The EV dealer of tomorrow is going to look remarkably different to the dealer of today.

EVs will fundamentally change the franchise dealership landscape. Along with the significant investment in infrastructure required, the EV Dealer of the Future will look remarkably different to the franchise dealer of internal combustion engines (ICE) of today.

We fully support the shift to EVs and welcome the government’s recent National EV Strategy (NEVS) consultation. The sooner we have a legislated fuel efficiency standard in Australia that aligns to the US and Europe the better to accelerate EV take-up and transition to net zero emission transport.

However, EV take-up isn’t the only hurdle and the transition to electrifying transport is complex. Australia needs to continue to move forward to catch up with the rest of the world in EV uptake, we need to learn the lessons from other countries and plan for the hurdles that may trip up what is a good thing for the environment, the industry and the Australian economy.

The cost structure of most dealerships is fixed and currently new-car sales and servicing are the biggest contributors to the bottom line.

With EVs becoming the focus of the showroom, the service aspect almost evaporates, and that means new cars become the dominant earner requiring significant structural changes to reduce costs.

In addition, EVs require a significant infrastructure investment from all segments of the economy to be a viable option in Australia.

Firstly, state and federal governments need to invest heavily in energy generation. If the issues plaguing the east coast power grid in the past six months are not a warning to governments that there needs to be a significant and urgent investment, then what is?

Private industry also needs to invest heavily into its own infrastructure. This is where dealers will need to fund the upgraded electricity distribution lines into their sites to obtain the necessary capacity to power the chargers required.

The final element is consumer post-purchase experience. Consumers will need to install infrastructure in their homes to reduce reliance on public infrastructure and as a matter of convenience to charge their EV.

An often not talked about facet of EV’s is their lifecycle emissions, which cannot be ignored.

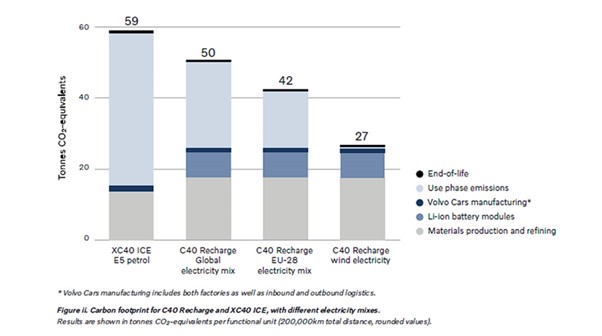

Volvo has produced studies of the emissions breakeven point for some popular models of their cars (the XC40 Recharge and ICE and C40 Recharge).

Volvo is one of the most progressive car manufacturers in this area and has committed to only sell (DTC and online only) fully electric cars by 2030 globally (in Australia Volvo has committed to 2026) and be climate neutral by 2040 across its entire value chain.

The emissions are captured throughout the lifecycle of the vehicle including:

- Materials production and refining

- Li-ion battery modules

- Volvo Manufacturing

- Use phase emission (including electricity mix)

- End-of-life

Given Australia’s reliance on coal as the main source of power generation, the global electricity mix is the best reference point for emissions in Australia.

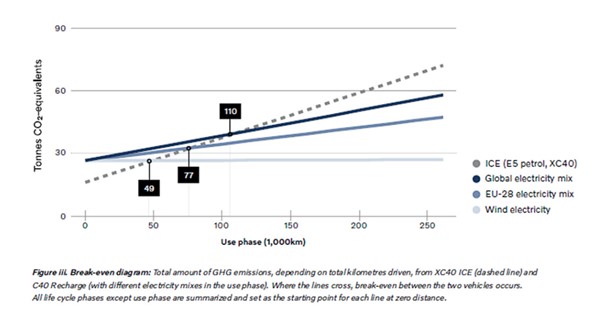

Volvo has estimated that the break even point of the XC40 Recharge versus ICE vehicle is at 110,000km’s driven. This is the point where the emissions of manufacturing and producing an electric vehicle versus an ICE vehicle are the same.

There is no doubt that electric vehicles are a method to reduce greenhouse gas emissions (especially when combined with solar at home charging), however for too long much of the discussion just focused on the use-phase emissions only.

As previously stated, the transition to EVs is important and should be a priority to the government and the automotive industry.

However, there are tricky obstacles along the way which need to be planned for to ensure we have a successful migration over time.

Key takeaways from this series

- The automotive industry is facing an unprecedented set of circumstances of which we haven’t experienced in the past 100 years.

- Despite what many would describe as poor macroeconomic trading conditions, dealerships are recording record profits due to supply constraints. There are lessons to be learned in the current market we are trading in for dealers, distributors and OEMs.

- Notwithstanding the two biggest disruptions to the dealership landscape being Electric Vehicles and the agency sales model, there are still many players in the market ready for the challenge.

- Larger dealer groups particularly see the changes giving them more influence in strategic decisions as they partner with the OEMs.

The only certainty these days in the motor industry currently is that there will be uncertainty.