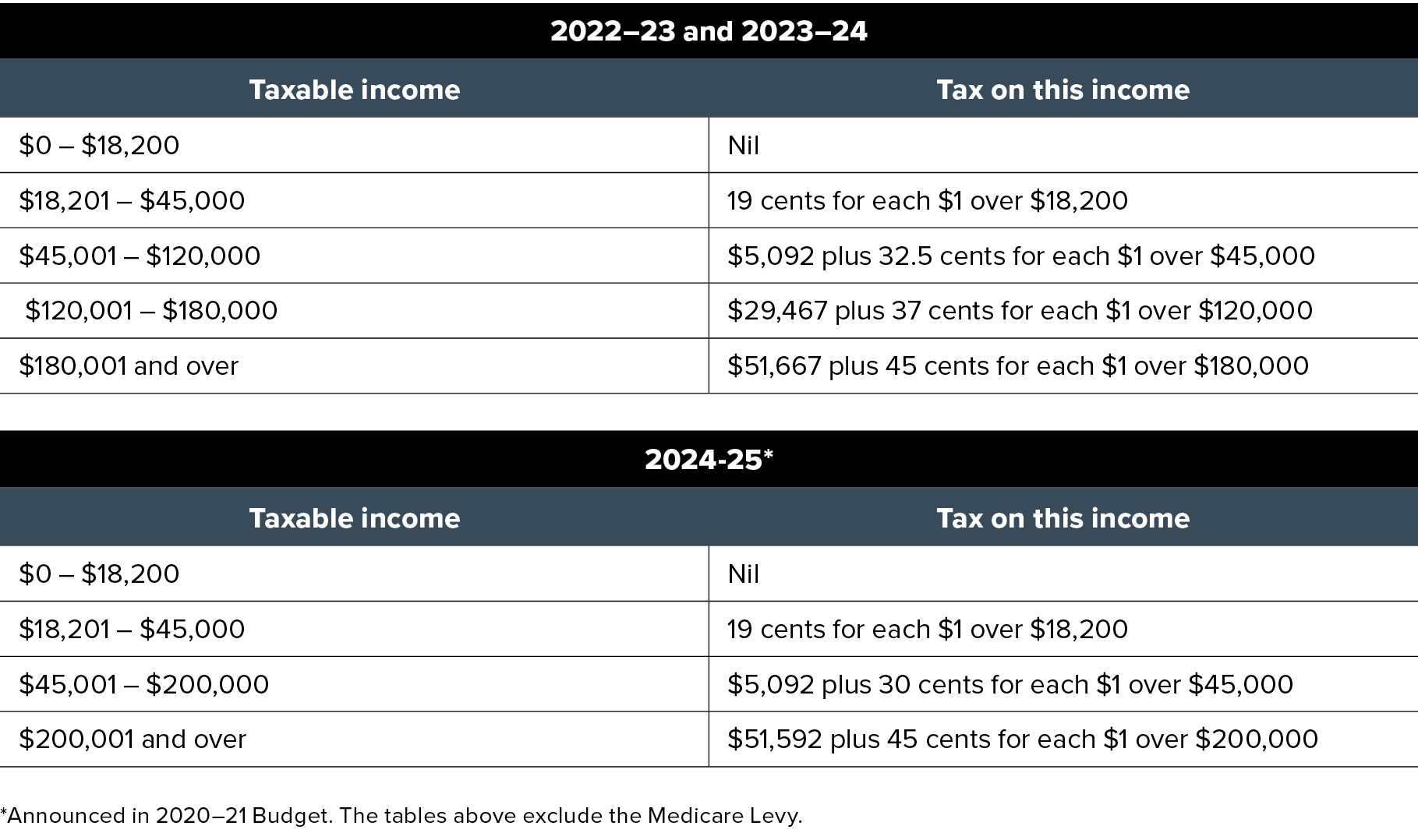

There have been no changes to the personal income tax rates for the 2022-23 income year or for subsequent years. The proposed changes in tax rates (including the Stage 3 tax cuts announced in previous budgets) are contained in the following table.

Lump sum payments in arrears to be exempt from Medicare Levy

The Government announced that lump sum payments in arrears received on or after 1 July 2024 will be exempt from Medicare Levy. Together with the existing lump sum in arrears tax offset, this change is intended to ensure taxpayers who receive a lump sum payment of income (e.g. back pay) are not disadvantaged.

Medicare Levy low-income thresholds

For the 2022-23 income year, the Medicare Levy low-income threshold for singles will be increased to $24,276 (up from $23,625). For couples with no children, the family income threshold will be increased to $40,939 (up from $39,402). For each dependent child or student, the family income threshold will increase by $3,760 (up from $3,619). For single seniors and pensioners eligible for the seniors and pensioners tax offset, the Medicare Levy low-income threshold will be increased to $38,365 (up from $36,925). The family threshold for seniors and pensioners will be increased to $53,406 (up from $51,401).