Navigating the Peaks: Bonds vs. Cash in a Monetary Cycle

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 01 October 2023

As we find ourselves close to a peak in the monetary cycle, it’s crucial to assess the best strategies for managing your investments.

One critical decision within the income component of your portfolio is around the allocation between bonds and cash at this point of the cycle. In this article, we will delve into the role and benefits of allocating to bonds compared to cash during these peak times.

The Reserve Bank of Australia (RBA) has started to signal the end of its rate-hiking cycle, which is a significant market indicator. This is especially important given that highly leveraged economies like Australia are susceptible to global economic slowdowns.

The perils of cash in a fast-repricing environment

While cash is often considered a safe haven investment, it’s essential to recognise its limitations during peak monetary cycles.

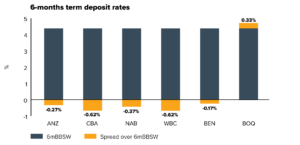

With central banks nearing the end of their tightening cycles and concerns about a global economic slowdown increase, the anticipation for rate cuts will grow in the financial markets. This means that banks will proactively reduce the rates on their cash instruments, such as savings accounts and term deposits, to be in line with market expectations, ultimately leading to lower income for savers.

A recent slowdown in credit growth further exacerbates this dynamic as banks simply do not need to raise as much funding from term deposits. This is demonstrated in the below chart which shows that banks are offering margins below the reference rate for new term deposit rates.

Source: bondadvisor

In contrast to the declining returns from cash, the value of bonds rise on anticipation of rate cuts, and they can continue to offer relatively higher coupons. The reset of bond yields during the rate-hiking cycle has brought yields in some markets to levels not seen since the Global Financial Crisis, with some US Government bonds now yielding over 5%.

Here’s another important point: bonds can also make you money through something called interest rate duration. This means that the longer you hold a bond, the more you benefit from the expectation of lower rates. Let’s take the example of a bond which has an interest rate duration of five years, bondholders benefit from a 5% in price appreciation for every 1% of rate cuts anticipated by the markets.

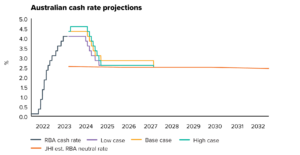

Many leading indicators such as inverted yield curves, tightening bank lending standards, slowing of mortgage applications, and weakening labour markets have historically been precedents for a recession in several countries and will weigh on rate projections priced into the bond market. The below chart displays the cash rate projections for Australia which points towards a normalisation of rates in the near future. It is therefore essential to consider such dynamics when constructing a cash allocation within an investment portfolio.

It’s important to note that while our current recommended investment tilts retain an overweight cash position, it largely accommodates our underweight recommendation on the equity and property asset classes, patiently waiting for more appealing deployment opportunities. Furthermore, we recently moved to an overweight recommendation on the fixed income asset class.

Source: Janus Henderson

The role of bonds in a monetary cycle

Bonds are often regarded as a stabilising force in investment portfolios, especially during periods of economic uncertainty or shifting monetary policies. When central banks reduce rates, it typically has the following effects on bonds:

- Income stream stability: Bonds provide a fixed interest rate, known as the coupon rate, which remains constant throughout the bond’s life. This ensures a stable and predictable income stream for bondholders.

- Price appreciation: As investors anticipate central banks will reduce rates to support the economy, the prices of existing bonds tend to rise. Investors can benefit from capital gains, resulting in potential profit opportunities.

- Portfolio diversification: Bonds can act as a valuable diversification tool within an investment portfolio. When central banks cut rates, equities and other riskier assets may experience increased volatility. Bonds, with their relative stability and income generation, can provide a counterbalance, reducing overall portfolio risk.

Both cash instruments and bonds face reinvestment risk when rates are falling. This risk is caused when proceeds realised or paid from higher yielding bonds need to be invested back into a lower interest rate environment. Cash instruments tend to be more vulnerable in this environment as unlike bonds, they have no additional ‘spread’ in returns and very little to no duration, thereby providing no opportunity for capital gains. Ultimately, timing the bond market is challenging, so a balanced approach can help spread risk and capture more favourable rates over time.

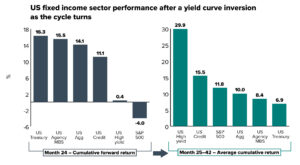

While every monetary cycle can produce various outcomes on the performance of each asset class, the below historical sector performance in the US, following the peak of each monetary cycle, can be used as a guide. It essentially shows that bonds outperform the rest of the sectors in the first 24 months after a yield curve inversion, largely benefiting from the appreciation in bond prices as the cash rate is cut lower in order to support the economy.

Source: Neuberger Berman

What if interest rates went higher?

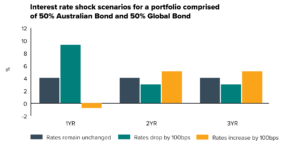

Bonds are now carrying higher coupons and pay more interest, which means investors receive a larger cash flow from these bonds. As a result, the higher cash flows from higher-coupon bonds help offset the potential price declines caused by rising interest rates, making them less sensitive to interest rate duration risk. It’s worth noting that floating rate securities can also benefit when interest rates rise as the coupons will be reset with a higher reference rate, ultimately increasing the income potential and limit price volatility.

The below chart provides the indicative performance for a bond portfolio under multiple interest rate scenarios. The bond portfolio includes domestic and global bonds. We can see that bonds now carry enough interest to offset the price decline if rates went up by another 1%.

Source: PIMCO

In conclusion, we believe bonds can be a more favourable investment option than cash as we transition past peak monetary cycles, when investors anticipate central banks to cut interest rates to support their economies. Bonds offer stable income streams, potential for price appreciation, portfolio diversification benefits, and a degree of risk mitigation against declining income on cash instruments.

As always, your Pitcher Partners Adviser is available to discuss how you can navigate the peaks of the monetary cycle with confidence and make the most of your investment opportunities.