Investment Markets In Review – December 2022

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 16 December 2022.

Whilst markets are staging a rally late into the year, 2022 has undeniably been a challenging year for investors.

Inflation has proved to be far more pervasive and stickier than what central banks believed less than 12 months ago, forcing many central banks to dramatically increase interest rates to try and address these pricing pressures. The consequence of these outcomes has been the realisation that the global economy has to slow down for these pressures to ease, which when you throw into the mix the war in Eastern Europe, China’s property market and zero-Covid policy implications, the unwinding of the stimulus ‘sugar hit’ from recent years – this has resulted in a widespread re-pricing of many financial markets over the calendar year.

Equities

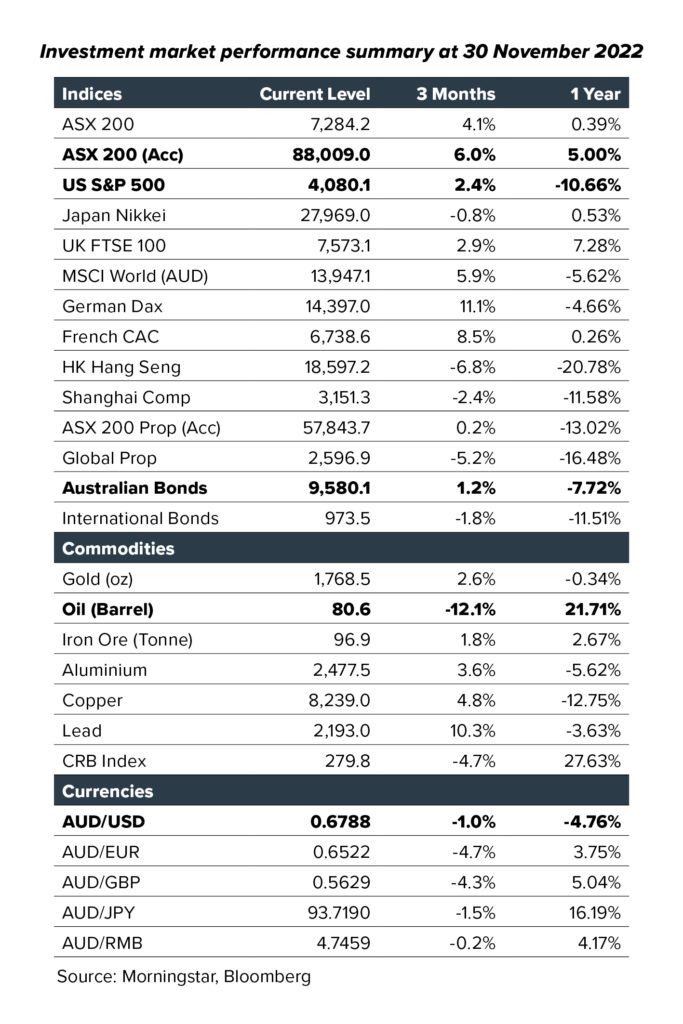

Australian equities turned the tables on its global counterparts this year, producing a positive gain of 5% for the last 12 months, versus -5.6% for unhedged global investors (-8% for currency hedged). Australia’s index composition (greater exposure to banks and resources, lower tech / comms weighting) played a major part in this relative outperformance. Globally, the rapid increases in interest rates posed major challenges for the valuation of technology companies, which helped drag the S&P500 down by 10.7%, while the Nasdaq declined by 24.8%. Europe, despite broader recessionary fears, performed relatively better given its cheaper valuations and a more favourable index composition to sectors such as energy, healthcare and consumer staples. After a steep drawdown during the year, China’s equity market is rallying this quarter in anticipation of a relaxation of its draconian zero-covid policy, which in-conjunction with pressures in its property sector, have resulted in a sharp deceleration in economic activity.

Over the last 3 months, both Australian and global equities returned ~6%, with equities rallying in anticipation of inflationary pressures peaking.

Fixed Interest & Credit

Our local and offshore fixed income benchmarks are set to post their weakest calendar year returns for decades as central banks aggressively raised interest rates to combat surging inflationary pressures during the year. To date, the RBA has lifted our cash rate by 300bps to 3.1% over the course of the year, while the Federal Reserve has lifted its own Funds rate by over 350bps to 4.00%-4.25%!.

Given this almost unprecedented level of monetary policy tightening, our Australian bond benchmark fell 7.5% for the 12 months to 30 November, while global bonds fell 11.5%. Emerging market bonds fared even worse, with the JPMorgan Diversified EM Bond Hdg $A Index declining by 16%. We also witnessed some widening in credit spreads as well in response to the deteriorating outlook for global growth, with the greater weakness evident in offshore markets vis a vis our local market.

Investors that had been positioned in floating rate instruments were well insulated from the broader volatility in fixed rate markets, with a modest 0.6% gain from our floating rate note credit benchmark. Private credit investors generally enjoyed significantly greater returns.

For the last 3 months, local bonds outperformed global (1.2% vs -1.8% respectively).

Property

The listed REIT markets have been sold off aggressively CYTD in response to the higher interest rate settings and their potential impact on underlying asset valuations. The domestic A-REIT market has fallen 13% for the 12 months to November 2022, while our global index fell 16% over the same period.

A big disconnect has occurred between the valuation of public equities versus private assets, with the listed sector trading at one of its widest discounts to its Net Tangible Assets in the past decade. We expect the value of unlisted assets to decline from here, however a dearth of any material transactions in the market – the pricing of which is a key input / component of any asset revaluation, is keeping values higher for now.

Commodities & Energy

Household energy bills are expected to continue rising sharply next year, as soaring coal and natural gas prices from the Russia-Ukraine war push up the cost of wholesale energy, which is then passed on to consumers – despite many Governments efforts to subsidise some of these costs.

Early in December, the G7, European Union, and Australia agreed to a $60 a barrel cap on shipments of Russian oil. Closer to home, the Australian government is currently debating whether price caps on coal should be implemented. NSW Treasurer Matt Kean has pushed back on government proposals to introduce the cap, claiming that; it’s too late to lower the prices, and that states will lose out on royalties. Queensland, which owns its electricity generators, is also resisting price caps on coal and natural gas (they increased the state royalty charges in the year).

Outside of energy, it was a volatile year for many commodities. The profits enjoyed earlier in the year caused by the shortages created by the war in Eastern Europe, gave way to losses as concerns over future global growth took hold, with several base and precious metal markets in negative territory for the year, despite a recent bounce in sentiment.

Outlook

We are now beginning to see some of the peak inflationary pressures start to ease, especially with regard to goods based inflation. On the other hand, tight labour markets are resulting in high labour costs and we expect services based inflation to remain elevated in the near term.

Central banks are expected to continue to lift rates through to March / April 2023, where it is anticipated they will likely pause to gauge their impact on activity, which is expected to trend lower from here as cost of living pressures intensify on households and businesses.

We believe Europe is likely already in a recession at the time of writing. The debate on the U.S economy remains evenly balanced between either an economic ‘soft landing’ or recession. We believe Australia’s economy will continue to grow but at a sub-trend rate in 2023, while China remains a key swing factor in terms of how it seeks to open up and stimulate its economy after its challenges experienced this year.

In looking at individual asset classes, we continue to believe equity investors are being too optimistic in wake of the uncertainty around global growth, but buying opportunities will likely present themselves at some stage in 2023. We are starting to see a lot more value emerge within fixed interest and higher quality credit, listed property markets appear very cheap versus private markets but we are wary of buying heavily into any downgrade cycle. Lastly, we continue to believe Alternatives and cash will provide the most compelling form of diversification in the very near term.

Finally, in what has been a tumultuous year at times, we wish you, your family and friends a very enjoyable, relaxing and safe festive period. It is our privilege to help you achieve your financial goals and we very much look forward to continuing to work with you in 2023.