Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at July 9, 2025.

Rapid advancements in Artificial Intelligence (AI) are now leading to somewhat of a revival across the global Venture Capital (VC) industry. Whilst Fintech, SAAS (software as a service), climate and other sectors remain in focus, AI opportunities across machine learning, workflow automation, generative AI and others are generating significant interest and capital from the investment community.

In recent years however, the industry has suffered a hangover of sorts since the peak of the VC cycle in late 2021. Fundraising has slowed significantly as investors, who had allocated healthily during those boom times, have reduced their future allocations or simply sat on the sidelines waiting for distributions / capital returns, much of which is yet to flow through to investors due to (in part) more challenging exit conditions for Fund investments.

However, the VC sector is evolving, despite these challenges. In this report we outline some of our key observations on the broader global and local VC markets, beginning with an overview of global dynamics.

The global landscape: AI dominance, exit challenges, and a bifurcating market

Globally, venture capital has ridden a rollercoaster since 2021. The exuberance of the pandemic-era boom, with record inflows surging into the sector and the launch of a record number of new fund managers, gave way to a sharp slowdown as inflation surged, interest rates rose, Silicon Valley Bank collapsed and investor risk appetite waned. Record initial inflows were later overshadowed by a lack of liquidity, exacerbating these concerns.

By late 2024 despite some of these challenges remaining (most notably around deal exits), the sector is showing signs of renewal.

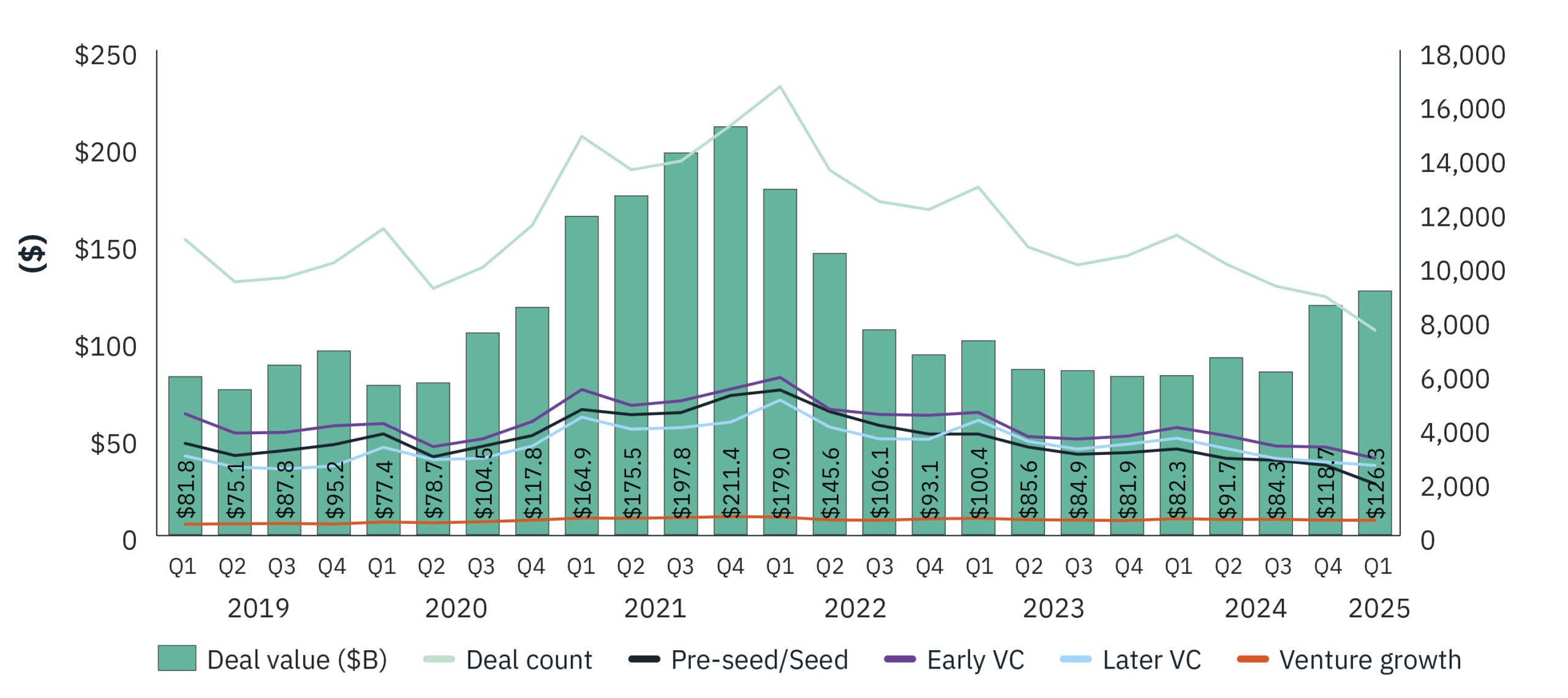

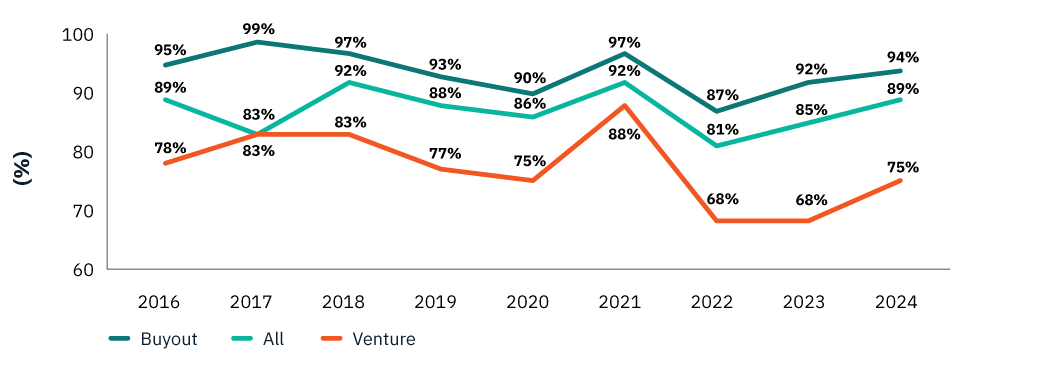

Global venture financing – 2019-Q1’25

Artificial intelligence has become the defining theme. Nearly half of all global VC investment dollars in 2024 flowed into AI startups, with mega-rounds and surging valuations for category leaders (Open AI US$300bn, Anthropic US$61.5bn). Investors see AI as the engine for the next decade’s innovation, akin to being the next ‘industrial revolution’, reflecting the immense opportunity set.

Exit conditions have been a central concern. After years of sluggish IPO and M&A activity, 2025 is only bringing cautious optimism for asset sales. Lower interest rates and improved market sentiment are expected to open the exit window wider, with various industry based surveys indicating approximately two-thirds of global VC fund managers are expecting an increase in exits this year. However, volatility still remains. IPOs remain challenging and many companies are opting for alternative exit strategies, including a greater usage of secondaries (selling units or part of a business directly.)

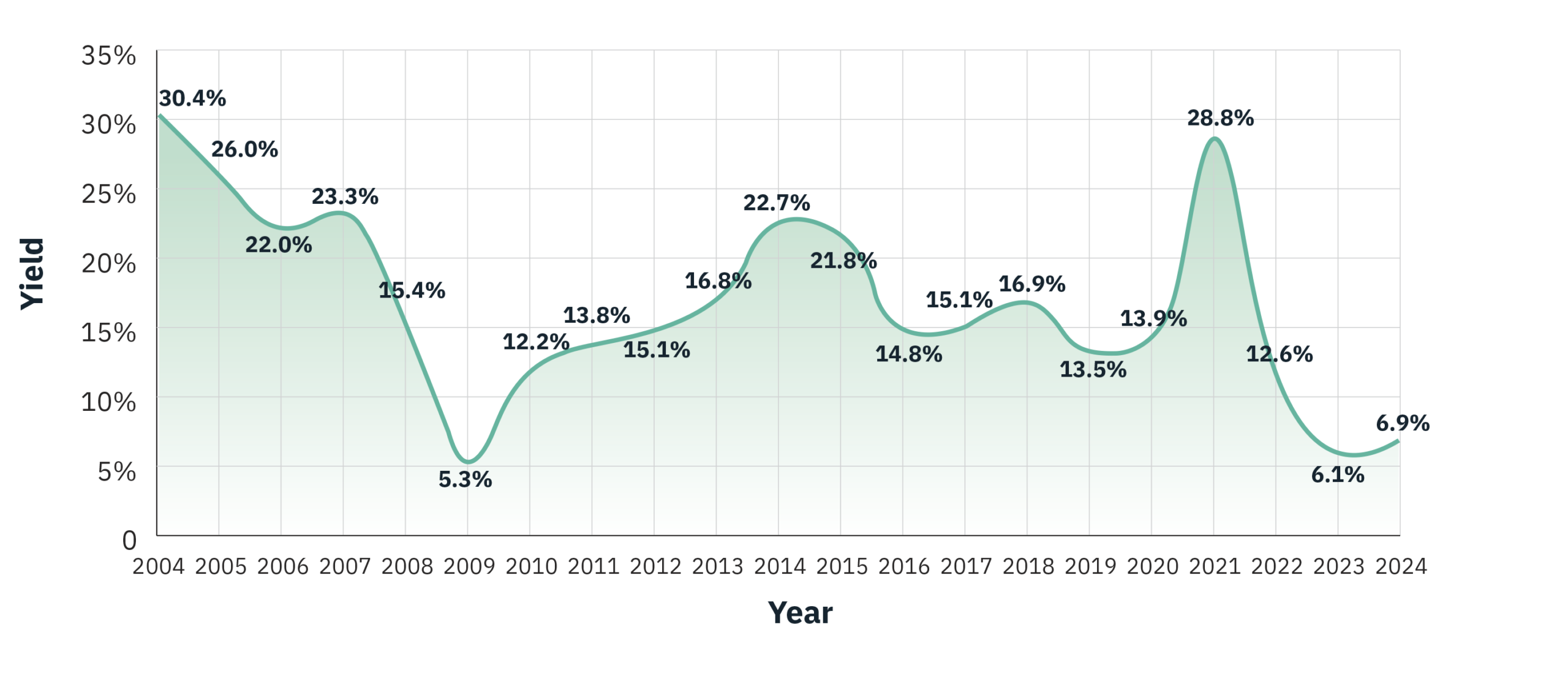

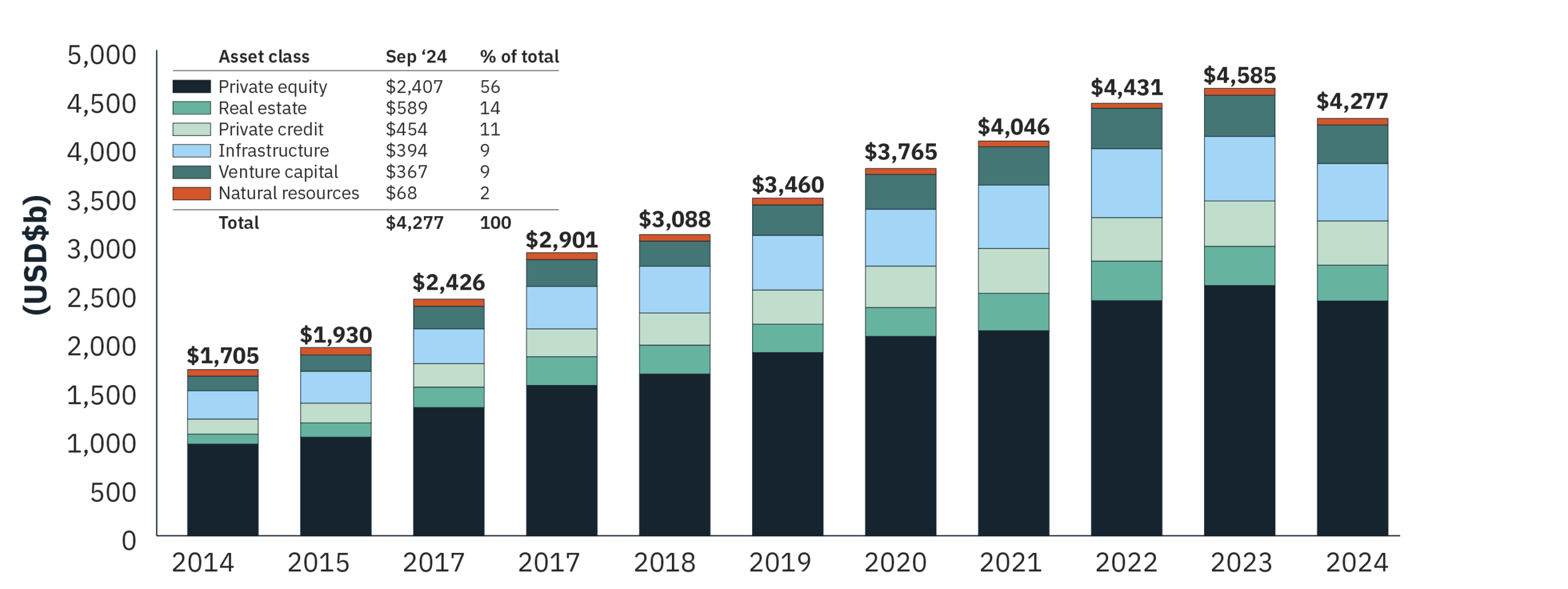

12-month distribution yield as a percentage of NAV

Secondary sales offer potentially faster and more flexible routes to liquidity for both investors and asset managers. There are a few different types of secondary sales. Limited Partner (LP) Secondaries are where existing investors in a Fund seek to sell their units as well as any future fund commitments to another investor – typically at a discount, which in the case of VC, tends to be wider than those seen for traditional Private Equity buyout funds – these discounts vary depending on overall market sentiment and the quality of the assets and Fund manager. ‘GP Secondaries’ are where the ‘General Partner’ i.e the Fund manager, sells part of an asset within the Fund to a new investor, providing liquidity to existing investors in that Fund with the aim of still retaining control of the asset. Sometimes these assets are rolled over into a new Fund typically called a ‘Continuation Vehicle’ which gives the GP far greater flexibility on when to divest the asset into the future.

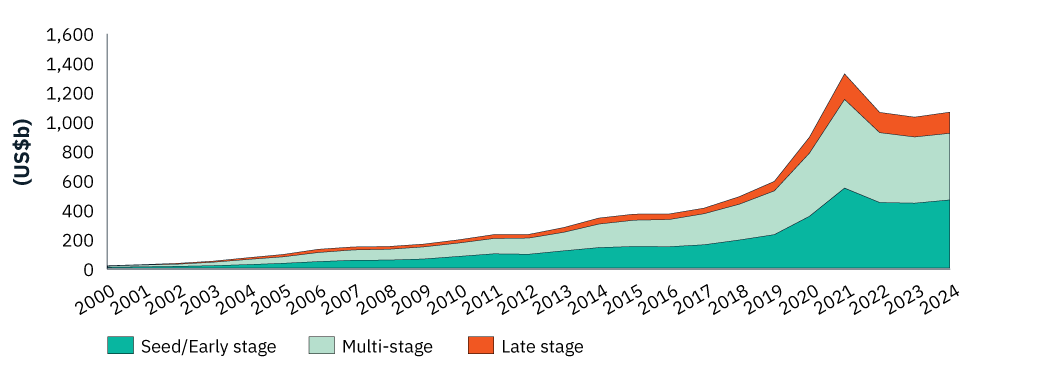

Private markets NAV (US$nb)¹

Attractive discounts in Venture Secondaries²

Valuations and deal structures have recalibrated. The days of easy money and unchecked growth are over. Investors are more selective, demanding clear revenue traction and operational discipline. Mega-rounds are still happening, but only for the most compelling companies, especially in AI and possibly climate tech. This is creating challenges for many smaller VC fund managers, who are effectively being crowded out and are struggling to raise capital and remain financially viable. This is pushing them into investing in earlier funding rounds or into deals where they have only a small, minority holding with little overall influence.

Fund Dynamics and the “Zombie VC” challenge. The clock is ticking for funds that raised capital during the boom years. With tens of billions (estimated – Pitchbook) in dry powder needing to be deployed by the end of 2025, there’s a risk of a flurry of late-stage funding rounds driven more by fund economics (fee capturing) than by business fundamentals – a few recent transactions, including one locally, have generated some unwanted media attention. At the same time, some VC firms are still struggling to raise new capital or deliver returns, leading to fears of a rise in “zombie VCs” – firms stuck in limbo, unable to invest or exit effectively.

Global dry powder by asset class

Total committed but uninvested LP capital, USD billions, end of period

Against this backdrop, we now turn our attention to how the Australian venture capital scene is adapting and evolving.

Australia’s VC market: Riding the global currents, navigating local realities

We begin by first stating that Australia is now a significant and fast growing player in tech and AI startups. Its ‘ecosystems’ are now well advanced and many companies and fund managers have shown they can compete on the global stage. A recent paper produced by the Australian Government Department of Industry, Science and Resources highlighted that Australia actually outperforms other countries on a per dollar invested basis (admittedly some sample bias here) and continues to produce global successes, but the industry faces increasingly fierce competition from larger economies, particularly with respect to A.I, given the scale and pace of investment from nations such as the US and China.

From Boom to Reset. Like the US and the rest of the world, Australia experienced a record breaking boom in 2021, with record capital raising, largest funds and high profile companies (Canva) and exits (Afterpay) putting the local ecosystem on the map. But when global markets cooled, Australia felt the chill. Fundraising dropped by more than half, deal volumes shrank and many startups had to pivot from “growth at all costs” to capital efficiency and sustainability, prompting significant layoffs and much greater capital discipline – actions reinforced by the VC fund managers themselves, who in turn are now more circumspect around capital allocation and governance than a few years ago, with a few notable collapses making the headlines.

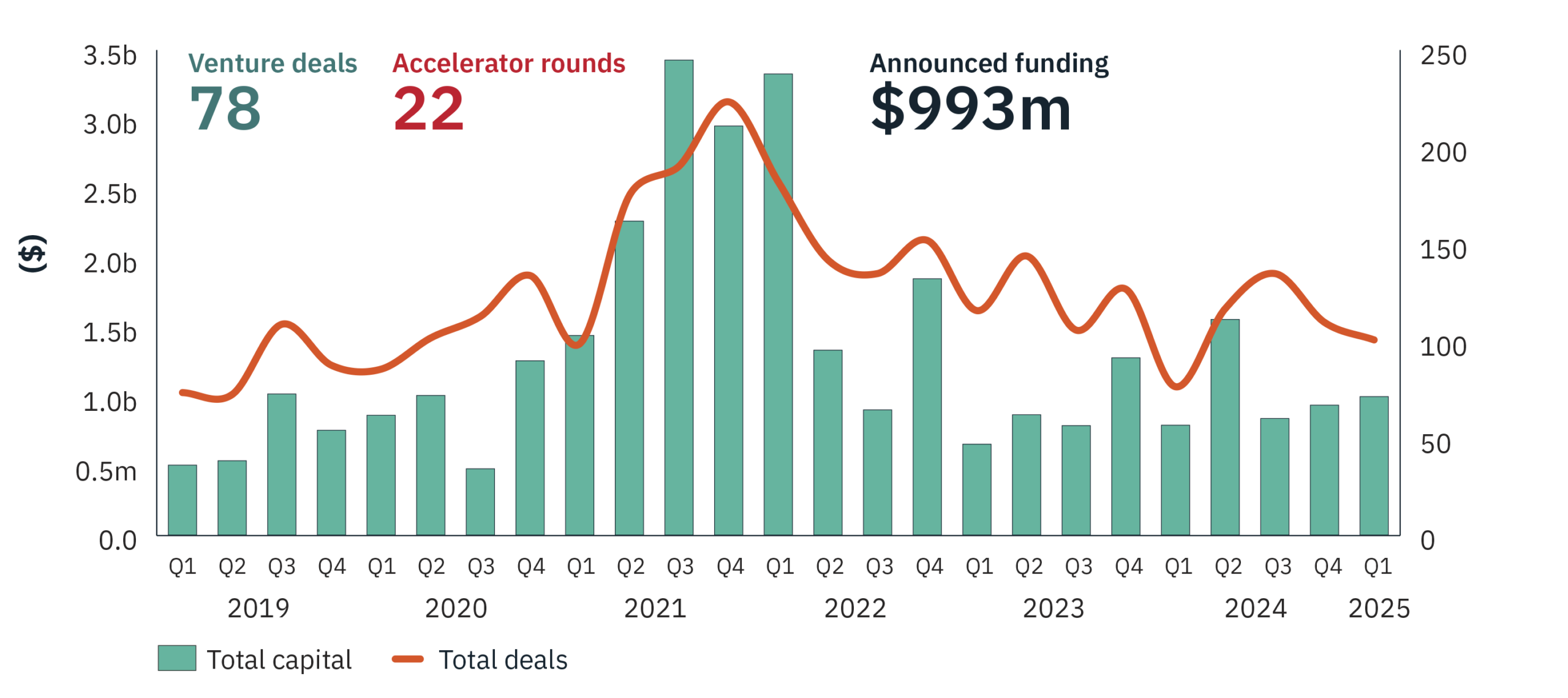

Q1 2025 Headline figures

The AI Effect and sector shifts. The global AI boom is making waves locally too. Australian startups in AI, deep tech, and climate tech saw capital raising lift in Q1 ’25 to the highest level since 2022, across 100 individual deals (Source: Cutthrough Venture). Australian startups continues to attract a growing share of global capital. Several high profile deals have bypassed local VC managers entirely, yet the number of locally funded deals is still growing. Capital allocation from fund managers we have spoken to recently continues to be quite discerning around strong fundamentals and operational resilience, with any ‘unproven’ concept opportunities attracting very low levels of investment.

Greater choice for investors. The surge of global private market managers seeking access to Australian’s wealth markets has resulted in a greater access to offshore VC managers than ever before, typically via 3rd party placement agents rather than establishing a direct local presence. Alongside fund investments, this has also brought with it potential co-investment opportunities into some large high profile funding rounds across AI and Space in particular.

Exit conditions: Thawing, but still tricky. Exits have been a major challenge for Australian VCs, amplifying global trends. The IPO window, especially for ASX listings, has narrowed considerably and trade sales have declined sharply – from 50% of exits in 2022 to just 28% in 2024. Instead, private equity buyouts and secondary sales (partial selldowns) are on the rise.

Since 2021, two of the three largest local VC managers, Blackbird and Square Peg, have actively used secondary sales to generate liquidity from stakes in companies such as Canva, providing long awaited capital returns to investors, despite those companies staying private for longer. Discussions on exits have certainly increased, largely driven by growing pressure from investors. Investors are observing fund managers launch new funds while seeing very little capital returned to them from existing investments. For these investors, actions are speaking louder than words, indicating a clear demand for liquidity before committing to new vehicles.

In aggregate though, as interest rates fall and valuation multiples stay high, exit conditions are expected to improve. Right now, the environment still remains selective, with only the most robust companies expected to achieve successful exits at attractive valuations. A high profile IPO from a company like Canva and/or Airwallex could significantly boost market confidence and set new valuation benchmarks, potentially providing the platform for further widespread transactions. Until such an event occurs, however, we anticipate only piecemeal deals as the ‘staying private for longer’ mantra continues to dominate.

Lastly, to take advantage of this liquidity mis-match, we are witnessing the participation of a greater number of specialist ‘secondary’ asset managers who are willing to provide liquidity to investors (fund managers or individual investors) who wish to fully or partially exit their investments earlier – albeit at a discounted price. We are currently exploring this specialised area within VC/Growth Capital for investment opportunities.

Summary

Australia’s venture capital industry is adjusting after the 2021 boom, with rapid advancements in AI leading to an improved choice and opportunities for investors. Challenges remain in the form of weak exit conditions and we hope to see local VC managers become more innovative and active around returning cash back to their investors.