Recent court and tribunal decisions in Victoria and New South Wales indicate that medical and allied health centres providing various administrative services and collecting patient fees and distributing these fees to doctors, net of service charges, may be caught under payroll tax provisions. This article discusses Thomas’ case and the compliance approach that State Revenue Authorities appear to be taking to medical centres.

The NSW Civil and Administrative Tribunal (“the Tribunal”) recently determined in Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCATAD 259 (“Thomas”) that medical centres were liable to payroll tax in respect of payments made to medical practitioners. The payments that were assessed comprised patient fees collected from Medicare by medical centres on behalf of medical practitioners operating out of these medical centres. The decision reflects a departure from the previous understanding that payments made to medical practitioners under the common tenancy and agency model adopted by medical centres was not subject to payroll tax.

We understand that the Taxpayer has sought leave to appeal this decision. If the decision is confirmed on appeal, the judgment would likely require a significant adjustment to practices adopted within the medical industry.

What were the facts of the case?

Dr Thomas and Ms Naaz were directors of a company which operated three medical centres. Doctors entered into service agreements with the company. As part of these agreements, the medical centres would provide rooms to the doctors as well as shared administrative and medical support services (including nurses, reception, administrative staff and the charging and collection of Medicare fees on behalf of the doctors).

The service agreements imposed general obligations on the doctors such as ensuring that they promoted the interests of the clinics, met roster commitments, signed in and out of each shift, and required notice for planned leave under the leave policy. There was also restrictive covenants restraining the doctors’ trade within 5 km of the medical centre within 2 years of their departure from the clinic.

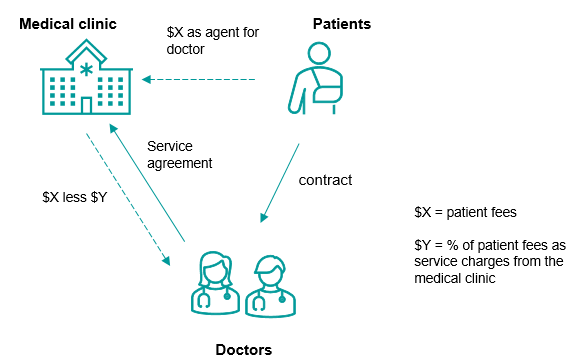

The Tribunal placed particular emphasis on the flow of funds which were as follows:

- The doctors provided medical services to patients

- The doctors bulk billed each patient who assigned their Medicare benefits to the doctors

- The medical centres, on behalf of the doctors, submitted the assigned claims for the medical benefits to Medicare

- Medicare paid those benefits into the medical centre’s bank account

- Administrative and support staff employed by the medical centre would record and reconcile the payments

- On a fortnightly basis, the medical centres would pay to the doctors an amount equal to 70% of the claims received by Medicare. The remaining 30% was retained by the medical centre as a service fee provided under the service agreement

The tenancy and agency model which is common to medical practices is depicted below:

What was the issue in the case?

The issue in the case was whether the payments comprising 70% of the Medicare benefits received (after deducting the clinic’s 30% service charge) were wages subject to payroll tax. The Chief Commissioner of State Revenue contended that the service agreements were contracts under which the medical centre, in the course of a business carried on by it, had supplied to it, the services of the doctors. As such, the service agreements were “relevant contracts” as that term was defined in section 32 of the Payroll Tax Act 2007 (NSW) (“the Act”) and thus that the amounts paid to the doctors were deemed to be wages under section 35 of the Act.

What did the tribunal decide?

The Tribunal held that the service agreements were indeed relevant contracts and thus that the payments to the doctors were wages subject to payroll tax. The Tribunal found that, on the facts in this case, a clear indirect relationship existed between the services provided by the doctors and the payments made by the medical centres to the doctors. Furthermore, the Tribunal held that the fact that the medical centres claimed Medicare fees on behalf of the doctors and held these funds on trust for the doctors before making the payments to the doctors were not relevant considerations in applying the provisions of the Act.

What are the implications of this decision?

This decision, together with the decision of the Victorian Court of Appeal in Optical Superstore1, demonstrates that payments from a healthcare practice to the healthcare practitioner may trigger payroll tax obligations. Arrangements where the healthcare centre collects fees from patients, including Medicare benefits, as part of its administrative services to the doctors face a risk of being challenged by revenue authorities in a payroll tax audit.

While Thomas’ case involved general practitioners, there is no reason why it could not be extended to similar arrangements with other healthcare or allied health practitioners as well as businesses in other industries that are structured in similar way.

Are there any payroll tax exemptions that could apply?

There are several available contractor exemptions that healthcare centres may be able to rely on in certain circumstances to exempt or reduce their payroll tax liability in respect of payments to healthcare practitioners. The three exemptions which are likely to be most relevant in the healthcare industry are:

- The healthcare practitioner provides services to the public generally. Broadly, this exemption is likely to be satisfied where the healthcare practitioner provides services in more than one unrelated healthcare practice

- The healthcare practitioner performs work for no more than 90 days in a financial year. To satisfy this exemption, among other things, the healthcare centre would need to have records of days when each healthcare practitioner provided services

- Services are performed by two or more persons. Generally, this exemption is likely to apply where the healthcare practitioner engages others to do all or part of the work pursuant to the contract

Where none of the exemptions are available, payments to healthcare practitioners are likely to be subject to payroll tax. Broadly, the payroll tax is most likely to apply to payments to a healthcare practitioner who works in one healthcare practice on a full-time basis.

What are the next steps?

Healthcare centres should review their arrangements with the healthcare practitioners in order to determine what action is required to comply with their payroll tax obligations and mitigate any risk of adverse payroll tax liability. This review should include, among other things, consideration of the following:

- the collection of fees and payment flow between the parties

- rostering arrangements or leave authorisation/ratification

- any restraint of trade where doctors seek to operate elsewhere

- arrangements in relation to storage of patients’ medical records

Addressing these issues proactively in advance of an audit from the relevant State Revenue authority may be a better approach rather than being reactive at the time of an audit where automatic penalties could be imposed.

Please contact us or your usual Pitcher Partners representative if you have any queries or require any further information.