Federal Budget 2021-22

Brave structural moves left on the shelf

Last night, Treasurer Josh Frydenberg delivered the Federal Budget 2021-22. The Budget details how the Government plans to continue encouraging business investment and spending as Australia recovers from the COVID-19 pandemic.

In what’s potentially its final Budget before the next Federal Election, the Government announced $94.7 billion of stimulus over four years. The focus of this Budget remained on supporting the near-term economic recovery through significant spending on infrastructure and targeted support for industries that will continue to suffer as borders remain closed.

While it’s fair to say there are some concessions aimed at the middle market, there is not as much support to employ, innovate or export from what we have seen to date, nor genuine long-term structural initiatives announced. This short-term debt-fuelled spending inevitably adds to the deficit that the Australian middle market and future generations will be asked to pay down.

Access our analysis below to understand the specific impacts of this year’s Federal Budget on individuals and middle market businesses.

View a recording of our Federal Budget 2021-22 breakfast event, livestreamed from Melbourne.

With $94.7 billion of stimulus over four years, the Federal Budget 2021-22 focuses on continuing to support near-term economic recovery through significant spending on infrastructure and targeted support for industries that will continue to suffer as borders remain closed. This short-term debt-fuelled spending inevitably adds to the deficit that the Australian middle market and future generations will be asked to pay down.

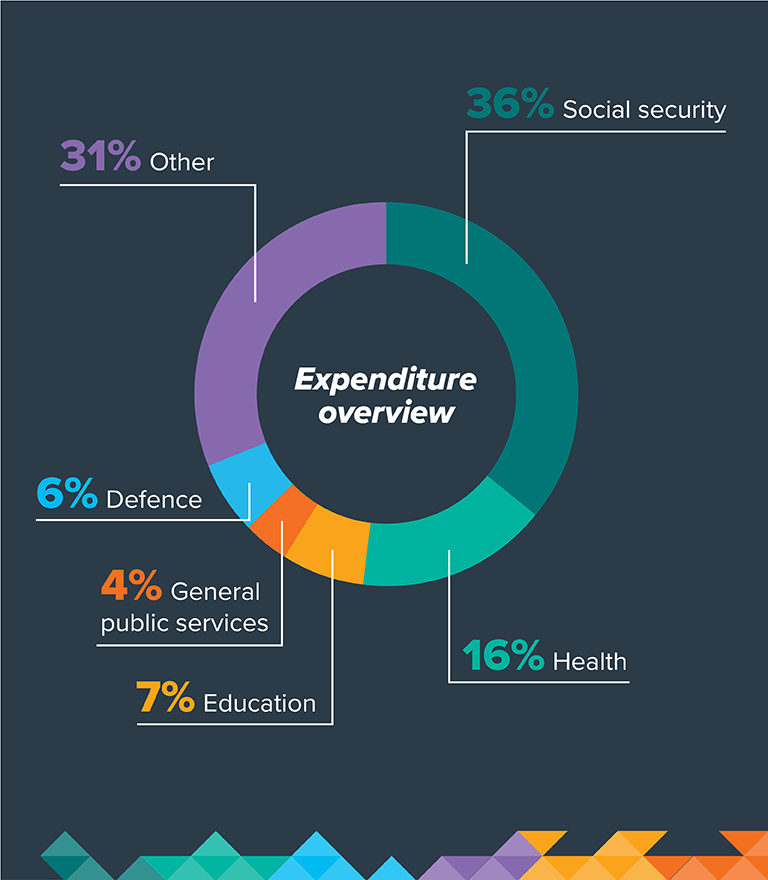

The Government announced a range of expenditure measures to stimulate growth in key sectors, while also addressing priority policy areas, including the country’s digital capabilities and funding to support women. Infrastructure received a further $15.2 billion over ten years. And, as expected, additional measures to make home ownership a reality for more Australians were announced.

Fast facts

Deficit

The underlying cash deficit is forecast to be $106.6 billion in 2021-22.Government debt

Gross debt is forecast to be $1.2 trillion by 2024-25, or 50% of GDP.Encouraging investment

Immediate asset write-offs and loss carry backs have been extended for another 12 months to encourage an estimated $370 billion worth of investment.Personal tax

An additional $7.8 billion in tax cuts through keeping the Low and Middle Income Tax Offset (LMITO) over 2021-22.Infrastructure

An additional $15.2 billion over the next four years to support over 30,000 construction jobs.Care services

A further $33 billion for care services, including a $17.7 billion to improve aged care quality and safety.The Government will maintain changes to reduce personal income tax. This measure is designed to continue to stimulate the economy by increasing the disposable income available to individuals. The Treasurer confirmed that the low and middle income tax offset (LMITO) and low income tax offset (LITO) will be retained for the 2021-22 income year.

The Government has proposed improvements to the tax and regulatory regime applying to employee share schemes (ESS). These measures are designed to make ESS arrangements more attractive and accessible to business when seeking to attract and retain talent. Part of these measures include removing termination of employment as a taxing point.

The Government has provided further support for capital investment by businesses and assistance with cash flows by extending the “temporary full expensing” measure as well as the loss carry-back offset for an additional income year. Important changes to the minimum threshold for the superannuation guarantee charge (SGC) have also been announced.

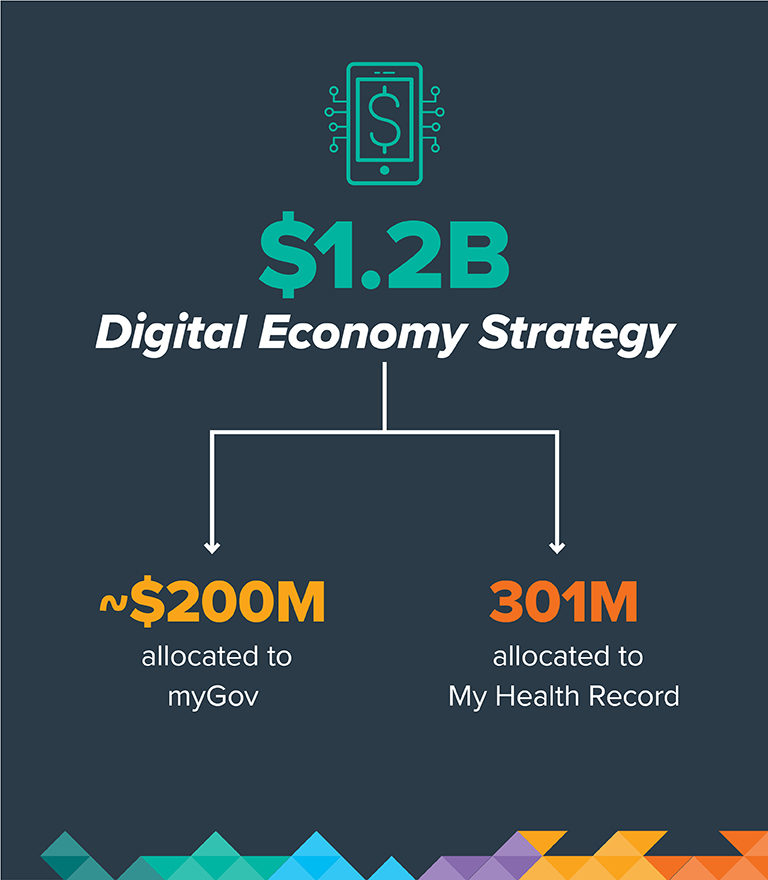

The Government outlined a number of significant measures in the Budget as part of a Digital Economy Strategy. As a part of that strategy, three tax incentives were announced, all proposing to reduce the overall tax paid by businesses conducting certain digital activities and investing in the development of intangible assets.

The Government has committed to the introduction of the Corporate Collective Investment Vehicles (CCIVs) regime, with a revised start date. There has also been a number of minor technical changes announced to the Taxation of Financial Arrangement (TOFA) rules relating to portfolio hedging and foreign currency.

The Government has announced a significant change to Australia’s individual tax residency rules, as well as some other cross-border proposals of note. Some of these proposals include simplification of the individual tax residency rules and maintaining New Zealand’s primary taxing rights over its sporting teams and support staff, and relaxing residency requirements for self-management superannuation funds (SMSFs).

Superannuation changes announced in the Budget are beneficial in nature and mainly target increasing flexibility and contribution opportunities for individuals over age 60. Key changes include the removal of the work test for non-concessional superannuation contributions, reducing the age of eligibility from 65 to 60 years for downsizer superannuation contributions, and increasing the maximum releasable amount for the First Home Superannuation Saver Scheme.

Pitcher Partners insights

Get the latest Pitcher Partners updates direct to your inbox