Pitcher Partners Wealth Management (Brisbane) | The information in these articles is current as at 9 July 2025

Key points

- Australia’s debt capital market is evolving with more offshore banks issuing AUD debt, creating new opportunities for local investors.

- The increase in foreign bank AUD Tier 2 (T2) issuance is linked to global regulatory changes and an attractive funding environment, offering investors higher yields due to additional credit and complexity risk.

- Kangaroo bonds allow global banks to diversify funding sources while providing Australian investors exposure to international credit without currency risk.

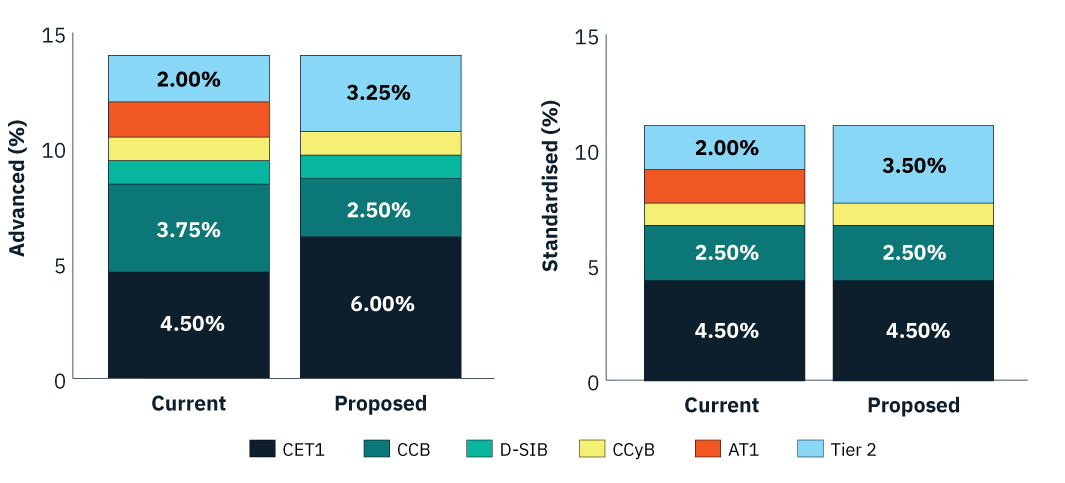

Australia’s debt capital market is evolving, with a growing number of offshore banks now issuing Australian dollar (AUD) debt. This trend reflects global shifts in how banks manage their capital and creates new opportunities for income-seeking local investors. The rise of offshore AUD-denominated debt is occurring whilst domestic regulatory reform is reshaping the Australian credit market. From 2027, Additional Tier 1 (AT1) instruments (also known as ASX-listed hybrids) will be reclassified as Tier 2 (T2) under APRA’s revised framework, with existing bank issued hybrid securities being phased out by 2032. These changes will alter bank capital structures and influence Australian credit market dynamics.

The increase in offshore AUD T2 issuance is linked to global regulatory changes introduced after the Global Financial Crisis. T2 debt is designed to absorb losses in times of distress, ranking below senior debt but above AT1 and equity in the capital structure. These instruments are typically issued in the wholesale market, offer fixed or floating-rate interest payments, and may contain structural features such as call options or interest payment deferrals. As the investor assumes additional credit and complexity risk, they are compensated with higher yields than those provided by traditional senior bank debt.

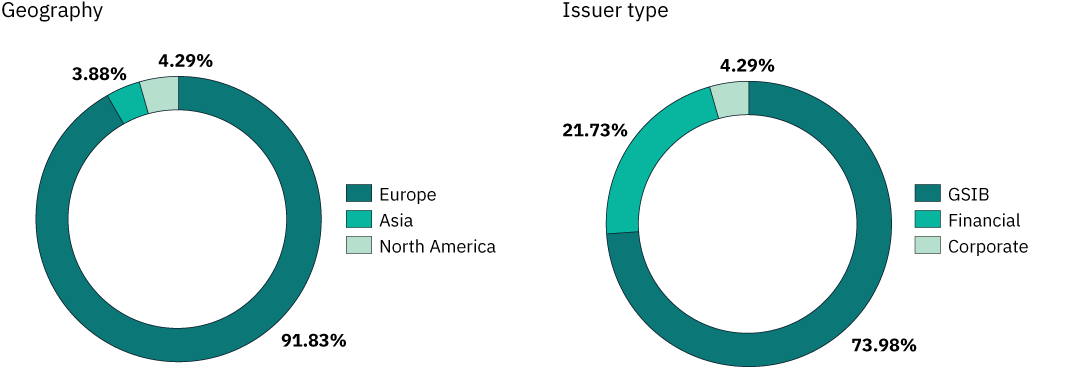

Foreign bank issuance of debt in Australia is known as Kangaroo debt, which is denominated in AUD. While traditionally used for senior debt, recent years have seen an increase in T2 issuance. Kangaroo bonds allow global banks to diversify their funding sources, while offering Australian investors exposure to international credit without the currency risk. These securities have been issued by a range of European and Asian banks, attracting strong support from superannuation funds, insurers, and a growing contingent of wealth managers.

Kangaroo T2 annual issuance

Many offshore institutions issuing Kangaroo T2 debt are designated Global Systemically Important Banks (G-SIBs). These are entities whose failure would pose significant risk to the global financial system. These banks are subject to more stringent regulatory oversight and hold higher capital buffers, including enhanced loss-absorbing capacity through instruments such as T2 debt. For investors, the involvement of G-SIBs in the Australian market is a positive. These institutions tend to have stronger capital positions, conservative risk frameworks, and are held to higher disclosure and transparency standards. While T2 debt carries increased risk, the structural and regulatory strength of G-SIBs offers additional confidence to investors allocating to this segment of the market.

Proportion of outstanding subordinated Kanga debt by:

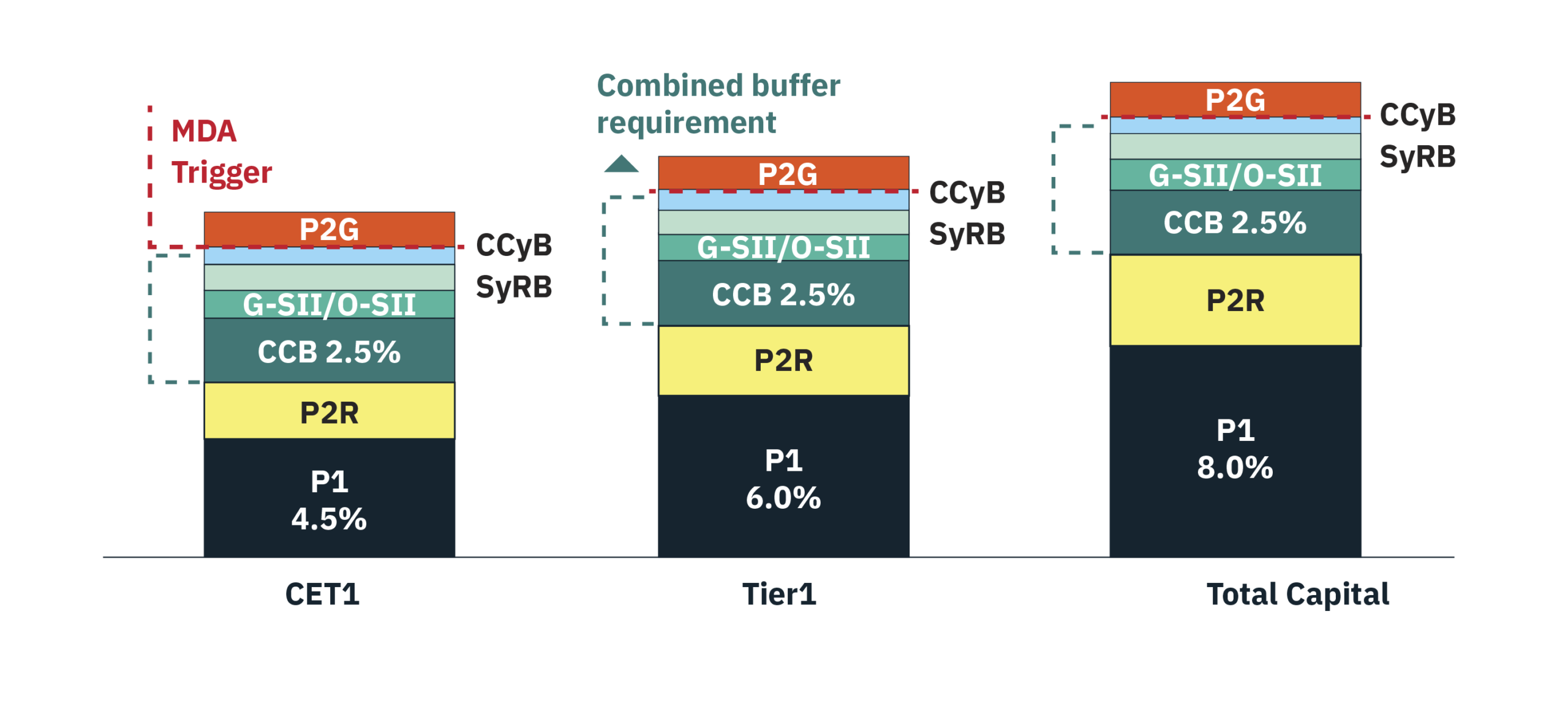

Investors in Kangaroo T2 debt benefit from the structural shift underway in the Australian bank capital framework. With APRA’s decision to phase out bank hybrids by 2027, domestic banks will lose the capital layer that sat between T2 debt and equity. This increases subordination risk for Australian T2 debt holders, who may now absorb losses directly after equity in a stress event. Foreign banks continue to operate under regulatory regimes that retain AT1 instruments in their capital structure. As a result, Kangaroo T2 debt benefit from the added loss-absorbing buffer provided by AT1 capital, reducing the likelihood of T2 experiencing losses in periods of financial distress. This divergence in capital structure may result in Kangaroo T2 debt offering a more attractive risk-reward profile relative to T2 debt issued by Australian banks.

Current vs proposed frameworks advanced (4 majors plus Macquarie Bank) vs standardised banks

EU risk-based capital framework

The Kangaroo T2 debt market has matured in recent years, with a series of landmark deals highlighting growing investor demand and increasing issuer sophistication. In March 2025, HSBC set a new benchmark with a record AUD $1.5 billion 10-year non-call 5-year (10NC5) transaction, attracting AUD $4.0 billion in demand. The size of the issue signalled strong domestic appetite for high-quality offshore debt and the scale global institutions can now achieve when issuing debt in AUD.

In June 2025, French banking group BPCE issued the market’s first-ever 15-year non-call 10-year Kangaroo T2 bond, highlighting issuer confidence in the local market’s increasing depth. Also in June, American utility NextEra Energy entered the market with an AUD 775 million 30-year non-call 5-year transaction, marking the first corporate Kangaroo subordinated debt issue. This expansion into corporate subordinated debt signals a diversifying and maturing market, providing investors a broader opportunity set when allocating capital.

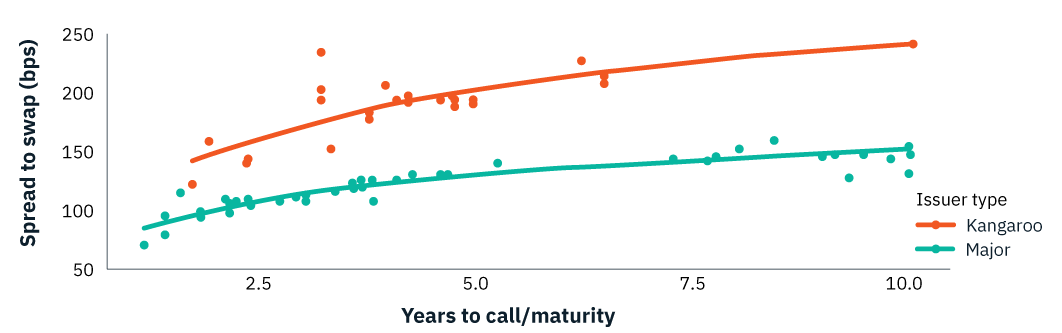

Kangaroo T2 debt offers several advantages for investors. These instruments typically provide higher yields than senior debt and often a yield premium over equivalent domestic T2 securities. The increased yield compensates for jurisdictional, structural, and liquidity-related factors. The relative increase in yield makes Kangaroo T2 debt attractive for income-focused investors seeking enhanced returns.

Tier 2 spreads – Kangaroo vs Australian majors

Being denominated in Australian dollars, they also remove currency hedging complexities for local investors, while expanding issuer diversification beyond the domestic banking sector. Since many offshore issuers retain AT1 capital, T2 debt may benefit from a more attractive risk-return profile due to relative differences in capital structure versus domestic peers.

However, these benefits are not without risk. As subordinated debt, T2 debt is more likely to absorb losses in times of stress through write-down or conversion mechanisms. Jurisdictional complexity can also create challenges, as resolution frameworks may not align with investor expectations or protections under Australian law. While many benchmark-sized issues from global banks are liquid, debt issued by smaller or less frequent issuers may face illiquidity risk.

The rise of Kangaroo T2 debt coincides with a structural shift in APRA’s capital framework, which prioritises T2 debt over AT1. Australian banks are expected to raise AUD 20–30 billion in T2 capital over the next three years, while global banks continue to tap the Australian market to diversify funding and benefit from strong investor demand.

Kangaroo T2 debt is emerging as a compelling alternative for Australian investors, offering enhanced yields, greater diversification, and access to high-quality global issuers. As the domestic market transitions from AT1 instruments and into T2 debt, the increasing presence of well-capitalised foreign banks provides a timely and attractive alternative. For those prepared to engage with the complexity, this segment of the market provides an intriguing opportunity for an investor’s income-based allocation.