In the past two and a half years (since Q4 2019), we have experienced the following:

2020/2021

- a pandemic with widespread and sometimes brutal lockdowns

- unprecedented government spending, quantitative easing (money printing) and low interest rates

- global and regional restrictions on travel and government assistance, leading to some of the highest savings rates in Australia’s history

- a global logistics crisis increasing input costs and limiting supply of parts

- constricted new vehicle supply, primarily due to a microchip shortage

- Holden’s exit from Australia and Honda and Mercedes Benz moving to agency sales models

- increased consumer demand for cars as travel and holiday spending went to zero, and the shift from public to personal transport preferences gaining traction

2022

- the cashed-up consumer was let loose, making up for lost time by spending their savings accumulated over the previous two years

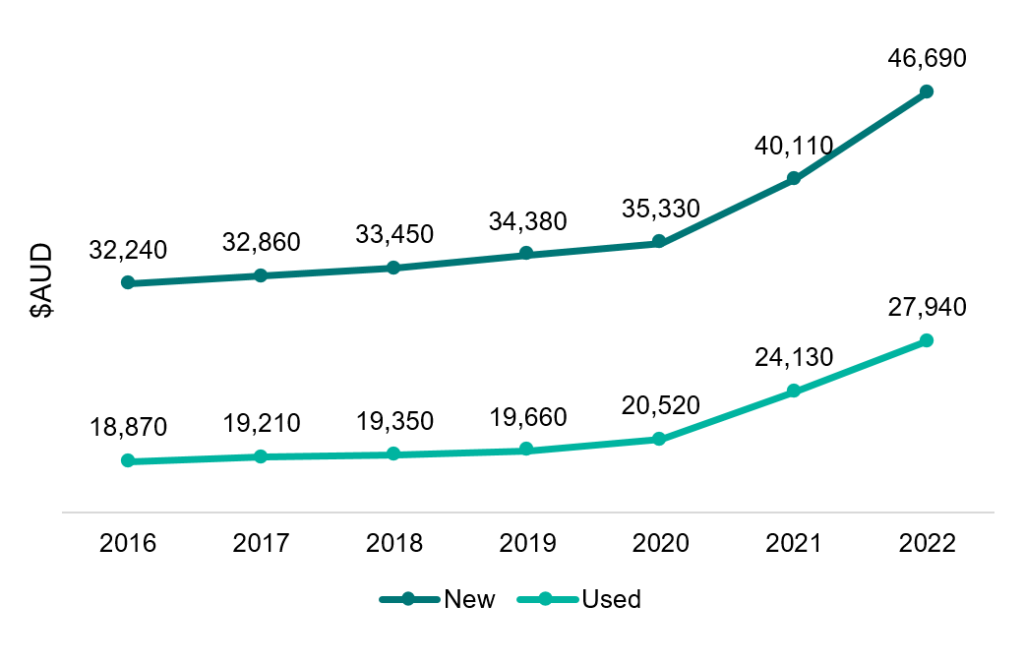

- the supply of new vehicles floundered in comparison to the demand from consumers, leading to inflated used car prices and ever-growing gross margins, as the transaction price has increased by approximately 50%, (refer chart below)

- microchip and other component shortages intensified with forecasted supply shortages to last another 12 months

- a war in Ukraine significantly escalating fuel and energy prices

- rapidly rising inflation (driven by central banks activity and supply constraints) in most economies, leading to interest rate raises at a pace not seen for over 40 years to reign it in

- consumer confidence now in a free-fall

- China threatening war in Taiwan, which is now being priced into capital markets 1

Average New and Used Car Prices

Source: Pitcher Partners Analysis

Some of these factors, which would usually have a sharp negative affect on the retail automotive industry, were countered by increased vehicle transaction values and margins that combined to deliver record profits for motor dealerships across Australia.

1 P. Durkin, ‘BHP, ANZ boards plan for the ‘unthinkable’ arising from war’, Financial Review, 2022, https://www.afr.com/policy/economy/bhp-anz-boards-plan-for-unthinkable-on-war-20220302-p5a0xh (accessed 23 September 2022).

Return to Australian retail automotive industry hub

This article was first published by Go Auto News on 27 September 2022. Licensed by the Copyright Agency. You must not copy this work without permission.

This content is general commentary only and does not constitute advice. Before making any decision or taking any action in relation to the content, you should consult your professional advisor. To the maximum extent permitted by law, neither Pitcher Partners or its affiliated entities, nor any of our employees will be liable for any loss, damage, liability or claim whatsoever suffered or incurred arising directly or indirectly out of the use or reliance on the material contained in this content.

Pitcher Partners is an association of independent firms. Pitcher Partners is a member of the global network of Baker Tilly International Limited, the members of which are separate and independent legal entities. Liability limited by a scheme approved under professional standards legislation.