International economy

Sydney Wealth Management services | The information in this article is current as at 01 July 2023

International economy

Inflation remains the topic du jour across the global economy. In both the US and Eurozone, interest rates are at their highest point since the global financial crisis. Economic growth continues to decelerate globally prompting more calls for interest rate cuts. In China, the opposite problem of deflation is emerging as its economy struggles with anaemic consumer demand and a weaker labour market.

United States

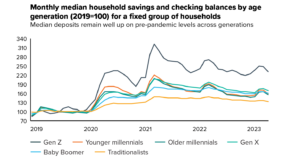

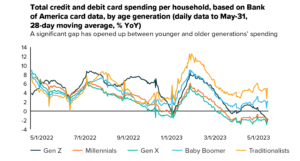

Household excess savings from the pandemic era (Exhibit 14 below) are helping sustain consumer spending. This is particularly the case for services with the Markit Composite PMI for June remaining in expansionary territory offsetting ongoing manufacturing weakness[1]. Older generations (Baby Boomer and Traditionalists highlighted below) are the key driver supporting spending as shown in Exhibit 5 following pent-up demand from the end of COVID-19 restrictions.

US household savings and spending to May-23, split by generation.

Source: Bank of America

Whilst services demand may be holding up, Exhibit 5 above shows that younger generations (Millennials, Gen Z and Gen X) are already seeing an outright decline in spending. Indeed, the volume of goods produced has declined by 4.5% for the year to April. We expect this to drag on the overall economy as household consumption accounts for a material portion of US GDP at 68% in the March quarter[1].

Leading indicators, such as the latest release of the Conference Board Leading Economic Index[2], suggest further weakness in economic activity ahead. In addition, other timely series, such as the Federal Reserve’s Weekly Economic Index[3], are pointing towards annualised growth of only 1.1% for the June quarter, an anaemic result that is below long-term averages.

The US central bank (“the Fed”) remains concerned with the pace of services inflation particularly to the extent that wage inflation is becoming entrenched. The Atlanta Fed wage growth tracker, a measure of median wage growth, is still elevated at 6% for the year to May, its highest level in the past 25 years. To that end it has forecast a further two rate hikes by the end of the year, which would take the Fed Funds rate to a range of 5.5% to 5.75%, its highest level since the early 2000s. As the labour market remains tight, with reportedly 1.5 job vacancies per unemployed person, wage price inflation may stay elevated for some time.

Source: Bloomberg

Until we see a clear shift in the labour market, it is likely that the Fed will retain a hawkish bias in the near term. This is despite the understanding that monetary policy works with a lagged effect, which means its full impact of slowing the economy has still not yet been felt.

At the same time, the latest deal to suspend the country’s debt ceiling (its maximum borrowing capacity) caps non-defence government spending to be flat in 2024 and rise by only 1% in 2025[1]. The combination of restrictive fiscal and monetary policies is likely to lead to a meaningful slowdown in growth.

In summary, leading indicators suggest US growth should continue to be subdued in the near term. While inflation is currently elevated, it is decelerating, however the presence of elevated wage growth means the Fed is likely to keep monetary policy tight in the near term, maintaining another headwind to the broader economy. Until there are clear signs of additional slack in the labour market (higher unemployment) the prospect of further interest rate hikes remains high, leading to lower growth.

Eurozone

The inflation backdrop is also a clear challenge in Europe, with both wage and core inflation (which strips out more volatile prices such as energy) remaining at elevated levels. The European Central Bank (ECB) has been hiking in earnest to take its policy rate to its highest since prior to the global financial crisis. We anticipate that the ECB will also retain its hawkish approach (favouring more rate hikes or retaining current levels) until the core inflation backdrop materially decelerates. Some indicators, such as the producer price index (PPI), are suggestive of weaker input costs particularly for goods, only rising 1% for the year to April. The ECB, however, is likely to wait until it sees clearer signs of a deceleration in wage growth before shifting its policy stance.

Source: Bloomberg

The fight against inflation has not been without cost. Europe’s largest economy, Germany, entered a technical recession (defined as two consecutive quarters of negative GDP growth) during the March quarter. Falling consumer demand was one of the key culprits with a 1.2% decline in the March quarter that was broad in its weakness. The broader Eurozone also experienced a technical recession over the same period.

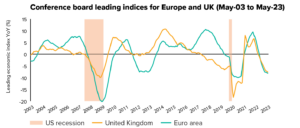

Leading indicators point to further weakness. The Conference Board Leading Index for Europe worsened to be down 8%, year-on-year, suggesting additional challenges ahead.

Source: Bloomberg

In summary, Europe is in technical recession with a narrow path to recovery. Leading indicators suggest little improvement ahead. Inflation data is painting a mixed picture. Some areas, such as goods inflation, are rapidly easing whilst others, notably wage growth, remain above-trend. There is still the downside risk of tighter monetary policy weighing on the economic outlook. The ECB is determined to tame inflation and that could see the Eurozone experience a “double-dip” recession echoing the aftermath of the global financial crisis a decade ago.

China

In China, the pace of underlying growth has slowed with industrial production, fixed asset investment and retail sales for the year to May all disappointing expectations. Manufacturing, the heart of the Chinese economy, has been weaker of late with the May PMI print expanding for the first time since February but business confidence fell to a 12-month low with employment also slipping[1].

In addition, inflation poses a different problem relative to the developed world with headline inflation of only 0.2% for the year to May. The producer price index, a measure of primarily goods inflation, remained in deflationary territory with a 4.6% drop over the same period[2]. This has been attributed to weakness in global demand and commodity prices by the Chinese National Bureau of Statistics and has led several market economists to downgrade their growth targets for 2023.

This slowdown has triggered policy intervention to support the economy, albeit minor, with cuts of only 0.1% to key lending rates[3] by the People’s Bank of China (the Chinese equivalent of the RBA). The challenge faced by authorities in China is weighing up the risks of providing additional support to the economy without also encouraging further leverage and unproductive investment spending. Premier Li Qiang in a recent speech noted the need to roll out additional “practical, effective measures to expand domestic demand”[4] but without more clarity it is difficult to be overly optimistic on this front.

In summary, we are seeing an economic slowdown persisting in China with limited stimulus in place to counteract.

Conclusion

For the global economy, services sectors are holding up well, but manufacturing is seeing a broad slowdown. Some regions have already entered technical recession, notably Germany and, closer to home, New Zealand[1]. Policymakers remain committed to fight inflation with the collateral damage of weakening the broader economy. There are limited positive offsets present in our view with China taking a conservative stance towards economic stimulus. We expect to see further weakness in the quarters ahead as a result.

Part 2: Key Economic Indicators

United States

| Economic snapshot | Last reported result | Date | 2023e | 2024e |

|---|---|---|---|---|

| Growth (GDP) | 1.60% | Mar-23 | 1.3% | 0.7% |

| Inflation | 4.00% | May-23 | 4.1% | 2.6% |

| Interest rates | 5.12% | Jun-23 | 5.4% | 3.9% |

| Unemployment rate | 3.70% | May-23 | 3.8% | 4.5% |

| Composite PMI | 53 | Jun-23 |

Eurozone

| Economic snapshot | Last reported result | Date | 2023e | 2024e |

|---|---|---|---|---|

| Growth (GDP) | 1.00% | Mar-23 | 0.6% | 1.0% |

| Inflation | 6.10% | May-23 | 5.4% | 2.5% |

| Interest rates | 3.50% | Jun-23 | 4.2% | 3.4% |

| Unemployment rate | 6.50% | Apr-23 | 6.7% | 6.8% |

| Composite PMI | 50.3 | Jun-23 |

China

| Economic snapshot | Last reported result | Date | 2023e | 2024e |

|---|---|---|---|---|

| Growth (GDP) | 4.50% | Mar-23 | 5.5% | 4.8% |

| Inflation | 0.20% | May-23 | 1.2% | 2.2% |

| Interest rates | 1.87% | Jun-23 | 4.3% | N/a. |

| Unemployment rate | 5.20% | May-23 | 5.2% | 5.0% |

| Composite PMI | 55.6 | May-23 |

Japan

| Economic snapshot | Last reported result | Date | 2023e | 2024e |

|---|---|---|---|---|

| Growth (GDP) | 1.90% | Mar-23 | 1.2% | 1.1% |

| Inflation | 3.20% | May-23 | 2.8% | 1.5% |

| Interest rates | -0.10% | Jun-23 | 0.0% | 0.0% |

| Unemployment rate | 2.60% | Mar-23 | 2.5% | 2.4% |

| Composite PMI | 53.3 | Jun-23 |

Source: Bloomberg