Sydney investment advice | The information in this article is current as at 1 July 2022.

Part 1: Overview

Monetary policy

The Reserve Bank of Australia (RBA) shifted its policy stance materially during the June quarter with two rate hikes of 0.25% and 0.50% to take the cash rate to 0.85%. This was despite wage inflation not yet reaching its pre-conditioned target of 3%, following confirmation of wage growth pressure from industry in its business liaison discussions.

Key factors to its shift according to Governor Lowe included;

- The economic recovery occurring at a speed greater than the RBA had anticipated, and

- Inflation being too high (5% year-on-year to March 2022) with a belief that it would hit 7% by year-end (an increase of 1% on its earlier 6% forecast).

It remains uncertain how far the RBA might go to curb inflation, but it is likely that the cash rate will rise to at least 2.5% based on recent guidance. The RBA believes that it can tighten further without causing a recession due to the financial strength of Australian households backed by stronger wage growth (though we’d note in aggregate this is lagging inflation) and high savings ($250bn relative to normal levels1) thanks to strong fiscal stimulus in response to the coronavirus pandemic since 2020.

Higher interest rates will:

- Slow economic growth by reducing credit growth as borrowing becomes more costly. Higher mortgage rates reduce the propensity for households to spend.

- Support the value of the Australian dollar, pressuring exporter earnings but supporting household purchases.

- Increase returns for savers with term deposit and savings rates repricing higher.

Growth

The Australian economy has continued to grow above expectations since the start of the year. Despite media reports of impending gloom, leading indicators including the Markit Composite PMI, continue to show strength in both manufacturing and the services sectors. Hospitality in particular is benefiting from a broader “re-opening trade” as spending shifts from goods to services. Business sentiment and investment intentions also remain above long-term averages2.

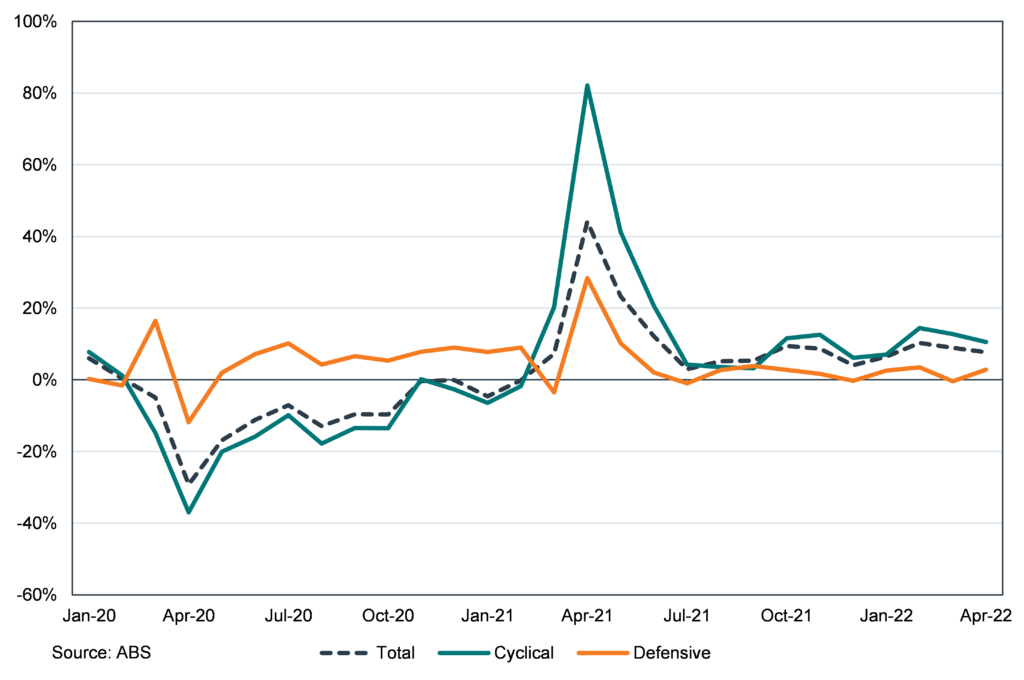

Annual growth in household spending by type of sector (Jan-20 to Apr-22)

Nevertheless, while household spending has been elevated, consumer confidence has collapsed and now sits at its lowest level since August 2020 (when Victoria entered its “second wave” lockdown). The negative sentiment is a by-product of rising inflationary pressures, fears over higher interest rates and the broader impact on the economic outlook.

High levels of savings are helping act as a buffer, but it is only a matter of time before discretionary spending starts to slow. Another hit to household spending will arrive in October when the fuel excise cut under the previous government is due to end.

Inflation

We see inflationary pressures persisting in Australia. The four main drivers at present are:

- Fuel and electricity costs – driven by surge in energy prices and adverse weather conditions (increasing demand for heating).

- Housing – mix of rising rents and higher costs for housing construction (new purchase costs up 13.7% in the year to March 20223) as the industry continues to see commodity shortfalls and shortage of workers needed to address the backlog from the Commonwealth’s Homebuilder initiative.

- Supply chain pressures – these remain elevated globally and are contributing to pressure on business logistics with more costs being passed on to end consumers.

- Wage growth – a tighter labour market (falling unemployment) means fewer surplus workers available for businesses, putting upward pressure on wages to attract and retain staff.

Importantly though, there remain some constraints on inflationary pressures here that are less evident in other countries. Wage growth in particular is not accelerating as strongly as the US, with Australian wages growing only 2.4% for the year to March 20224. News such as the recently agreed 5.2% increase to the minimum wage5 will play a part in pushing wages higher.

The major change since the March quarter has been the escalation of gas price pressures particularly in the East Coast states (Western Australia benefits from less demand and a gas reservation policy). This has seen the Australian regulatory body (AEMO) directly intervene in electricity markets to ensure sufficient generation is maintained.

Taken together, these form an outlook for materially higher inflation in the near term with the RBA predicting 7% by the end of 2022. The extent that RBA rate hikes slow down this acceleration remains uncertain but is likely to be more acutely felt in 2023 after excess household savings are wound down.

Conclusion

Australia continues to track well in economic terms with above-trend growth likely to persist over the second half of 2022. The outlook beyond this is less clear. The drags of higher inflation, higher interest rates, limited government fiscal spending and weak consumer sentiment pose material challenges. We would expect these to weigh on growth in 2023 as household excess savings start to erode and global economic challenges feature more prominently.

Upside risks for Australia include an uptick in Chinese economic stimulus (spurring resource demand and investment), the boost from business investment spending if it keeps in line with current plans and an earlier conclusion to the Russia-Ukraine conflict that should support lower energy prices.

Part 2: Key economic indicators

| Indicator | Last reported result | Comments |

| Growth (GDP)6 | 0.8% q/q Q1’22

3.3% y/y Q1’22 |

The Australian economy continued to rebound after its third largest contraction on record in the third quarter of 2021, with a 3.4% rise in the December quarter followed by 0.8% growth in the first quarter of 2022. The solid reading was underpinned by household and government spending, following the easing of COVID-19 restrictions. |

| 12-month outlook: | The economy is likely to continue to grow moderately over the second half of the year before persistent inflation, higher interest rates, and lower disposable incomes precipitate a slowdown in 2023. | |

| Retail trade6 | 0.9% m/m Apr’22

9.6% y/y Apr’22 |

Retail trade remained sold in April, underpinned by turnover at cafes, restaurants and takeaway food outlets (19% higher than pre-pandemic levels). |

| 12-month outlook: | Retail sales are likely to remain solid in the near term but face headwinds in 2023 as rate rises impact discretionary spending. | |

| Manufacturing PMI7 | 52.4 May’22

53.2 Feb’22 |

The Australian Industry Group (AIG) stated that the Performance of Manufacturing Index (PMI) declined 6.1 points over the month and continues to indicate an expanding manufacturing sector. |

| 12-month outlook: | The manufacturing sector should continue to remain solid, but risks remain around price inflation, labour shortages and supply-chain disruptions. | |

| Business investment (Private New Capital Expenditure)6 | -0.3% q/q Q1’22

4.5% y/y Q1’22 |

Private new capital expenditure declined over the quarter as spending on building and structures fell by 1.3%. |

| 12-month outlook: | The outlook for business investment is likely to remain supported by a strong infrastructure pipeline, although the uncertain global economic landscape tempers optimism. | |

| Unemployment6 | 3.9% Apr’22 | The unemployment rate remained unchanged in April as 4,000 individuals were added to the workforce. |

| 12-month outlook: | Over the remainder of 2022, the unemployment rate is likely to rise slightly from current levels as interest rate rises cloud the domestic outlook. | |

| Inflation6 and interest rates | Inflation:

2.1% q/q Q1’22 5.1% y/y Q1’22 |

The Consumer Price Index (CPI) rose solidly in the first quarter, underpinned by higher dwelling construction costs and fuel prices. |

| Interest rates:

0.85% Cash Rate Jun’22 |

The RBA raised the cash rate by a larger than expected 0.50% in June on expectation that inflation will rise to 7% by the end of the year. | |

| 12-month outlook: | Inflation risks are likely to continue to increase as a result of persistent supply-side bottlenecks and energy price inflation. With consistent inflation readings above the RBA’s upper bound likely to continue, further interest rate rises are expected over the remainder of the year. | |

| Australian Dollar | AU$1 = US$0.69 | The Australian Dollar declined over the quarter as central banks across the globe tightened interest rates in a bid to reign in soaring inflation. Fears of a slowing global economy have also acted as a headwind, partially offset by the highest terms of trade on record. |

| 12-month outlook: | We expect the Australian dollar (AUD) to remain supported around current levels as commodity prices remain strong by historical standards, notwithstanding risks to the global economic outlook and higher relative interest rates in the United States. |