The key macroeconomic conditions that will provide headwinds for dealers in the next 12 months have been identified.

These include:

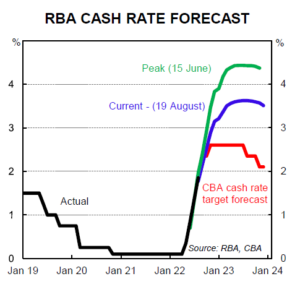

1. Interest rates on the rise

The availability of cheap consumer debt over the last eight years has driven a surge in house prices and contributed to significant increases in home loan debt and average loan size as well as car finance. As interest rates increase and historically low fixed rates mature in the next 6-18 months, the effect on discretionary spending will see a downward pressure or demand for new vehicles. The first interest rate rise in this current cycle was in May 2022. It typically takes 6-9 months before interest rate movements flow through to the general economy. We are only now starting to feel the impacts on demand and higher costs.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

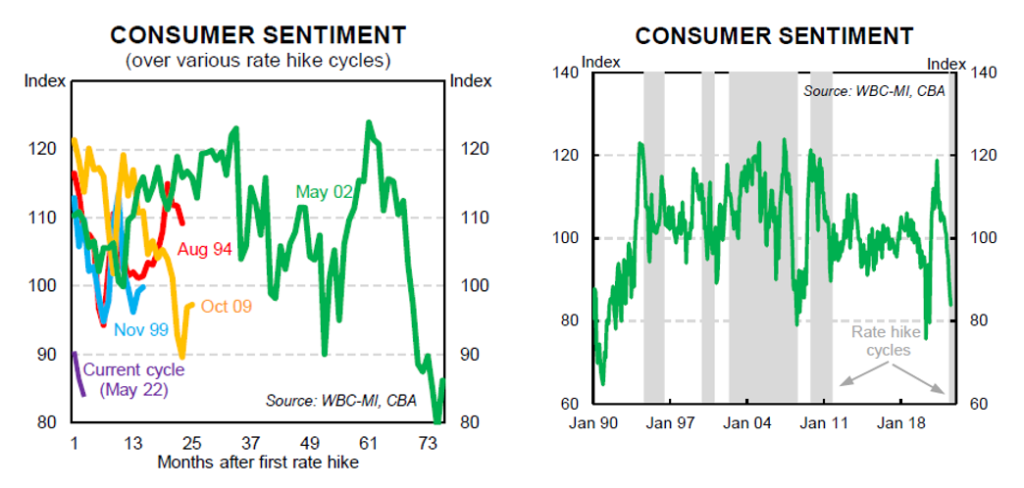

2. Consumer sentiment

Australian consumer sentiment is already below the bottom of that experienced during interest rate rises due to inflation in 1994, the dot come bubble of 2000 and the Global Financial Crisis in 2009. This is a lead indicator to predicting significant headwinds in future trading periods.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

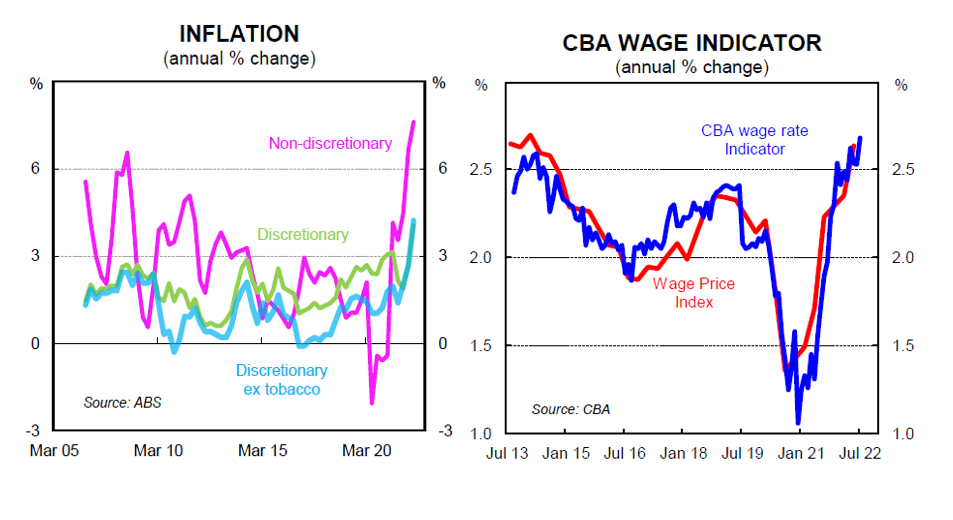

3. Inflation & Wage growth

In his statement regarding the September 2022 cash rate hike, the RBA governor said that its central forecast is for CPI inflation to be around 7.75% over 2022, above 4% over 2023 and around 3% over 2024. CBA1 expects headline inflation to peak at 6.5% in Q3 2022 before reducing to within its inflation target whilst wages growth will lag at 3.25%. With real wages in decline, new vehicle sales are one of the first items to be impacted as consumers rein in the purse strings. This provides opportunities for dealers who pivot to used cars to maintain volumes as the consumer behavioural shift takes hold.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

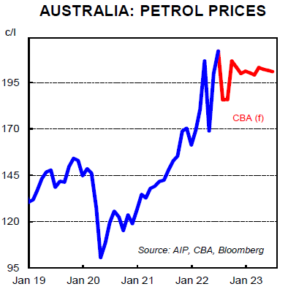

4. Fuel Prices

Ongoing conflict in the Ukraine has inflated oil and gas pricing, and therefore fuel prices. Without a resolution to the conflict or relaxation of trade sanctions, petrol prices can be expected to remain high as global demand is stretching supply chains and resources.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

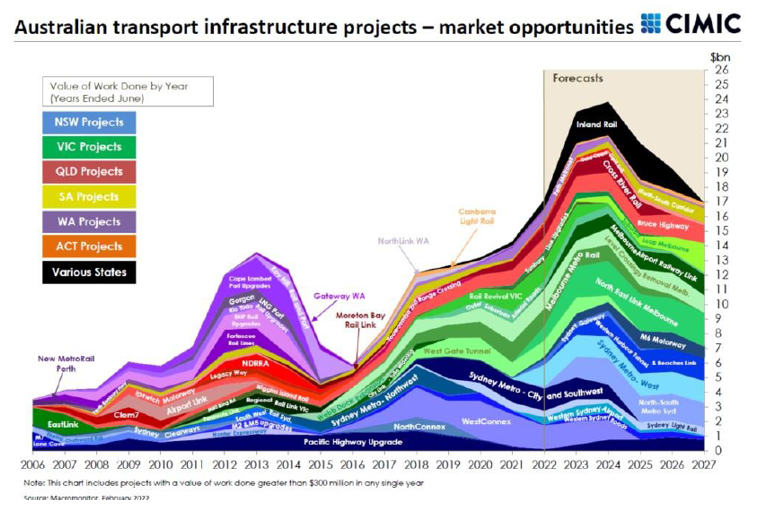

5. Infrastructure Spend

State and Federal governments have committed to significant infrastructure programs across the country. This government spending will underpin the economy and provide a baseline of activity, its intended purpose during times of uncertainty. This spending is not expected to peak until 2024, and therefore any downturn in private new car sales can be offset by fleet and rental customer volumes.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

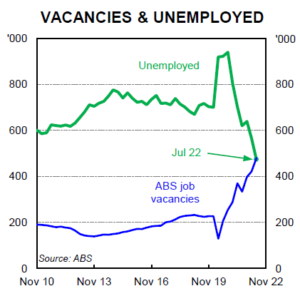

6. Employment

Unemployment is a lag indicator, typically we only see movements in unemployment 6-12 months after the economy shifts. Low unemployment is a double-edged sword for retail. While it drives vehicle sales, it also drives up wage costs impacting profitability long after demand has receded.

Due to constricted migration, Australia labour market is currently at its inflection point where there are more job vacancies than available people. A result of this will be higher than average wage growth as companies compete for talent. This tension will not ease until overseas migration returns to pre-COVID levels.

Source: Commonwealth Bank of Australia “Inflation, interest rates and what happens now”.

Return to Australian retail automotive industry hub