Investment Markets in Review – Q3 2023

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 01 October 2023

The third quarter ended weaker, despite a promising start to markets in July, as central banks began re-affirming their commitment to combatting inflationary pressures.

Several prominent central banks, such as the US Federal Reserve, Bank of England and the European Central Bank all raised rates in the quarter, while the RBA held firm.

Inflationary pressures across most economies continued to ease, albeit at a slower rate. Inflation proved to be stubborn in most developed economies, with inflation data ticking up slightly in August, causing some concern in markets. US headline inflation ticked up in August, from 4.7% to 4.9% year on year, with the US Fed reacting by raising rates further.

US Fed Chairman, Jay Powell, in his eagerly anticipated Jackson Hole speech, argued that “although inflation has moved down from its peak – a welcome development – it remains too high” and thus signalled to the market that interest rates may yet increase further from current levels. This is despite a majority of economists having predicted that rates had peaked or were close to peaking.

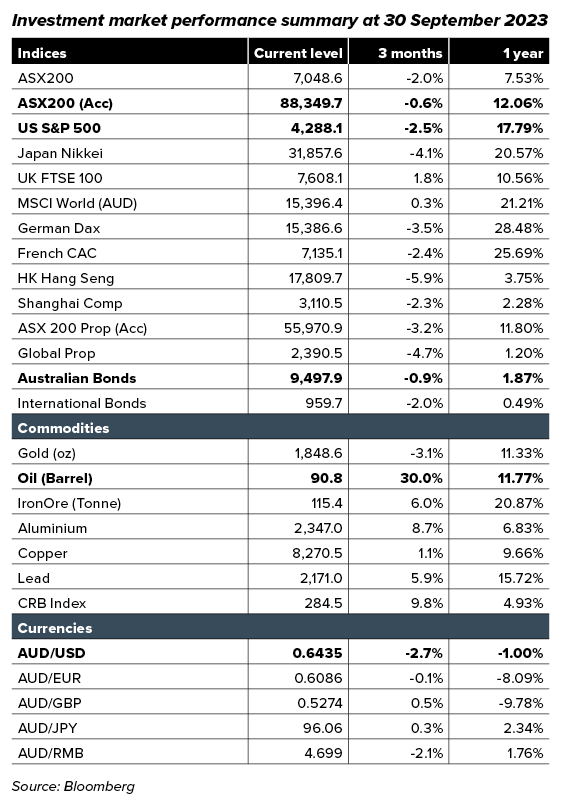

Bond markets reacted to central bank actions displaying higher volatility. Global bonds sold off (-2%), while Australian bonds fared slightly better (-0.9%). The inverted yield curve in the U.S flattened modestly over the period, with the 10yr bond yield rising 76bps to 4.57%. The Australian 10-year bond yield rose to its highest level over the last 12 years, closing the period at 4.52%.

Credit spreads widened due to fears of more restrictive monetary policy affecting growth prospects. These signs of economic slowing weighed more broadly on markets, with increasing pressure on consumer spending habits, particularly among the lower income households. This caused a rise in concerns over the general health of the consumer economy, particularly in the face of continued strong job markets.”

Most asset classes traded weaker over the quarter as a result of the weaker outlook for global growth.

Q3 2023 – Quarter In Review

Equity markets globally drifted lower during the third quarter, with most markets declining. The ASX 200 Accumulation index weakened by 2.0% over the quarter, though outperforming most other developed markets.

The S&P500 lost 2.5%, despite the ongoing strength of a small cohort of stocks which continued to benefit from the ongoing excitement and hype over the AI thematic. The ongoing energy issues in Europe, coupled with persistent inflationary pressures saw European markets underperform, with most sectors displaying weakness.

The more cyclical bellwether north Asian markets, such as South Korea and Taiwan, performed poorly as the outlook for global trade deteriorated further, causing some concern over the health of the global economy. The weakness in China continued, with ongoing foreign selling reflective of a disappointment in the lack of effective stimulus to get the economy back to a solid growth outlook post the Covid re-opening. Further property market woes and a reluctance of consumers to spend have not been helpful.

ASX company reporting during the period highlighted softer guidance and cost pressures being the key drivers behind overall downgrades to earnings expectations in the market. While the resilience in earnings had been highlighted in the final half of the financial year, despite the toughening environment, companies opted for more conservative guidance, which often fell below the expectations of the market.

REITS traded weaker, with the ASX 200 property index losing 3.2%, and underperforming the broader ASX 200. Higher interest rates and concerns over leasing outlooks were the primary concerns in the market.

Commodity markets were stronger during the quarter, with the CRB Index gaining 9.8% for the quarter. Oil was one of the strongest commodities, rising 30% in the quarter with most other commodities posting positive returns (in AUD terms), except gold, which was down 3.1%.

The AUD weakened further, shedding another 2.7% vs the USD, ending the quarter just above 64c.