With the new financial year underway, two major changes to superannuation are likely to impact many retirees to some extent

The first change saw a 50% reduction in the minimum pension drawdown rate, which was introduced during the COVID-19 pandemic to provide financial relief during the market downturn, and the second relates to how the Transfer Balance Cap is indexed.

While neither change requires urgent action, it is important that retirees recognise where adjustments are being made so they can properly manage their retirement savings.

Minimum pension drawdown rate

For the last four financial years, the minimum drawdown rate has been significantly discounted from the 2018-19 rates.

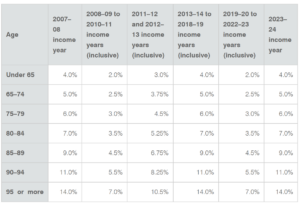

Essentially the minimum rate has been doubled for the 2023-24 financial year, bringing it back into line with 2018-19 rates before the pandemic-induced discount. Retirees now need to draw down twice as much from their super annually which is demonstrated in the below table:

Minimum percentage of account balance factors, by age

The trustee of public offer funds works to ensure this minimum is met but superannuation holders should consider the impact it may have on fund balances. This can help avoid being subject to trustee directed sales, which may result in the unwanted disposal of an asset.

Beneficiaries of self-managed super funds (SMSF) should work closely with their advisors to meet the new minimums by increasing their regular withdrawals or taking a larger ad-hoc income payment.

Also, if retirees don’t meet the minimum pension requirement each year, financial penalties may apply. The Australian Tax Office (ATO) could determine that the income stream has ceased for taxation purposes, which could result in all investment earnings being treated as assessable income for the fund.

Transfer Balance Cap

Introduced in July 2017, the transfer balance cap (TBC) limits the amount of superannuation that can be transferred into a superannuation income stream once an individual meets a condition of release.

The TBC was designed to prevent individuals from holding excessive wealth in their tax-free superannuation accounts, and is indexed to ensure it keeps its real value over time.

A spike in inflation caused the general cap to climb to $1.9 million on 1 July 2023, however not all individuals are entitled to the full indexation amount and each person has a personal TBC.

The ATO considers several factors when determining an individual’s entitlement, such as the financial year when your transfer balance account (TBA) is started and the highest ever balance in your TBA.

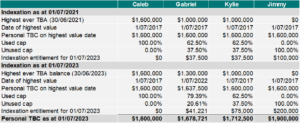

The indexation impact can vary, and these examples can help to demonstrate the impact across diverse circumstances assuming a date of highest value at July 1, 2017:

- Caleb: Started pension with $1.6 million balance, took a commutation of $200,000 on April 1, 2022

- Gabriel: Started pension with $1 million balance, commenced second pension of $300,000 on July 1, 2022

- Kylie: Started pension with $1 million and has not commenced any new pensions since.

- Jimmy: Super balance of $1.5 million, not commenced a pension as he had not met a condition of release at the time. He will reach age 65 on July 1, 2023 and commence a pension, with his super balance having since grown to $1.9 million.

The following table shows each person’s TBC based on their circumstances:

Given how unique financial; circumstances can be it is important to seek tailored advice when planning for and during retirement.

While the rules can be complex to navigate, a little planning goes a long way to ensure retirees can take maximum advantage of the concessions available.

What to do next

If you have questions about how the changes to superannuation may impact you or your family, reach out to your local Pitcher Partners expert today