The information in this article is current as at 1 April 2022.

Overview

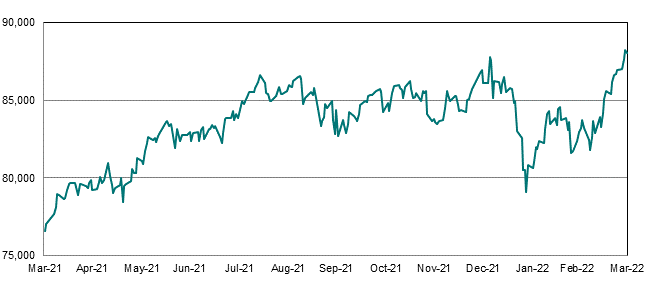

The S&P/ASX 200 Total Return Index returned 2.2% over the three months and 6.2% over the nine months to 31 March 2022.

S&P ASX200 Accumulation Index

Source: S&P

Outlook

Recommendation: Maintain neutral.

The Australian sharemarket has been volatile, albeit broadly steady in 2022 on a total return basis. Strong performances of the Energy, Materials and Financial sectors have offset weak performances of Consumer sectors and Health Care. The tailwinds that have propelled the Australian sharemarket to strong gains since the depths seen at the outset of the COVID-19 crisis remain broadly intact. First, pent up demand and household savings boosted by stimulus measures should continue to support consumer spending on goods and services. Second, monetary policy is likely to remain accommodative. Although interest rates are likely to rise this year, the pace of interest rate rises is expected to be low when compared to many advanced economies. Third, supply-side constraints caused by the pandemic and the war in Ukraine should provide a boost to exporters, notably those of iron ore, oil and gas, and LNG.

Risks to growth expectations however are building. First, the war in Ukraine is further disrupting global supply chains, already reeling from the damage inflicted by COVID-19. Second, the price of both hard and soft commodities has increased significantly. Whilst positive for Australian resource companies, this is a clear negative for others as input costs rise significantly. Third, global growth prospects have been lowered and may be cut further if the conflict is not resolved in due course. Fourth, the growth outlook for China, our main trading partner, remains challenged and highly contingent on how the debt crisis in China’s property market plays out. Fifth, consumer sentiment has weakened notwithstanding the strong labour market, which reflects pressure on households and poses and increasing risk for household spending.

In summary, the balance of risks is evenly poised.

Sector view

Our outlook for some of the major sectors of the S&P/ASX 200 is as follows:

Banks

Recommendation: Retain neutral.

The banking sector has outperformed the ASX200 during the first quarter of 2022. Accommodative monetary policy and fiscal policy continue to be positive supports for mortgage book growth, but Net Interest Margins (NIMs) and interest income remain adversely affected by the low interest rate environment. Further, NIMs are being impacted by banks’ higher exposure to liquid assets (due to the removal of the Committed Liquid Facility – CLF) that earn negligible interest, higher mortgage and business lending competition and continuing growth in lower-spread fixed rate mortgages. Credit quality continues to improve, however, with home loan arrears falling along with impaired assets as a result of a better economic environment.

We expect bank financing costs to rise as the RBA emergency funding facility (RBA’s Term Funding Facility -TFF) is withdrawn and the cost of the offshore wholesale funding increases. In addition, banks have more fixed rate loans than ever before (around 50% of new loans in calendar 2022 alone), which reduces the capacity to instantly reprice its loan book as borrowing costs (wholesale funding and term deposits) start to rise. This impact is softened by the fact that these fixed-rate loans are instantly repriced as they expire over the near-term.

General economic conditions such as credit growth and unemployment continue to be favourable for the banking sector. The protracted war in Ukraine, however, casts a dark shadow over the global economic outlook and therefore makes the outlook for the banking sector more uncertain. We maintain a neutral outlook for the banking sector.

Resources

Recommendation: Maintain neutral.

Commodity prices have risen strongly over the past year, benefitting from the tailwinds of unprecedented global fiscal stimulus packages, massive infrastructure spending and supply-side bottlenecks. Prices are expected to remain supported as the reflation of the global economy continues and inventories remain at historically low levels across most commodities. This has been exacerbated by the war in Ukraine as sanctions against Russia, coupled with military occupation, reduce global supply from these significant producers. This is evidenced by the S&P GSCI benchmark, which tracks the performance of the global commodities market, rising by around 20% since the day before Russia’s invasion.

Although short-term conditions remain highly favourable, we expect some moderation in commodity prices over the medium-term as governments and central banks gradually withdraw stimulus measures. This is in line with the latest projections for global growth, which have been lowered by the IMF from 4.9% to 4.4%. Another potential negative for commodity prices remains the worsening growth outlook for China, which has prompted the Chinese Authorities to flag their intent to stabilise financial markets and resolve property risks, should the need arise.

The larger Australian resource companies, for the most part, have long-life, low-cost and expandable assets. The focus of many of these companies over the past few years has been on productivity improvements, reducing the cost of production, simplifying the business via asset divestment and many have continued to strengthen their balance sheets as a result of their strong cash flows. We maintain a neutral outlook for the resources sector.

Retail

Recommendation: Retain neutral.

The retail sector in Australia has grappled with business disruption since the onset of the COVID-19 crisis. The challenging operating environment has forced retailers to accelerate their response to evolving consumer purchasing behaviours, disrupted supply chains, shifting operating models, cost challenges and talent shortages. To adapt to the challenges, Australian retailers have continued to shy away from a single channel focus, instead offering an omnichannel proposition. What has previously been an “add-on” service has now become an important component to deliver a fully integrated experience.

The COVID-19 pandemic has triggered significant and widespread supply chain disruptions, including port congestion, limitations in cargo space, container and pallet shortages, and labour constraints. This has led to significant cost pressures including increased raw material, commodity, shipping and labour costs. These headwinds are unlikely to dissipate quickly as they are a function of supply-side constraints rather than demand.

Notwithstanding, turnover for these businesses continues to normalise as a result of the lifting of many lockdown restrictions, which have unleashed a torrent of pent-up demand. This is evidenced by the figures for retail trade in Australia which, after being relatively stable though to August 2021, gained momentum in the last quarter of 2021 as restrictions progressively lifted. Whilst the economic landscape for consumers remains favourable (accommodative interest rates, high savings rates and strong consumer confidence levels) and will underpin retail sales readings over the short-term, most companies in the sector are cycling very strong earnings in 2021 and we therefore reaffirm our neutral outlook.

Australian Real Estate Investment Trusts (AREITs)

Recommendation: Retain neutral.

After a strong 2021, AREITs have had a weak start to 2022. The AREIT Total Return Index is around 7.1% lower this calendar year. The poor performance can be primarily attributed to rising inflation fears, stoking concerns of a more rapid normalisation of interest rates.

The retail sector continues to benefit from strong discretionary spending. The sector has enjoyed several tailwinds, notably high savings rates accumulated as a result of lockdowns, low interest rates and strong consumer confidence levels. These tailwinds are expected to moderate over the second half of the year as the likelihood of higher interest rates and the war in Ukraine dampen consumer confidence.

The office sub-sector remains challenged notwithstanding its recovery from the battering it received as a result of the pandemic and associated lockdowns. Occupancy levels for offices have rebounded in line with the easing of lockdown restrictions and the returning of workers to the office. Whilst this trend is likely to continue, a concern remains around the renegotiation of expiring leases which, if renewed, are likely to involve a smaller footprint and possibly at lower rates than current leases, as a more flexible working environment for many companies translates into lower demand for office space.

The residential sub-sector has enjoyed a strong performance since the second half of 2020, driven by low interest rates, government incentives and income support measures, and increasing household wealth. Many of these tailwinds are likely to ease in 2022. Further, borrowing levels may be impacted by macro-prudential tightening. Price falls from current levels appear to be limited as the re-opening of borders should see immigration levels revert to pre-pandemic levels and, with this, bring a new cohort of potential buyers.

The industrial sub-sector remains solid. Industrial properties continue to be sought after, which has led to both capitalisation rates and vacancy rates falling to historical lows. Investor demand for industrial real estate is likely to continue to remain strong, notwithstanding rising costs associated with both construction and maintenance. E-commerce penetration is forecasted to be around 20% in 2025, which should see strong demand for industrial real estate well into the medium-term.1

In conclusion, the environment for AREITS is likely to be less favourable than the most recent past and valuations across the sector appear to be full. We remain neutral on the sector.