An integrated storage solution

Pitcher Partners Investment Services (Melbourne) | The information in this article is current as at 1 October 2025

The National Electricity Market (NEM), the combined five regional market jurisdictions of Qld, NSW (including ACT), Vic, SA and Tas), is experiencing a profound structural transformation, with battery storage rapidly moving from a supporting role to the centre of its evolution. As Australia accelerates its transition to renewable energy, the variability of wind and solar generation has created new challenges for grid stability, reliability, and efficient energy dispatch. Battery storage, which includes both large-scale batteries, often called Battery Energy Storage Systems (BESS), and home batteries is emerging as the critical solution to these challenges.

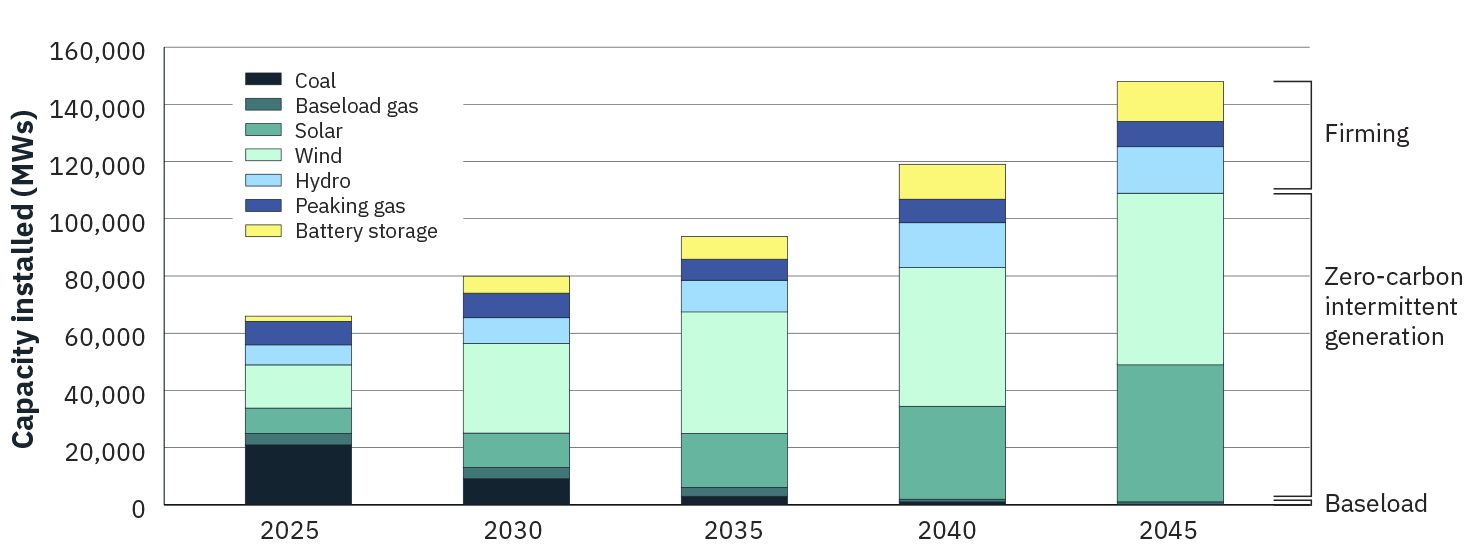

Total energy storage capacity within the NEM currently stands at ~7.4 GWh, which includes both grid-scale and distributed (home and small business) batteries. The rollout is expected to accelerate with projections of 18 GW by 2028 and 43 GW by 2040, according to Australian Energy Market Operator’s (AEMO) Integrated System Plan*. The NEM’s future design, including market reforms, investment schemes like the Capacity Investment Scheme (CIS) and the National Battery Strategy, is built around integrating this storage capacity.

In short, batteries are not just supporting the NEM, they are reshaping it. Without widespread deployment of BESS and home batteries, the NEM cannot reliably operate in a high-renewables future. Their rollout is essential to achieving Australia’s energy transition goals.

‘Firming’ technologies are used to ensure a reliable and consistent power supply by ‘firming’ the variability of renewable energy. These technologies include battery storage, hydropower and peaking gas.

Large-scale BESS are typically installed by utilities or independent power producers at grid or substation level. These systems can store hundreds of megawatt-hours of energy, providing critical services such as frequency control, grid balancing, and “firming” of renewable generation. They help absorb excess solar or wind output during periods of low demand and release it when the grid needs it most, reducing curtailment and supporting reliability.

This grid-scale battery growth is booming, with major “gentailers” (vertical integration of companies operating in the NEM, where generators own a retail arm e.g. AGL, Energy Australia and Origin Energy) investing billions to secure their position in the evolving market. By way of example, AGL dedicated approximately $900 million to battery energy storage systems and renewables in FY2025, progressing several utility-scale projects and targeting a flexible fleet capacity of 8.3 GW. Origin, meanwhile, has committed around $1.7 billion to large-scale batteries this financial year, with a goal of adding 4–5 GW of renewables and storage by 2030.

* AEMO’s Integrated System Plan (ISP) is a whole-of-system 20 year plan that provides an integrated roadmap for the development of the NEM which is reviewed every two years.

Home batteries, on the other hand, are installed by individual households or small businesses. While each unit is much smaller, their collective impact is significant, especially as more homes participate in Virtual Power Plants (VPPs). A VPP is a digitally coordinated network of distributed energy resources, primarily home solar batteries that operate collectively like a single power plant.

VPPs are not just a consumer tool – they’re another strategic asset for gentailers. By aggregating thousands of batteries, these companies can:

- Firm renewable generation

- Participate in frequency control markets

- Reduce wholesale energy costs

- Build decentralised energy portfolios

AGL’s acquisition of Tesla’s S.A. VPP and Origin’s expansion of its Loop VPP are clear signals that VPPs supports “sticky” customers, creates a new revenue stream and supports future growth strategies.

To highlight the importance of this transition by 2030, it is expected that battery storage could contribute hundreds of millions in annual EBITDA for both AGL and Origin. This will be driven by:

- Energy arbitrage in a volatile market (buy renewable power when there is excess and sell into the peak periods of power demand)

- FCAS (Frequency Control Ancillary Services are critical services that maintain the stability of the NEM by balancing supply and demand to control grid frequency) and capacity services

- VPP orchestration and decentralised asset monetisation

- Policy support via the Capacity Investment Scheme (CIS – refer below)

Battery technology is rapidly evolving as noted recently, with RWE Renewables Australia successfully registering Australia’s first 8-hour duration BESS with AEMO. BESS typically utilises lithium-ion (Li-ion) technology with recent advancements driving falling system costs, higher power densities and modularity i.e. long-duration energy storage (LDES). This extended duration enables the system to provide backup during low renewable energy generation or high demand periods, potentially reducing reliance on gas “peaker plants”.

Government regulation along with incentives has also played a key role in the take-up of battery technology.

- The Cheaper Home Batteries Program is a major Australian Government initiative launched on 1 July 2025 to accelerate the uptake of home and small business battery storage. Backed by $2.3 billion in funding, the program aims to make battery systems more affordable and accessible, supporting Australia’s transition to renewable energy and grid resilience. A key feature includes around a 30% discount on the upfront cost of installing a battery system to eligible households, small businesses, and community i.e. for a typical 11.5 kWh battery, this could mean savings of about $4,000.

- The Capacity Investment Scheme (CIS) is a cornerstone of Australia’s strategy to accelerate battery storage deployment. At its core, the CIS provides long-term revenue certainty for investors in BESS as the government guarantees a floor price for dispatchable capacity while capping windfall profits during high-price events. This reduces financial risk and makes battery projects more bankable, especially those with longer durations or located in grid-constrained areas.

- Australia’s National Battery Strategy is a landmark initiative designed to position the country as a global leader in battery innovation, manufacturing, and deployment while supporting the energy transition, economic resilience, and job creation. Essentially the strategy will look to develop end-to-end capabilities from raw mineral processing (leveraging off Australia’s natural advantages in lithium, nickel, cobalt, and copper) to advanced battery manufacturing by 2035.

Battery storage is fast becoming a core earnings engine for Australia’s leading gentailers. With listed AGL Energy and Origin Energy investing billions into grid-scale BESS, VPP’s, and decentralised energy platforms, the ability to stack revenues from energy arbitrage and frequency control to capacity services is transforming battery assets into high-margin earnings contributors. As coal retires and market volatility increases, batteries are expected to replace a significant portion of their legacy EBITDA, positioning both companies for resilient, low-carbon growth.