Most business owners have a reasonable grasp on financial results, but what is necessary for agility is a meaningful understanding of the key drivers behind the numbers.

Isolating those drivers and using the data to improve and grow the business is now more critical than ever as businesses look to re-establish themselves post COVID-19. In this article, we detail how businesses can use data to inform better decision making as they look ahead and achieve their 2021 objectives and beyond.

Data can help you navigate difficult business decisions

Many difficult decisions have already been made by small and medium businesses and as the economy gradually reopens, more tough calls are looming. Every business decision needs to be supported by fact-based and data driven processes. Successful organisations with a growth appetite and being in a position to capitalise on opportunities will not leave decisions to chance or intuition.

Data should influence every facet of the business, ranging from which product lines to stock and how much, to more complex questions such as, what days and what times do I open to be most profitable? With restrictions impacting the number of customers permitted through the door, do I even open at all?

Navigating these turbulent times requires deep analysis of data to support the intuition inherent in business owners and leaders to recognise exactly where your deficiencies lie, address blind spots and turn data-driven insights into actions.

Understand what’s needed to open the doors

Despite the easing of restrictions across Australia, many business owners are uncertain about whether their organisation can operate profitably. While some businesses could easily estimate the impact of the new opening rules on revenue and costs, others require an in-depth break-even analysis to ascertain their projected profitability. This assessment is based on assumptions and information extracted from the collection and standardisation of data assets, allowing an analysis to be factual.

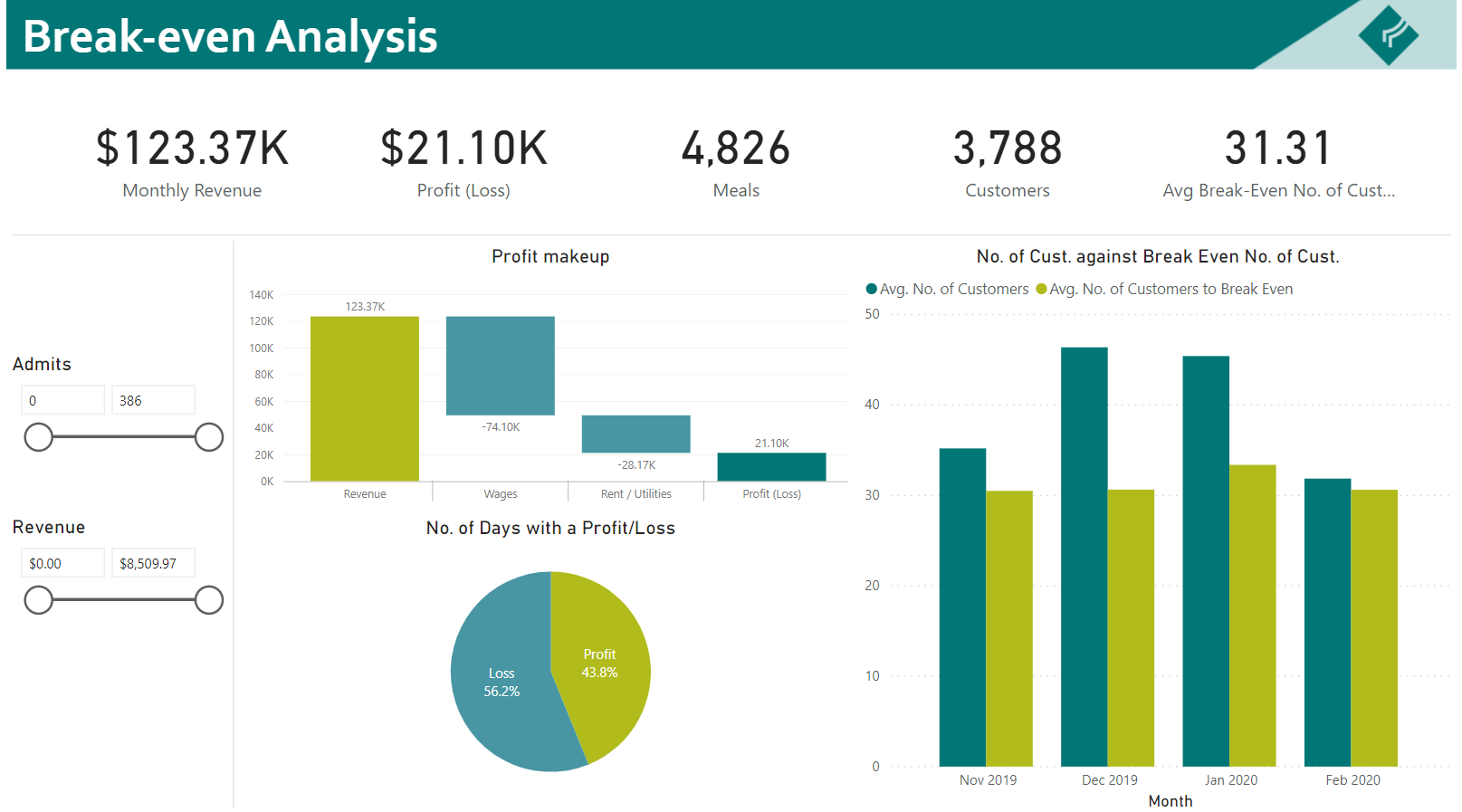

Break-even analysis in practice: A large hospitality business

We recently conducted a break-even analysis for a large hospitality client, which had complex and variable revenue and cost structures. Revenue data was collected from its physical, digital and partner channels (e.g. food delivery platforms and commercial customers), whilst cost data came from payroll, rent, utilities and its food and beverage system.

Dashboard example

Note: For the purpose of this article, some visuals in this dashboard have been simplified and values modified to de-identify our client. This dashboard is for illustration purpose only.

The analysis estimated the average number of customers required for them to be profitable, combining analysis of these data sets.

By automating the collation of these datasets into a centralised repository and developed a near real-time business intelligence (BI) dashboard the client was able to project revenue and profitability. Armed with this tool, the client was able to validate their intuition and develop a data-driven strategy based on the detailed financials underpinning their operations to determine when it was appropriate to relaunch.

Use margin analytics to drive a rapid response to change

COVID-19 has not only impacted the hospitality industry. The organisations that supply products to these businesses have also had to make significant adjustments, requiring deeper insights to make informed changes. Many of these businesses could no longer rely solely on their existing knowledge, past experience and expertise.

Margin analytics in practice: Fast-moving consumer goods (FMCG)

Earlier this year, we were engaged by a FMCG company that supplies its products to hundreds of customers across Australia to develop a margin analytics engine. Leveraging its rich sales transaction data, our team developed a margin analytics engine capable of identifying automatically, and in near real time, the key events causing shifts in sales volumes and margins.

During the pandemic, this tool proved extremely beneficial in that it enabled the client to quickly identify the most significant items at risk in its portfolio. Without this tool, the business would have been significantly slower to perform the analysis and respond rapidly to change.

Where many companies were left to improvise strategies, the client made data-driven decisions that helped limit losses and maximise new opportunities. Today this company is also better placed than its competitors, as it is able to spot and act fast on changes resulting from the easing of the restrictions.

Use data to provide clarity on the business’s strategy and operations

There are going to be key decisions that business owners will need to make over the coming weeks and months. Will these business owners use their gut initiation to answer these questions and navigate through these difficult times, or will they adopt a fact-based, data-driven approach to provide a competitive edge? There’s a certain level of intuition inherent in every entrepreneurial business owner but combining this experience with data driven insights will give businesses the foundations needed to navigate difficult times and adapt quickly.

If you have questions about how data analytics can strengthen decision making in your business, contact a Pitcher Partners specialist below to discuss your situation.