With the new car sector of the car sales market constantly evolving and not always in the best interests of dealers, the opportunity is in used cars.

From making up a large segment of the Australian car sales market to a smart way to bypass the supply chain issues plaguing the Original Equipment Manufacturers (OEMs), used car sales offer dealer groups more control over their marketing, growing their customer database, and sales. Keep reading to learn about the factors that make used car sales a promising opportunity for dealers.

Four key traits make used car sales commercially appealing

While some dealer groups lost focus on used cars over the past 30 years, with all their attention on new car sales, the autonomy and profit potential of concentrating your dealership around used cars now acts as the platform for the best-practice dealer groups. This is because used cars offer four distinct traits that new car departments lack.

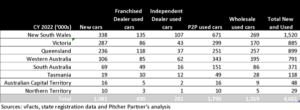

- Bigger opportunity: The used car retail market is almost 2.5 times the size of the new car market and 3.6 times when you include wholesales (see Chart 1).

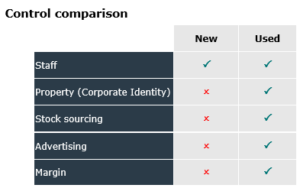

- More control: Used car sales give dealers more control and autonomy over their business (see Chart 2), allowing them to choose where to invest, when to invest and the payback period of the investment. Further, dealers can choose to stock cars that sell, not what the OEM prescribes.

- Better verticals: Used cars come with a significant opportunity to sell insurance products, aftermarket additions, internal combustion engine (ICE) servicing, and finance.

- Building brand value: Dealers selling used cars have the opportunity to build a brand around their business and unique product and service offerings rather than having to follow marketing guidelines set by the OEMs.

Chart 1: Used car sales in Australia – 2022 calendar year

Australia’s total used car market is about 3.6 million vehicles a year, around 2.5 million more than the new car market. The holy grail for car retailers is carving into the share of the private-to-private used car market, which represents about 1.8 million vehicle sales a year alone.

Chart 2: Control comparison between new and used cars

Chart 2 compares the parts of the business that used car retailers have control over compared with the hold OEMs have over them in the new car trade. Unlike a dealership that sells new cars, a dealership focused on selling used cars is free to create its own branding and reputation via the quality and type of vehicles it selects for stock. This means the business can choose to stock the vehicles that are currently selling and popular in the market at the time, decide on advertising spend, and balance stock returns through its pricing. With autonomy over these crucial aspects of growing a car dealership, the benefits flow into larger profit margins too.

Develop a plan to capitalise on the used car market opportunity

Like any other business opportunity, you must approach it with a plan that is supported by data and facts. Dealers need to build a business plan with financial models, marketing plans, used car supply security, demographic and sales data to determine stock holding, physical site locations, staffing, dealer management system, customer relationship management system, and timelines to execute everything.

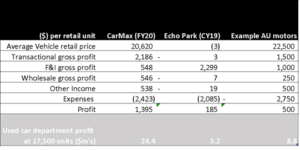

By taking the time now to set up everything properly, you can build your own brand and tap into the infrastructure and skills that already exist within your business. For example, look to international used vehicle concepts that translate high volumes to profitability successfully. Chart 3, below, details how CarMax, the first used car superstore established in Richmond, Virginia in 1993 and another dealership in Echo Park in Los Angeles, California, operate and its impacts on profit margins. As two successful but very different models in executing the used car only concept, the below can be used as a guide as to how the best operators perform.

Chart 3: Example: used car business models profit and loss

Notes:

- CarMax – year ended February 2020 utilised to exclude the pandemic used car trading anomaly.

- Echo Park – year ended December 2020 utilised to exclude the pandemic used car trading anomaly.

- Target 0.5% market share of total used car market of 3.5 million units, or 17,500 units.

The above sample for Example AU motors is an Australian used car concept modelled on the following assumptions:

- Average vehicle retail price of $22,500. This would be variable based on localised circumstances. However, the transaction price needs to be in the volume sweet spot for used cars.

- Transactional gross profit of $1,500 per unit is lower than the industry standard to encourage volume sales and high stock turnover to drive the velocity return on investment model.

- Finance and insurance are estimated at 40-50 per cent penetration rates at $2,000 per contract.

- Wholesale gross and volume are assumed to be an 80/20 retail to wholesale ratio.

- Expenses include all operating expenses and interest.

- 17,500 units would be spread over up to 10 sites delivering 150 units per month.

Get expert advice to seize the used car sales opportunity

With a profit of $8.8 million on selling 17,500 units, the Example AU motors case above demonstrates the powerful opportunity of building your business around used car sales. But before you leap into building your own used car brand, you should consider the challenges too. You need to rebuild your brand and develop strong sales and marketing systems, which can take time. While shifting your business to a used car only sales model can be challenging, the autonomy, ability to build a longstanding independent brand, and potential profit make the journey worthwhile.

If you would like help to develop a used car only concept profit and loss and a sustainable business model, Pitcher Partners experts can support you during this phase of change and growth.