Key points:

-

New Vehicle Efficiency Standard (NVES) turns vehicle emissions into a direct commercial cost, requiring OEMs to either reduce fleet emissions or purchase credits, with penalties likely flowing through to vehicle pricing.

-

Penalty exposure escalates rapidly under NVES, disproportionately impacting high-volume and LCV-heavy brands as emissions overruns are multiplied across total units sold.

-

NVES will quickly reshape competitive dynamics, favouring brands with strong EV and PHEV portfolios while emissions-intensive line-ups face higher costs and reduced competitiveness.

A transformative shift in regulation and market dynamics

The NVES has moved from policy intent to operational reality, imposing fleet‑based CO₂ emissions targets on all vehicles entered onto the Register of Approved Vehicles (RAV). A central unit trading scheme rewards suppliers (OEMs and Distributors) that outperform their targets with tradable efficiency units and penalises those who fall short. In practice, this creates a new compliance currency that compels OEMs to either innovate towards lower emissions or purchase units, with financial penalties likely passed on to consumers.

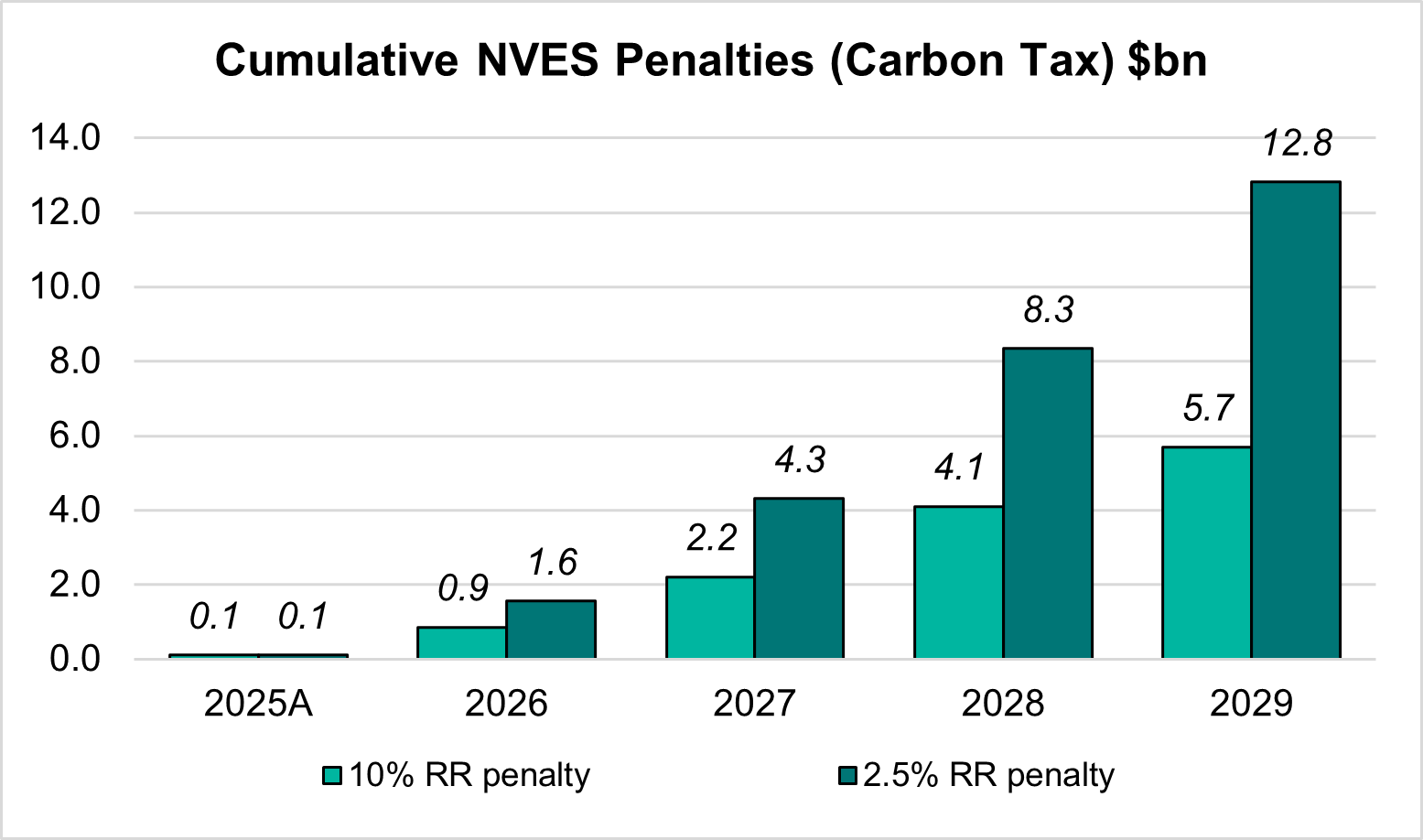

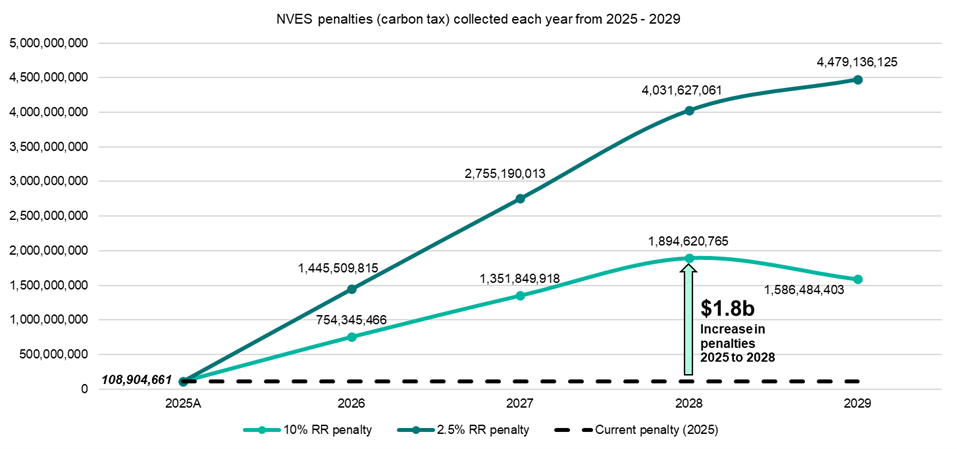

Penalties will escalate quickly

Initial penalties for the first six months of NVES (to 31 December 2025) are estimated at $109 million (discounted rate of $50 per gram over target). Under optimistic scenarios, penalties could rise to $754 million in 2026 and $1.586 billion by 2029 with a 10% annual reduction in average emissions. Under historical improvement rates (~2.5% per year), 2029 penalties may reach $4.479 billion at the discounted rate—amplifying risk for brands with high volumes and higher average emissions.

Winners and losers will crystallise early

- Most popular brands face a compliance crisis. Leading brands in 2024–2025 are likely to struggle with 2025 targets and miss them by 2029, risking significant penalties and market disruption.

- LCVs are hit hardest. Brands exceeding the 2025 LCV target (201 g/km) will be most affected, either passing costs to consumers or buying credits.

- Volume magnifies risk. Every gram over target is multiplied across total units sold, amplifying penalties for high‑volume players.

- Luxury and American‑style pickups can absorb penalties. Higher price sensitivity is less of an issue for these segments.

- Chinese EV brands emerge as clear winners. Many already sit below 2029 targets, giving them a structural advantage in the NVES regime.

Bottom line: NVES is not just an emissions policy – it is a market‑shaping economic mechanism that will accelerate the competitive advantage of brands with deep EV/PHEV portfolios, reshape allocation battles, and make emissions performance a core commercial lever.